| Welcome to the Weekly Fix, the newsletter that's not trying to pick a fight with Matt Levine. I'm cross-asset reporter Katie Greifeld. Happy Jackson Hole! Federal Reserve chief Jerome Powell takes the (virtual) stage at 10 a.m. Washington D.C. time today. By about 10:30 am, investors around the globe should have a fairly good idea of whether or not the central bank will began tapering large-scale asset purchases this year or next. While Powell has been steadfast in his patience, the hawks are circling. On the symposium's eve, three of the Fed's leading hawks -- Dallas Fed president Robert Kaplan, St. Louis's James Bullard and Kansas City Fed's Esther George — conveyed a common message: policy makers should begin tapering sooner rather than later, even as the delta variant's spread threatens to impede the economic recovery.

"I think it's important to get started and the conditions of pace, timing of when we end, I'm open minded to listening to the debates around that," George said in a Bloomberg TV interview with Michael McKee. "But I am less interested in deferring that decision."

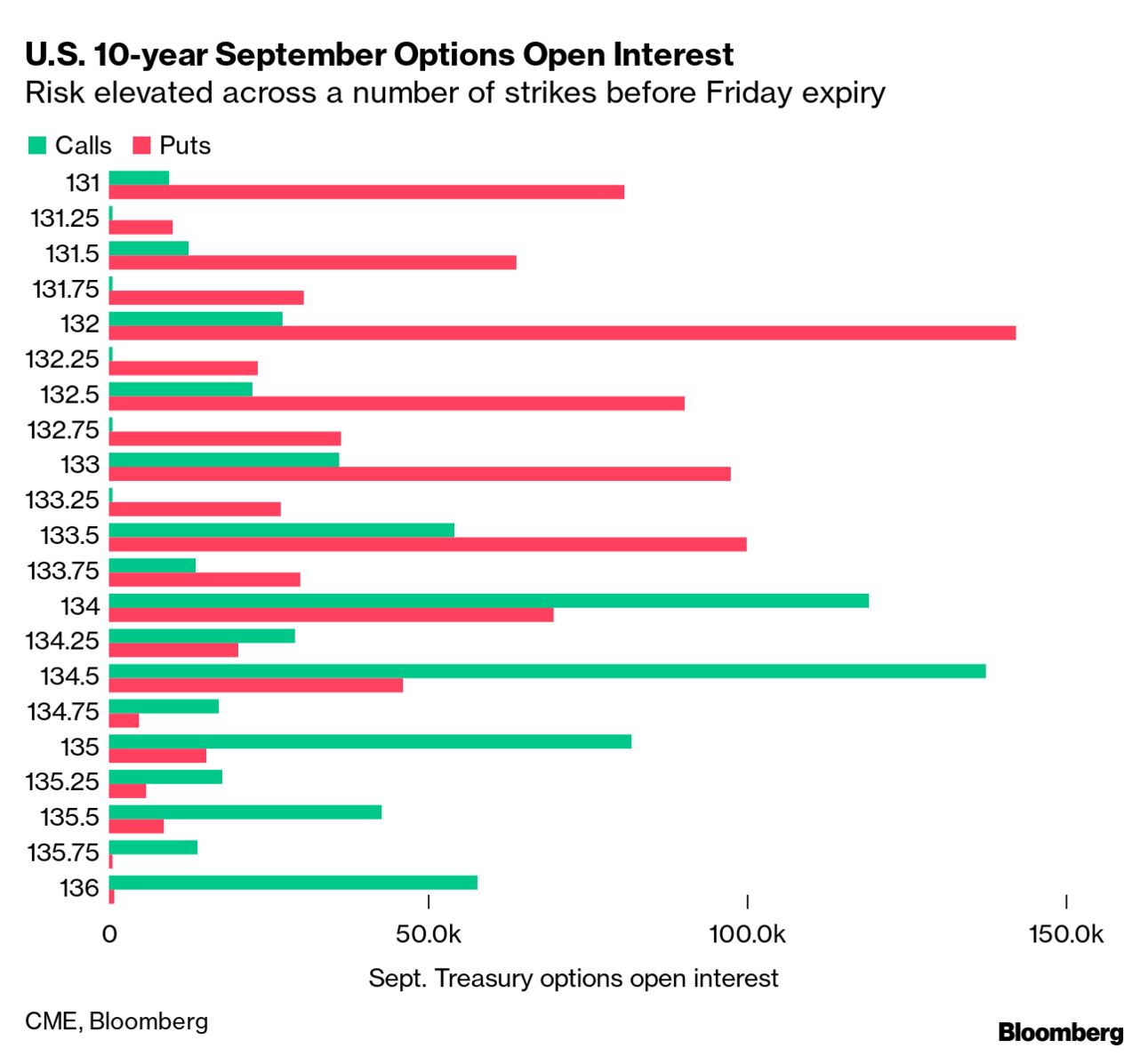

None of the trio are currently voting members of the Federal Open Market Committee, but that will change next year for George and Bullard. And remember, the minutes from the Fed's July meeting showed that most policy makers see the taper process kicking off this year. Which side of the line Powell chooses to toe remains to be seen. But in any case, the biggest moves in the Treasury market on Friday might boil down to the options market. As reported by Bloomberg's resident rates expert Edward Bolingbroke, more than 2 million options in the September 10-year contract expire by the end of trading Friday. That amounts to a whopping 63% of the total options open interest in Treasuries. As of Wednesday's close, most of the risk is concentrated around several options structures that equate to 10-year yields of about 1.5%, 1.34% and 1.21%. Currently, the benchmark rate is hovering near 1.34%.  So, we could see some fireworks around those levels. As Bolingbroke explains it: Those levels stand out as having potential to sway trading in the aftermath of Powell's speech, should dealers and option holders trim their vulnerability to market movements leading up to the options expiry and move the price of 10-year futures close to the strike price.

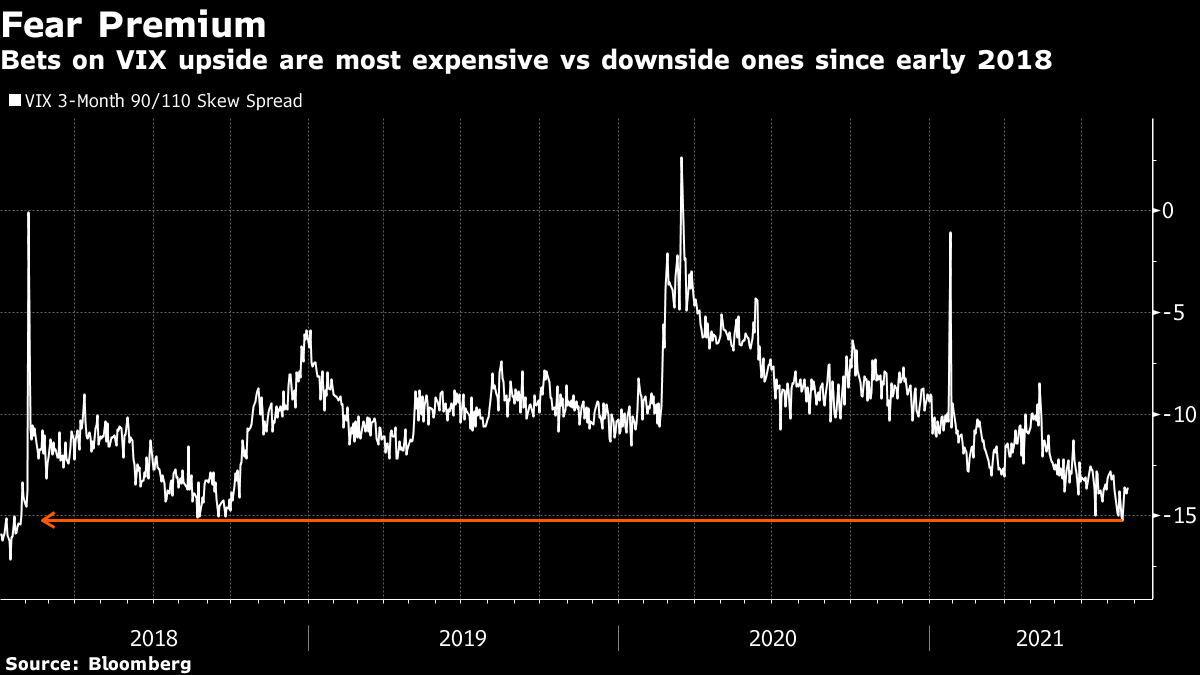

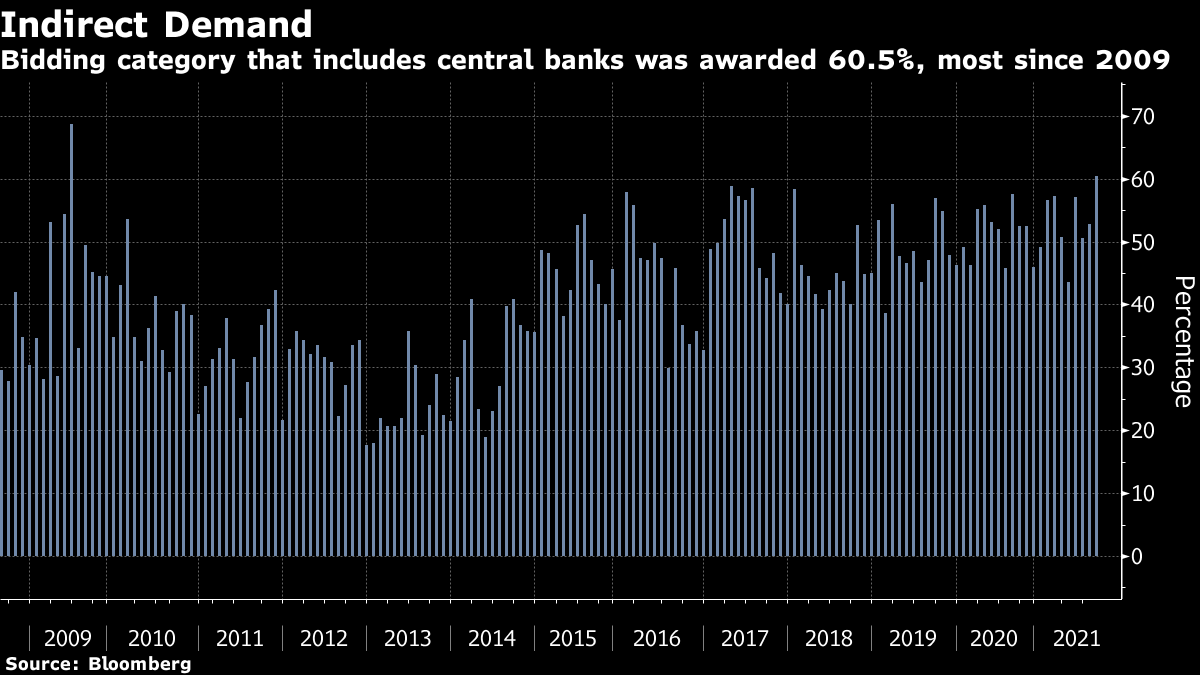

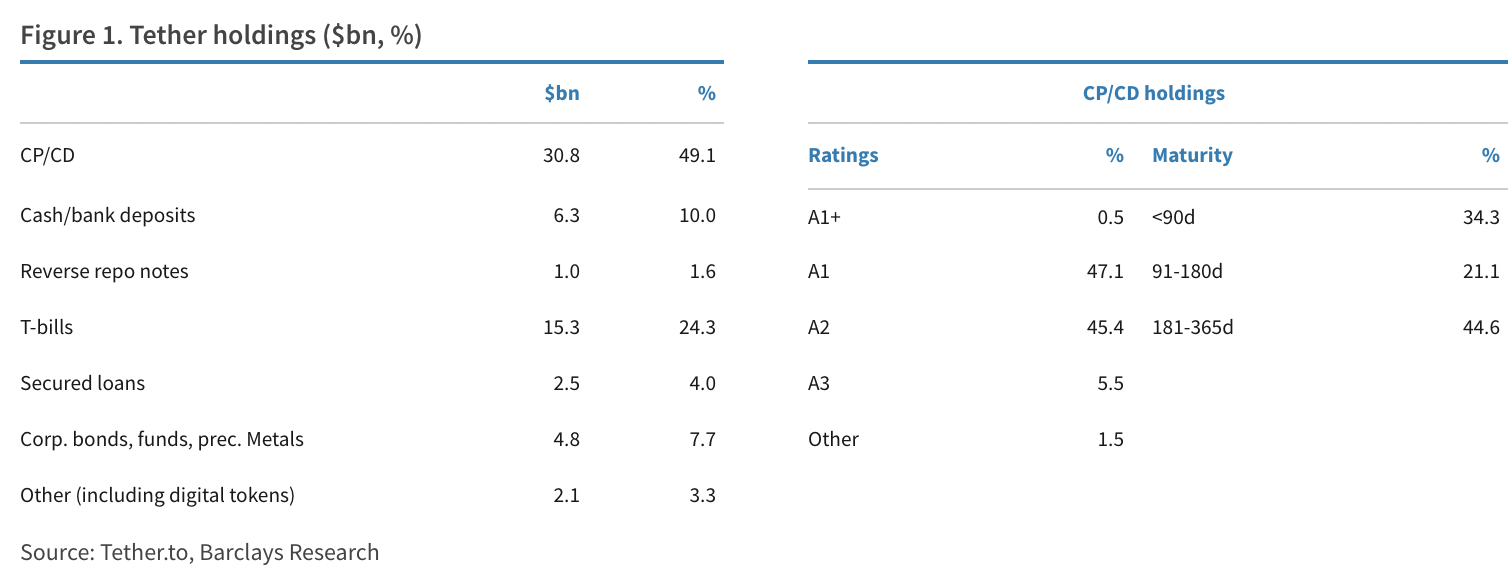

It's worth pointing out how remarkably clean positioning is at the moment. JPMorgan Chase data show that after whittling down short bets, the bank's clients are close to the most neutral stance in months. Additionally, the options skew -- representing the relative appetite for put and call options on 10-year notes -- has been mostly calm.  Meanwhile, strategists remain all over the map. Citigroup Global Markets strategists still see 10-year rates climbing to 2% by year-end. However, Bank of America analysts including Mark Cabana slashed the year-end target to 1.55% from 1.9% this week, citing "a softening in the U.S. economic data, resurgence and persistent risk of Covid, as well as expectations for a lower neutral rate." Looking for a last-minute Jackson Hole hedge? The credit market may be the place to go, according to JPMorgan. Strategists there led by Marko Kolanovic wrote this week that while corporate bond markets will likely be choppy through month-end, they offer a cheaper alternative relative to other hedges -- such as equities -- as investors contend with virus-variant fears and any possible shift in rhetoric at Jackson Hole or at the Fed's September policy meeting. "While the market will likely hold up through Fed tapering, those wishing to hedge associated risk should consider using credit or credit volatility rather than equities given credit's more limited upside and lower implied volatility levels," the strategists wrote.  As Bloomberg's Joanna Ossinger points out, three-month VIX contracts betting on a volatility jump are the most expensive versus those seeing a drop since early 2018. That relatively expensive equity hedge makes credit markets -- where U.S. high-grade and high-yield spreads have been widening for weeks -- look like a relative bargain. However, it looks like the slump in blue-chip bonds may be breaking. U.S. investment grade spreads are set to inch tighter this week -- the first weekly drop since late June. It's a similar story in the junk bond market, where spreads are on pace to narrow on a weekly basis for the first time since early July. While waiting for the Jackson Hole symposium to kick off, fixed-income traders had the chance to busy themselves with this week's combined $183 billion of 2-, 5- and 7-year slate of Treasury auctions. Overall, demand metrics were fine -- Tuesday's 2-year sale stopped through, while the other two tailed -- but what really stuck out was the strength of the overseas bid. Indirect bidders -- a category that's widely considered to include foreign central banks -- took down an above-average share of the 5- and 7-year sales, according to BMO Capital Markets. At Tuesday's 2-year auction, they showed up and then some: the indirect category was awarded 60.5% of the $60 billion offering, the biggest share since 2009, according to Bloomberg data.  When I mentioned how robust the overseas bid was on Twitter, I received this amusing reply from user AGTrader: "can't buy bunds!" They're not wrong. Let's check in on what a 10-year security goes for in some of the other major developed bond markets. In Japan, 10-year bonds yield just about 0.01%. In the U.K., the rate clocks in at 0.6%. And in Germany, as AGTrader points out, rates on 10-year bunds are deeply negative at minus 0.41%. In comparison, a 1.3% yield on a 10-year Treasury looks downright juicy. It's the fixed-income version of the TINA argument often trotted out to explain why stocks only seem to go up -- that with global interest rates so low, 'there is no alternative' to riskier assets such as equities. For bond-centric investors around the globe, there are very few alternatives to the U.S. Treasury market at this point. That much was obvious in the details of this week's auctions. As a fixed-income enthusiast and cryptocurrency tourist, imagine my delight when a research note from Barclays touching on both landed in my inbox. The topic at hand is the stablecoin -- a cryptocurrency that seeks to maintain a fixed exchange-rate with a fiat currency by holding reserves. Tether -- the largest stablecoin -- was forced to release a breakdown of its reserves in May as part of a legal settlement with the New York Attorney General's Office, which revealed that the stablecoin is largely backed by unspecified commercial paper. At $62 billion in market cap -- equating to a $31 billion commercial paper portfolio -- Tether would rank as one of the largest prime money funds on the market. But Tether's holdings tend to be longer maturity and lower quality than the typical prime fund, Barclays strategist Joseph Abate wrote. As Abate notes, commercial paper is "asymmetrically liquid" at best -- it's a buy-and-hold security, and there's not much of a secondary market in which to sell it. That creates a difficult policy question for the Fed in the event of a run on Tether -- historically, the Fed acts as the "deep-pocketed liquidity backstop provider" that ends such prime fund fire-sales.  Bloomberg Bloomberg "How might the Fed respond to a redemption run in Tether? Is Tether and its holdings enough of a potential threat to the CP market to warrant preemptively considering the policy implications of liquidity backstops?" Abate wrote. "Normally, these types of threats are addressed through regulation. But, does the Fed have any regulatory authority over stablecoins located outside the U.S.?" They're difficult questions which are impossible to answer until it happens. But policy makers have started to make worried noises about stablecoins. Treasury Secretary Janet Yellen urged regulators to "act quickly" to ensure stablecoins face appropriate rules at a meeting last month. We Need to Talk About the Great Mayonnaise Inflation Mystery Fund Named MEME Is on the Way to Surf the Retail Investor Waves For Fed Taper, Forget When It Starts. The End Matters More |

Post a Comment