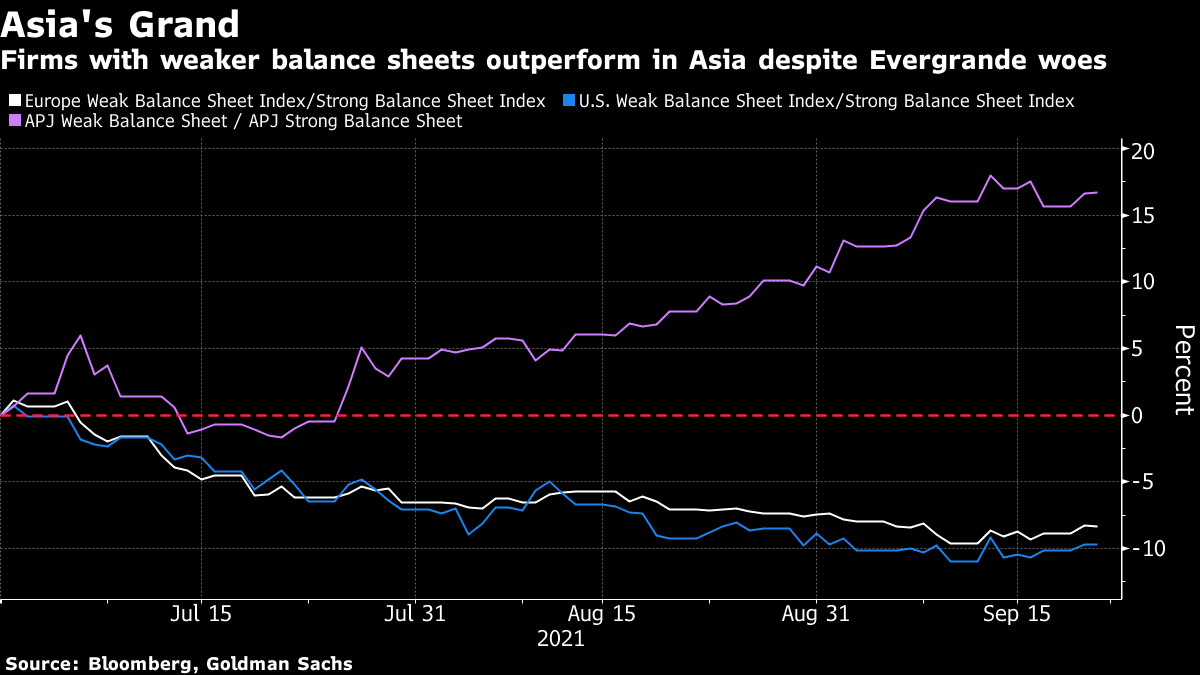

| Good morning. Transatlantic travel opens up, Evergrande is seen on the brink of default and Britain's power sector braces for a rough winter. Here's what's moving markets. The U.K. won't bail out failed energy companies, and the government expects to see some businesses go bankrupt in the coming weeks, Business Secretary Kwasi Kwarteng warned, as gas prices marked new records. The official said the country faces a "long, difficult" winter with high energy prices tipping power suppliers into bankruptcy, after three days of inconclusive talks over how to navigate the potential chaos. Across Europe, governments are taking steps to curb the impact of high prices on households. Italy is set to spend around 3.5 billion euros protecting consumers, while Spain, France and Greece are acting to stem the hit to their economies. The U.S. will soon allow entry to most foreign air travelers as long as they're fully vaccinated against Covid-19. The new policy will take effect in "early November," according to the White House. Europe's biggest trans-Atlantic airlines and airports reacted jubilantly to the move, with shares in the travel and aerospace sectors rising despite broad stock market declines. In other good pandemic news, Pfizer and BioNTech said their vaccine was safe and produced strong antibody responses in children ages 5 to 11, findings that could pave the way to begin vaccinating grade-school kids within months.  | Prime Minister Justin Trudeau is poised to win a third term in a snap election but fall short of regaining the parliamentary majority he was seeking. CTV News and the Canadian Broadcasting Corp. projected his governing Liberal Party will win a plurality of seats and form a left-leaning minority government. The Liberal victory is a historic milestone for Trudeau, marking only the eighth time a Canadian leader has won three successive elections. Trudeau's father, Pierre, also did it. It represents a comeback of sorts for Trudeau, whose party was trailing in the polls midway through the five-week campaign. China Evergrande Group slid deeper in equity and credit markets today, fueling concerns about broader contagion after S&P Global Ratings said the developer is on the brink of default. The agency believes Evergrande failing by itself is unlikely to trigger intervention from the Chinese government, absent contagion in the sector that would pose systemic risk to its economy. Contagion fears have already fueled a global selloff on Monday, as investors rushed to price in the risk that Chinese President Xi Jinping will miscalculate as he tries to curb property-market excesses. European stock futures point to modest gains after Monday's selloff, as losses in Asian markets also moderate. Sweden's Riksbank is next in this week's central-bank-a-thon; economists expect it to keep policy unchanged but adjust its forecasts this morning. Elsewhere on the macro front, OECD economic forecasts and Swiss watch exports are due. Earnings are expected from British DIY retailer Kingfisher and French nursing home operator Orpea, though bigger fish are reporting in the U.S., namely FedEx and Adobe. This is what's caught our eye over the past 24 hours. Fears of an imminent restructuring of the world's most-indebted developer might seem like an opportune time for investors to tilt their portfolios toward more robust companies, but that's yet to happen in Asia. Despite the crisis at Evergrande, a Goldman Sachs basket of Asia ex-Japan stocks with less-than-robust balance sheets -- based on measures such as leverage and liquidity ratios -- has continued to best a cohort of stronger peers this quarter. Since the end of June, the gauge has outperformed by about 12 percentage points through Monday. That's in contrast to the U.S. and Europe, where it is the stronger names which have outperformed, beating weaker peers by around 10 and 8 percentage points respectively. The divergence likely stems in part from the different drivers of underperformance in Asia's stock market this year. The biggest losers have included those stocks most affected by China's crackdown on private enterprise, which has little to do with the structure of a company's balance sheet. But that shouldn't distract from the broader theme that fundamentals eventually matter. Asia investors would do well to follow the example of their U.S. and European peers, and dial back their exposure to the region's weaker firms.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment