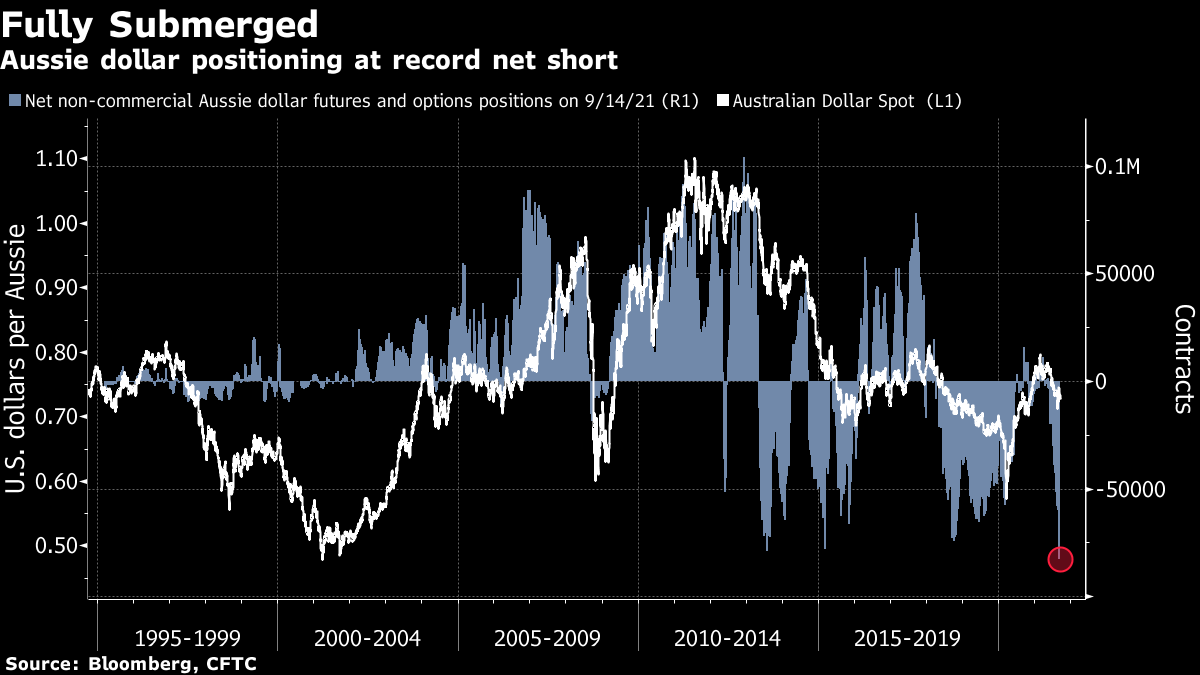

| Good morning. Surging gas prices, Lufthansa, Emmy Awards, Hong Kong stocks sink. Here's what's moving markets. U.K. energy companies are seeking a massive government bailout as a surge in gas and electricity prices threatens to push suppliers out of business. The U.K. government is set for a third day of emergency talks with the industry on Monday after Business Secretary Kwasi Kwarteng said small suppliers were under "pressure." Meanwhile, Prime Minister Boris Johnson said the unprecedented surge in natural gas prices is a "temporary" problem. Deutsche Lufthansa plans to raise 2.14 billion euros ($2.5 billion) by offering new shares to repay part of a German government bailout that helped the national carrier through the coronavirus pandemic. The move will help Lufthansa remove the state from its shareholder list about 18 months after it took a stake. Repaying the aid would free the company from restrictive conditions the European Commission attached to its approval of the deal, such as a ban on dividends, management bonuses and any purchase of a stake of more than 10% in a rival airline. Apple's "Ted Lasso," a show about a U.S. football coach who moves to England to lead a soccer team, was crowned television's best comedy at the 73rd Emmy Awards, a breakthrough for the giant tech company's efforts to build its Apple TV+ service. Meanwhile, Netflix's "The Crown" won best drama series, giving the streaming industry leader the top prize on the TV industry's biggest night for the first time. Growing investor angst about China's real-estate crackdown rippled through markets, pummeling Hong Kong developers and adding pressure on officials to prevent financial contagion. Separately, China's top regulators are said to have defended their market-roiling regulatory curbs on various industries in a meeting with Wall Street executives, while reassuring them the stricter rules aren't aimed at stifling technology companies or the private sector. European stocks are set to open lower as the focus shifts to the Federal Reserve meeting this week that's expected to signal moves toward scaling back stimulus. Oil fell for a second day and iron-ore's rout deepened. Meanwhile, U.K. Prime Minister Johnson said he will tell Jeff Bezos that Amazon must pay its fair share of taxes in the country when the two meet on Monday. Elsewhere, heads of state are scheduled to attend a week-long United Nations gathering in New York, where expanding access to Covid-19 vaccines and confronting the rising dangers of climate change will dominate the agenda. This is what's caught our eye over the past 24 hours. It's not just the Élysée Palace on the war-path against Australia. Hedge funds have boosted their bearish bets against the Australian dollar to record levels. Net-short non-commercial futures and options positions on the currency grew to the most on record last week, according to the latest data from the Commodity Futures Trading Commission. The Aussie was the worst performing Group-of-10 currency last week against the greenback amid a plunge in iron ore and ongoing lockdowns to deal with coronavirus outbreaks. Central bank chief Philip Lowe pushing back against bets on early interest-rate increases also weighed, as did weaker-than-expected employment data. And as a key vehicle for risk on/off bets in the FX market, the bearish positioning is also likely influenced by growing pessimism about the strength of the global economic recovery. It's almost a perfect script for Aussie bears but that in itself is now a risk. The sheer size of the short positions in the currency mean it is highly vulnerable to a squeeze on any sign of a respite to Australia's current woes.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment