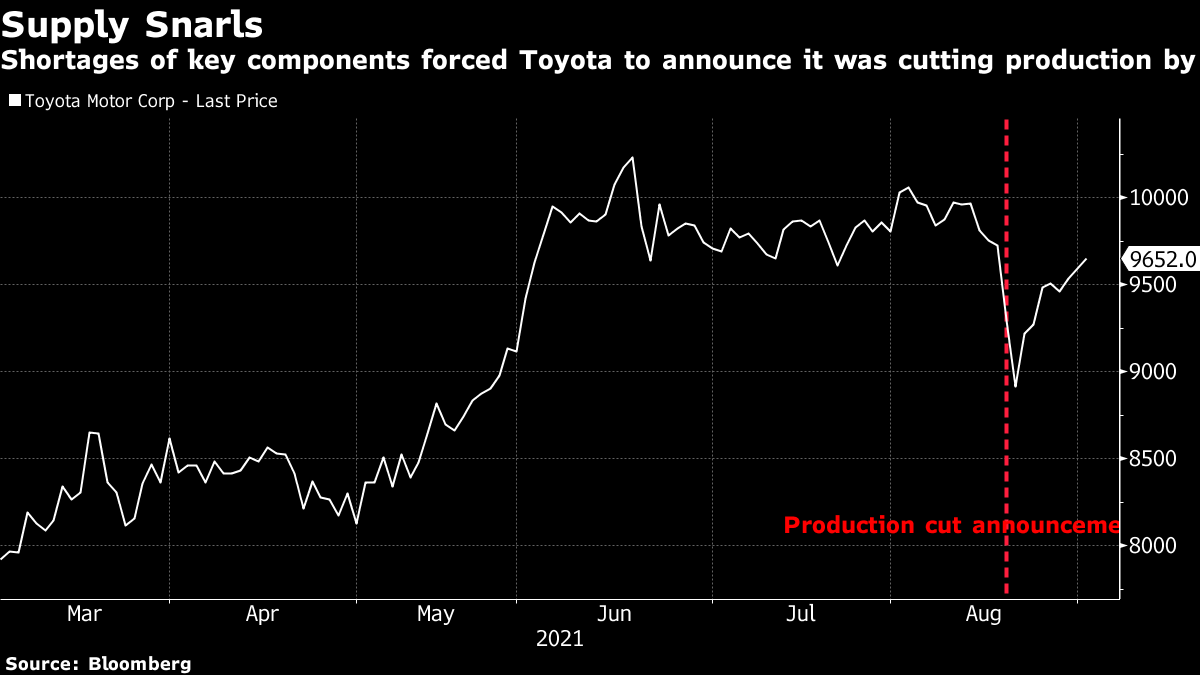

| Chinese companies are rushing to embrace Xi's "common prosperity" push. Many Covid survivors are suffering painless kidney damage. The world's most toxic air could shorten the lives of 480 million people. Here's what you need to know this morning. Scores of listed Chinese companies have rushed to embrace President Xi Jinping's "common prosperity" drive in earnings reports. At least 73 companies, including China's largest insurer Ping An Insurance, Meituan and Bank of China, used the slogan in statements filed to the Hong Kong, Shanghai and Shenzhen stock exchanges in recent weeks. While that accounted for less than 2% of the more than 4,000 filings surveyed by Bloomberg News, it featured some of the country's most-influential firms. Check out our Storythread for all the latest news on how Xi plans to redistribute the wealth. Meanwhile, Evergrande's overall liabilities rose to a near-record 1.97 trillion yuan ($305 billion), thanks mainly to swelling bills to suppliers. Kidney damage is the latest ailment to be identified afflicting a large swath of Covid-19 survivors. Painless, silent injury to the blood-filtering organ can occur among people who recover from the coronavirus at home, and escalates with the severity of Covid, according to a new study. A separate study found almost a third of children aged 11 to 17 experience persistent coronavirus symptoms, such as fatigue and shortness of breath, three months after diagnosis, suggesting long Covid afflicts the young. In other virus news a Pfizer booster shot does provide added protection against the coronavirus, according to data from Israel; Moderna is seeking clearance to give Americans booster shots; and the unwavering spread of delta has seen Southeast Asia become a choke point for the world's top carmaker. Asian stocks look set for a steady open after large U.S. technology shares climbed in a defensive tilt to the Wall Street rally. The dollar slipped to about a three-week low. Futures climbed in Japan and Hong Kong, but fell in Australia. The tech-heavy Nasdaq 100 edged up to a record while the S&P 500 was little changed amid mixed data suggesting a slower labor market recovery. Benchmark U.S. 10-year Treasury yields retreated below 1.30%. Traders are awaiting key U.S. jobs data Friday for more clues on the economic outlook and the likely timeline for a reduction in Federal Reserve pandemic-era stimulus. The world's worst air pollution could shorten the lives of 480 million people — more than the entire U.S. population — by as much as 8 1/2 years across northern India. A study found the entire South Asian nation of 1.3 billion is currently breathing air that exceeds the World Health Organization's guidelines on annual average particulate pollution levels. When measured in life expectancy, ambient particulate pollution is more dangerous than other health risks, including cigarette smoking, unsafe water, malaria, and conflict and terrorism. Meanwhile, in London eight women used hammers and chisels to smash windows at JPMorgan, to protest against organizations that support fossil fuels. And here's why the next few weeks are critical for global climate diplomacy. China's so-called ghost cities became the subject of Western media fascination a decade ago. Now these vast urban districts that once stood vacant are gaining residents and businesses — ghosts no more. In 1978 just 18% of China's population lived in cities; by last year that figure had reached 64%. The country now has at least 10 "megacities" with more than 10 million residents each, and more than one-tenth of the world's population resides in Chinese cities. In other city news, China should guard against the risk of falling property prices and a potential crisis if home values start dropping below mortgages, a prominent state-linked economist warned. And here's why Chinese cities are unprepared for climate disasters. This is what's caught our eye over the past 24 hours: One Covid case in a factory near Hanoi was enough to cause massive problems for Toyota, the world's biggest carmaker and the embodiment of "just-in-time" production. The company relies on suppliers in Vietnam to make many of its cars' components, including the wire harnesses which connect various parts. As Bloomberg reports, disruptions at the Hanoi factory combined with outbreaks in Malaysia that knocked semiconductor production, ended up causing a cascade effect that was big enough to force Toyota to announce last month that it was cutting production by a shocking 40%. The just-in-time model is supposed to maximize corporate efficiency by having companies buy components right before they're actually needed to make things. One way of thinking about it is like a kitchen. You can either have a fully-stocked kitchen, with an inventory that includes all of the ingredients you might possibly need to satisfy food orders for a while, or you can go out and purchase ingredients as each order comes in. The latter method will save you lots of money, but it does leave you exposed to the possibility of failing to fulfil orders if you can't quickly find what you need.  The lean manufacturing ethos of just-in-time supply chains was pioneered by companies like Toyota in the 1970s (so much so that it's sometimes referred to as the Toyota Production System, or TPS). But the model boomed in popularity in the 1980s, when maximizing shareholder value was all the rage. Peter Atwater, president of Financial Insyghts, points out the similarities with securitization— another process that has its roots in the 1980s ethos of minimizing capital use as much as possible in order to eke out every ounce of value available from one's balance sheet. But the global pandemic has challenged the model and "today, in response to shortages, businesses and even governments are shifting to what I call a 'just-in-case' business model. They are stockpiling critical supplies, onshoring previously outsourced production and boosting inventories where possible," he writes. Companies may be willing to accept a lower level of efficiency longer-term, in order to avoid supply shortages that risk shutting down their production processes entirely. The big question is what impact the shift from "just-in-time" to "just-in-case" will have on the wider economy. |

Post a Comment