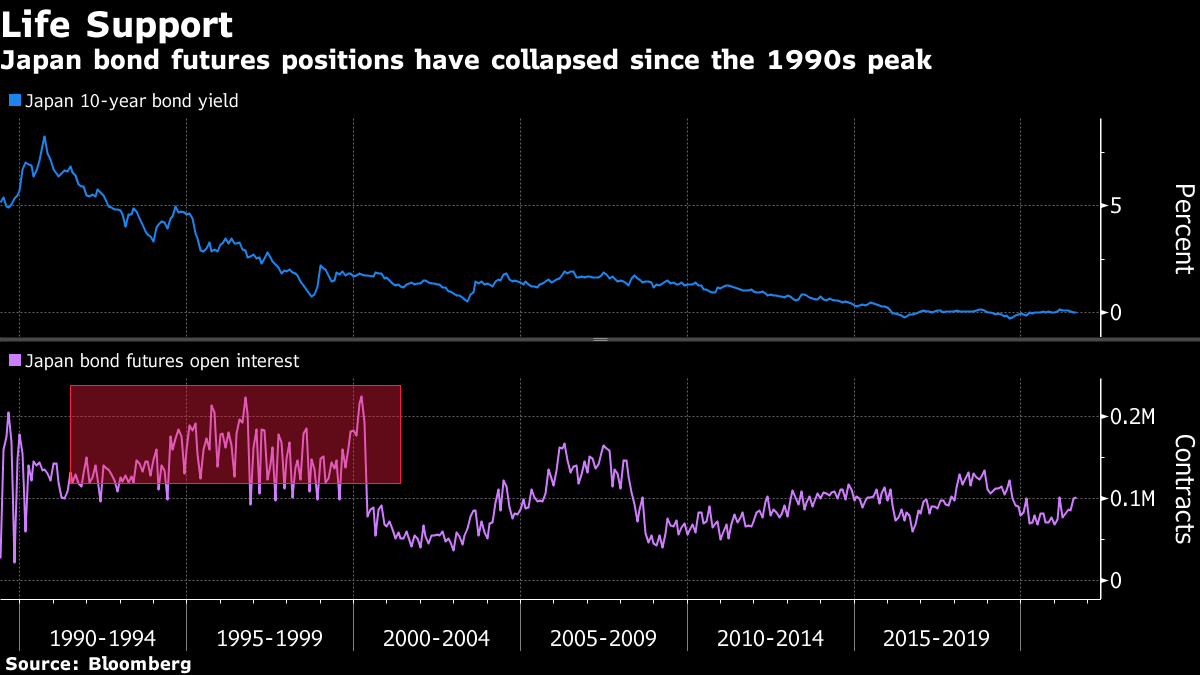

| Japan has the world's second-largest government bond market. It's 10-year benchmark bond hit 0% earlier this week for the first time this year --- and yet few were watching, or cared, because they don't really matter. Just 25 years ago, everyone was watching. It's the mid-1990s, Bon Jovi and Madonna are top of the charts, Japan is the world's second-largest economy and changes in nation's huge bond markets are a key yardstick for investors and macro traders, offering great insight into how the global business cycle is shaking out. A former colleague who traded Japanese bonds for over 20 years said, back then, everybody who was anybody was active in Japan bonds. All the big banks, hedge funds, real money, plus a huge domestic presence, and as the market developed -- with interest rate swaps and repos -- it only got bigger and better.  Fast-forward to today. The Bank of Japan owns almost half of the nation's government bonds, and is still waiting for Godot (inflation). These bonds barely trade. One day earlier this week, there were zero trades in the 10-year benchmark, despite there being a bond auction. Is this a sign of things to come for other developed central banks (looking at you ECB) who are now addicted to bond buying? Perhaps, but that's a question for another day. Enter: China. This is shaping up to be the Japanese government bond of the old days. China, now the world's number two economy, offers a fixed-income and rates market that can give you a helpful temperature check on the global business cycle. In the book, "Trading Fixed Income and FX in Emerging Markets: A Practitioner's Guide" -- the bible on how to trade and interpret emerging-market bonds -- the authors called calls China bonds "JGBs for Millennials."  They're right and it would be prudent for investors to look at what's happening there. China bonds have been incredibly active, benchmark yields have dropped for eight straight weeks, and now sit around the lowest levels since June 2020. The economy is slowing down, business surveys are worsening and shutdowns due to the virus outbreak have forced economists to rethink lofty growth estimates. The easing has begun with a surprise cut in banks' reserve ratio requirement last month kick-starting the rally. Half of Wall Street seems to be recommending Chinese debt as more easing is on the way. And the other half just hasn't realized it yet. Sub-zero bonds are back: the global stock of negative-yielding debt has picked up from a "low" of about $12 trillion dollars in May and is now knocking on the door of $17 trillion. And all it took was a mutated spike protein to get us here. Bond bulls are vindicated, though they would most likely happily give up being right in return for expunging the coronavirus.  Europe in particular is seeing a deepening pool of debt with yields below zero, as Bloomberg's James Hirai reported this week. German 10-year bond yields tumbled in July by the most since the start of 2020 to minus 0.46%. The days of the reflation trade seem like a distant memory, when in fact it was all the rage just a few months ago. Now, the debate over what is going on has no end in sight and is so intense it can likely fund lots more $100,000 newbie analysts. Is the bond market plain wrong to ignore jumping inflation, or just too distorted by central banks, or actually astutely pointing to a disinflationary post-pandemic legacy? No idea. One thing does stand out though: U.S. Treasuries actually offer a yield, unlike much of the rest of the developed world, which is perhaps one reason why people are buying them. Call an ambulance, we have a new macro hedge fund casualty after the latest unwind of the so-called "reflation trade," which has caused a monumental short-squeeze in bond markets. Hedge fund Alphadyne Asset Management is looking at losses of around $1.5 billion after its hedge funds plunged through July, according to people familiar with the matter. That's a tough break for a fund that has never lost money since it started. It's a humbling game in markets but let's remember they aren't alone. It's been an incredibly difficult year for those trading bonds particularly and many of their peers are right along with them. The Financial Times reported in late June how a bunch of big name hedge funds have also been roiled by the unwind of the reflation trade — included the likes of Caxton Associates, Rokos Capital and Brevan Howard, according to the article. Misery loves company. Spiritual opium Press under threat Rents due |

Post a Comment