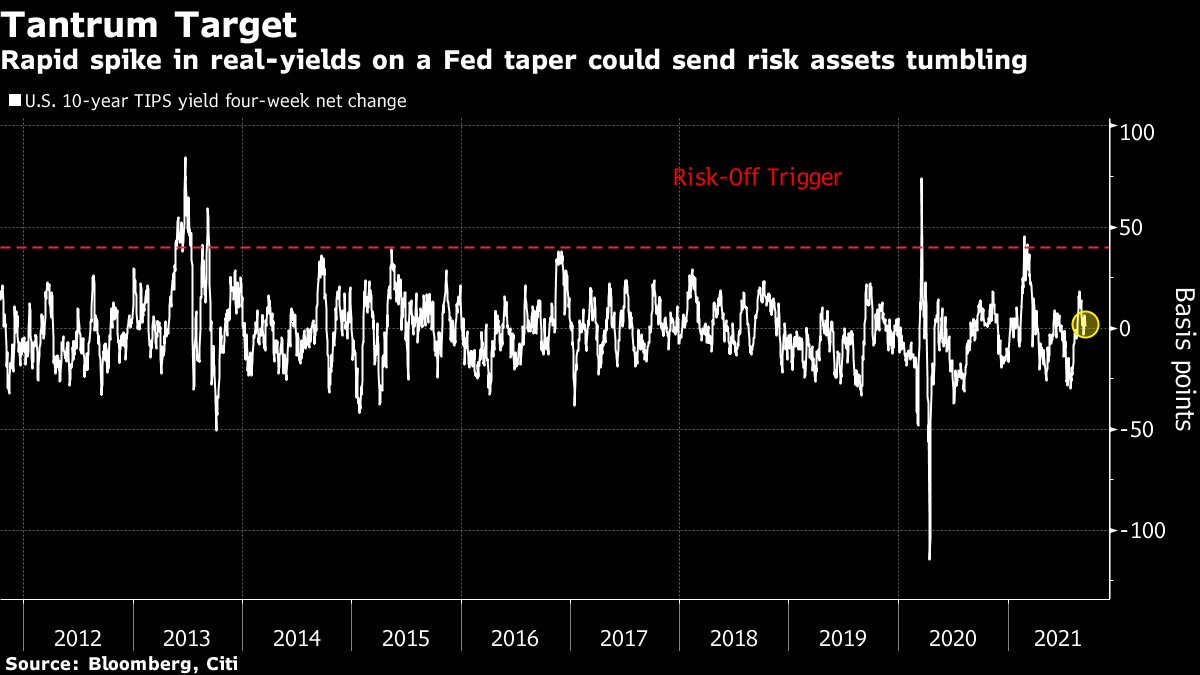

| Good morning. Europe faces surging energy prices, recruiters are calling for looser U.K. immigration rules, researchers flag the risk of future pandemics and U.S. inflation cools. Here's what's moving markets. Surging energy prices are gripping Europe, leading to two energy suppliers that service more than half a million customers in the U.K. going out of business. Utility Point and People's Energy announced Tuesday it would stop operating — the latest of recent failures at challenger suppliers as power and gas prices climb to record highs. In Italy, the government is planning to use public funds to tackle soaring energy prices, adding to government measures across Europe. The U.K. government is facing calls for a looser immigration policy as a labor shortage is threatening the post-pandemic recovery. Nine out of 10 members of the Recruitment & Employment Confederation list the shortage of workers as one of their biggest concerns for this year, with the government so far resisting the easing of rules for blue-collar hires. It comes as parliament voted through a hike to taxes paid by workers and their employers to finance health care.  | Infections from animals carrying coronaviruses may infect hundreds of thousands of people a year, according to a study focusing on the ongoing threat of pandemics. Most infections, which can amount to about 400,000 each year, go unrecognized but each spillover can cause the next pandemic, based on researchers with the EcoHealth Alliance and Singapore's Duke-NUS Medical School. Meanwhile, the effects of the current Covid-19 pandemic are far from over, with China's economy weakening further in August after virus controls curbed consumer spending and travel. The pace of consumer price rises in the U.S. cooled in August as inflation prints come in lower than expected Thursday. The figures are key for Federal Reserve policy makers who will debate next week on how and when to begin tapering asset purchases, with a potential decision bound to affect markets globally. The number was initially seen as taking pressure off the central bank to act, with bond traders pushing off bets on the start of asset-purchase tapering. European stocks look set to defy the selloff in the U.S. and Asia, where investors were rattled by weak Chinese economic data and the second North Korean missile test in less than a week. It's a big day for European fast fashion giants, with Zara owner Inditex reporting earnings and H&M giving a sales update. Germany's Auto1 Group also reports. ECB Chief Economist Philip Lane speaks on the bank's strategy review at webinar, and the U.S. gives its weekly crude oil inventory report. This is what's caught our eye over the past 24 hours. Though Tuesday's U.S. inflation data dampened talk of an imminent Fed taper announcement, market participants are growing increasingly concerned about its impact on inflation-protected securities. They say a combination of Fed purchases and surging demand for inflation protection have disproportionately benefited the relatively thinly traded TIPS market, pushing yields to deeply negative levels. The benchmark TIPS yield -- the so-called real yield which also acts as a gauge of investor expectations for growth -- fell to as low as 1.2% in August. As noted by my colleague Ye Xie, UBS has called TIPS one of the most-mispriced assets with strategists predicting 10-year real yields could rise 50 basis points in coming months. Should a rise of that magnitude happen over a shorter timeframe, that could put significant pressure on risk assets. A study earlier this year by Citigroup suggested a four-week change in real yields of plus 40 basis points is a good rule of thumb for a risk-off trigger. Ten-year TIPS yields are up just one basis point from their level four weeks ago, so investors can rest easy for now. But traders should keep a close eye on how the securities react to any hint of a taper, be it at next week's Fed meeting or more likely in early November.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment