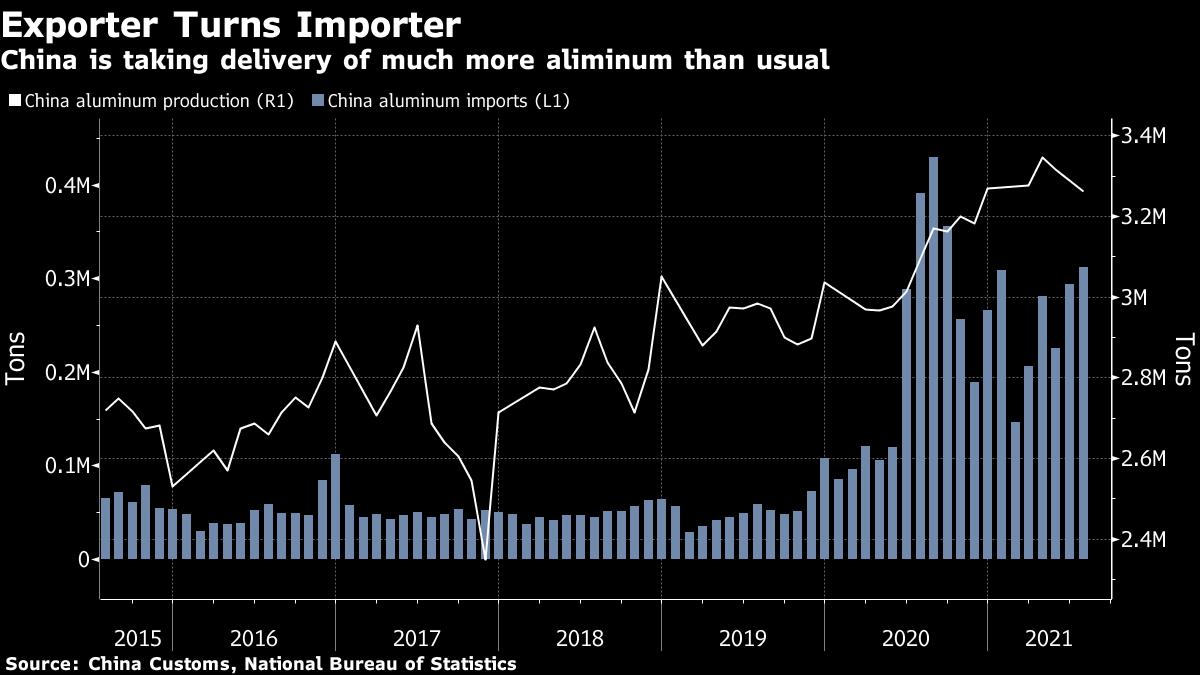

| Good morning. China export surge, energy price shock, Bitcoin targeted and Deutsche Telekom eyes a unit sale. Here's what's moving markets. China's export growth unexpectedly surged in August, with demand from the U.S. and Europe resilient as retailers probably brought forward their Christmas shopping orders. The pickup came despite disruptions at China's second-largest port last month, which pushed up shipping costs. Still, exports could cool in the fourth quarter as the year-earlier base becomes less favorable, Bloomberg Intelligence said. Europe's facing an energy price shock as a supply crunch lifts the cost of producing power just as more businesses reopen and people return to the office, adding to demand. Benchmark European gas futures traded in the Netherlands surged to a record on Monday, as did U.K. prices. That could further fuel inflation and hamper the economic recovery. Reddit traders have a not-so-surprising target in their sights: Bitcoin. Some users of the platform are are discussing plans to buy $30 worth of the cryptocurrency en masse today to mark a new Bitcoin law coming into effect in the Latin American country of El Salvador. Still, doing so may prove tricky in practice, one exchange said. Bitcoin is edging up this morning. There's deal news as Deutsche Telekom nears an agreement to sell its Dutch unit, which could fetch around 5 billion euros and rank as one of its largest divestments of recent years, people familiar with the matter said. The German company could announce a sale of T-Mobile Netherlands in the coming days, with a consortium backed by Warburg Pincus and Apax Partners seen as a strong contender. European stocks are set to open lower despite gains in Asia, where Japan's Nikkei 225 touched 30,000 for the first time since April. Elsewhere, the U.K. government has drawn up plans for an October "firebreak" that could extend the half-term holiday, dependent on Covid-19 hospitalizations, the i newspaper reports. Apparel designers Ferragamo and Ted Baker provide corporate updates, while the IAA Mobility trade show starts with German Chancellor Angela Merkel due to open the event. Finally, Hong Kong relaxed some China border restrictions, which could boost luxury stocks. This is what's caught our eye over the past 24 hours. The fragility of the covid-era global economy was brought into sharp focus this week as a coup in Guinea sent aluminum prices soaring. Bauxite is mined in Guinea and shipped to China where it's turned first into alumina and then aluminum. There's no suggestion that supply of bauxite will immediately be disrupted, yet markets reacted as if that's exactly what's happening. The flow of aluminum has already been severely impacted by port closures and transportation restrictions. Usually, China supplies much of the rest of the world with aluminum. Right now it's an importer, as this chart rustled up by my colleague Mark Burton shows.  The episode brings to mind the pressure on the flow of goods when the cargo ship Ever Given was stuck in the Suez. One boat in one canal brought panic to the world's factory and shop floors. The Guinea reaction reflects how supply chains for almost all physical goods are stretched to breaking point. And in those conditions, it doesn't take much to spook markets. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment