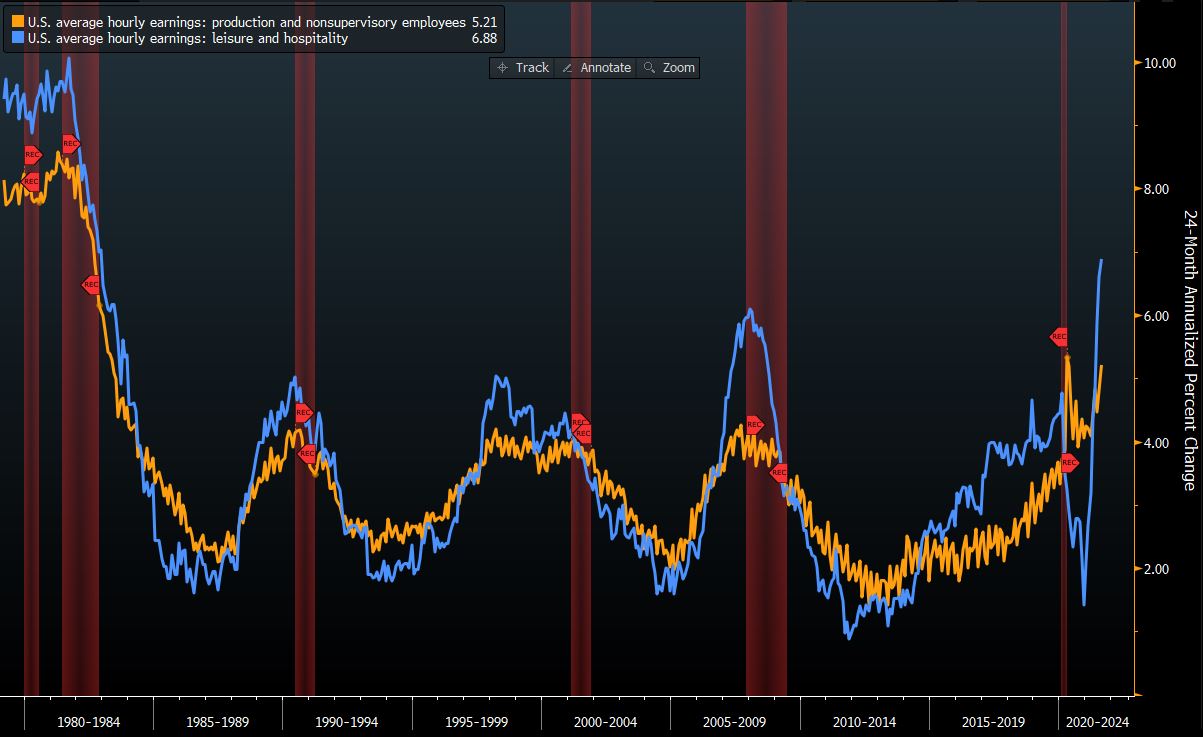

| Delta is battering the global economic recovery, China pledges to tighten supervision in financial services, and SPACs are coming to Singapore. Here's what you need to know to start the week. The pandemic's summer resurgence is slowing the global economic recovery as the delta variant dogs efforts to rev up factories, offices and schools. Instead of entering the final months of 2021 confident that the acute phase of the pandemic is over, it's becoming clear that booster shots may be needed for fading vaccines, workplace re-openings will be delayed and border closures remain. Meanwhile, even a severe case of Covid won't persuade some people to get vaccinated; studies are finding one vaccine makes more antibodies than another — here's why that matters; Australia's Covid epicenter sees another day of record cases; and Japan's extending its state of emergency in Tokyo. Asian stocks look set for a boost from Japan, where the planned exit of the prime minister sparked a rally. Traders are also weighing the impact of sharply slower U.S. hiring on the stimulus outlook. Futures for Japan jumped more than 1%, following a surge in the Topix index Friday to a three-decade high on hopes of better pandemic management and more spending by Prime Minister Yoshihide Suga's successor. Futures for Hong Kong edged higher but slipped for Australia. Elsewhere, gold begins the week firmer on easing concerns about a quicker start to Fed tapering. Bitcoin was trading near $52,000. A UBS hedge fund unit is considering giving investors direct access to its China strategy, after it navigated through a raft of regulatory interventions that threw doubt on the country's investment potential. The strategy has booked double-digit gains this year, with "very positive" returns in both July and August, said Kevin Russell, New York-based chief investment officer of the $9.6 billion UBS O'Connor unit. He declined to give precise performance numbers. In other news, Chinese officials pledged to tighten supervision in the financial services industry, suggesting a recent regulatory onslaught on the private sector is not over yet. The central bank will close loopholes in its financial technology regulation, and include all types of financial institutions, services and products into its prudential supervision framework. China's push for "common prosperity" is not just about taxing the rich but also directing resources into rural areas and the lower-income group, according to one of the country's most prominent experts, known in international academic circles as "Mr. Chinese income distribution." The income gap has widened in the country over the past five years due to the rise of technology and financial sectors, and taxation has done little in narrowing the gap, said Li Shi, an economics professor at Zhejiang University. Here he explains just how wide that gap is and what can be done to fix the problem. Blank-check companies could revive Singapore's languishing market for initial public offerings as stock exchanges from Mumbai to Seoul profit from blockbuster deals. Singapore Exchange has presented rules for the listing of special purpose acquisition companies, or SPACs, as it attempts to get a slice of what has become a worldwide frenzy. It is allowing SPACs to list under a rulebook that is more lenient than initially envisioned and more in line with the framework in the U.S. The move comes as global financial regulators are raising scrutiny of these structures. This is what's caught our eye over the past 24 hours: "Supply or demand?" seems to be the dominant question facing major economies at the moment. You can see the tension between the two in the payrolls figure which came out on Friday, showing that the U.S. economy added 235,000 new jobs in August — much less than the 725,000 economists had expected. On the one hand, the lower-than-expected jobs number could suggest that the delta variant spooked businesses last month, causing them to cut back on hiring given the uncertain demand outlook. We know, for instance, that U.S. consumer confidence dropped to a six-month low in August. Meanwhile, the Institute for Supply Management's services index fell to 61.7 from 64.1 in July — still expanding, but at a slower pace.  Bloomberg Bloomberg But on the other hand, there are some signs that the jobs number may have been held back by supply rather than demand. A major source of weakness was in leisure and hospitality, with no new jobs added in the sector. That's a stark turnaround after averaging more than 350,000 per month for much of the year. But wages continue to grow strongly, suggesting such businesses are clamoring for workers. They just can't find them. Disaggregating supply from demand is difficult at the best of times, much less after a global pandemic. But figuring which of these is in the driver's seat is important, since the two factors require very different policy responses. |

Post a Comment