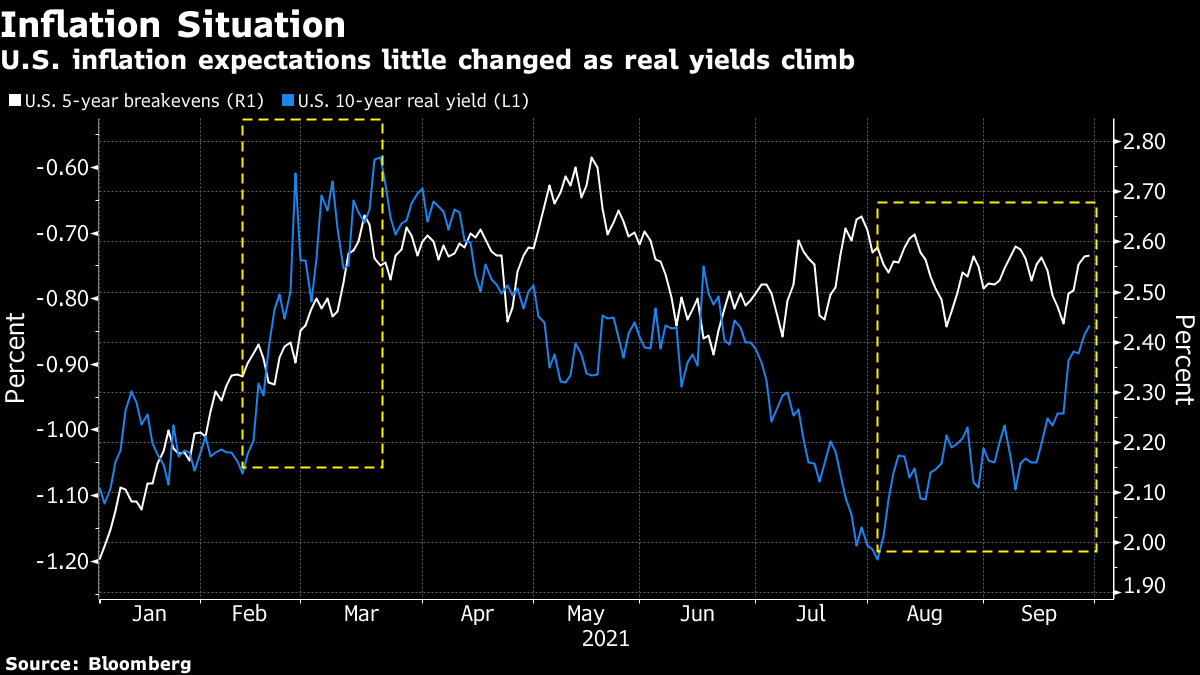

| Good morning. Markets in turmoil, Warren and Powell, U.K. fuel crisis easing, and EU and U.K. seek to cool tensions. Here's what's moving markets. It was a wild day for markets Tuesday as traders digested news of supply-chain breakdowns, rising Treasury yields and the U.S. nearing its debt limit. While some investors jumped in and stanched the bleeding during the extended selloff in Treasuries, Asian stocks sank Wednesday. The oil rally paused. However, U.S. and European futures are pointing higher after their benchmarks plunged on Tuesday. Senator Elizabeth Warren said she wouldn't support Federal Reserve Chair Jerome Powell for a second term as head of the U.S. central bank -- the highest-profile Democrat with a say on his confirmation to come out against him. It's not clear Warren's disapproval would derail Powell, whose term expires in February. The senator vehemently denounced Powell to his face as "a dangerous man" because he was making it too easy for big banks to take big risks. Boris Johnson said the U.K.'s fuel crisis is stabilizing, as he pushed back against industry demands to issue more visas to foreign truckers to fix the ructions in the country's supply chains. The prime minister was speaking publicly for the first time on the fuel shortages, a crisis that has forced him into a series of emergency measures. The U.K. and European Union are seeking to cool tensions over a thorny Brexit dispute related to Northern Ireland as they prepare to engage in weeks of intensive negotiations over how to resolve it. The EU is said to be planning to offer a set of proposals next month aimed at addressing British complaints about the Northern Ireland protocol. That is expected to trigger intensive talks that could last until December. Treasury yields steadied during Asian trading while cotton rose to near a decade-high. Japan's ruling party lawmakers began an election that determines the next prime minister. In the U.S., Senate Democrats are seeking a vote Wednesday on a stopgap funding bill to avert a government shutdown, but without a provision to increase the federal debt limit. Also, the inaugural meeting of the Trade and Technology Council is set to kick off later today in Pittsburgh, where officials from the U.S. and the EU are set to meet. This is what's caught our eye over the past 24 hours. It may or may not be your father's Treasuries scare, but it's definitely not your one-year old daughter's. This month's resurgence in yields is not just a repeat of what happened earlier this year, so don't expect the same playbook, which was relatively benign for risk assets. Unlike in the first quarter, in the U.S. at least, inflation expectations have barely budged though real yields have pushed higher. That combination suggests a rethink of Federal Reserve policy is behind the recent bond selloff, including the potential for much earlier than expected rate hikes. Overnight swap rates now suggest that traders expect the Fed to raise borrowing costs as soon as September 2022 -- helped in part by St. Louis Fed President James Bullard telling Reuters that he sees two interest-rate increases next year. That's a much different dynamic from February and March, when bond yields climbed on growth-driven inflation bets and rate hikes were seen a long way out. That should raise the stakes for risk assets -- especially those with the highest valuations.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment