| Hello. Today we look at Europe's supply line struggles, the latest data from Asia as the delta variant hits and a look inside the new Afghanistan central bank. Europe's largest economies are starting to feel the squeeze from fraying supply chains.

The speed of Germany's recovery is being put at risk as companies in the manufacturing powerhouse report shortages of materials ranging from memory chips to lower-tech parts and even basics such as wooden pallets. Pandemic jolts everywhere are throttling even an economy with a brand built on efficiency and a reputation for precision and durability. The supply problems are wreaking havoc on companies from Siemens to BMW, and they could persist into next year or even longer. "In my career we haven't had a situation with so many commodities being scarce at the same time, and I've been dealing with the same materials since 1996," said Thomas Nuernberger, managing director of sales at Mulfingen, Germany-based EBM Papst, a maker of industrial fans. "This is the most difficult situation in the global supply chain I've witnessed." Germany is enduring the squeeze in other ways too: imported inflation there surged to 15% in August, fueling a surge in overall consumer price growth in the euro region that was the fastest in a decade, according to data released Tuesday. Meanwhile, U.K.-based supermarkets and fast-food chains are running short of some supplies amid a shortage of truckers and post-Brexit bureaucracy. Consumers can't get milkshakes at British branches of McDonald's, some stores are running low on bacon, milk and bread, and there have been warnings of shortages at Christmas. The experience in both countries exposes how supply chain problems are no longer a short-term phenomenon and risk hobbling supply, curbing demand and fanning inflation into 2022. —Simon Kennedy - We're tracking how Covid-19 is impacting global trade and supply chains. Subscribe to our Supply Lines newsletter

- Got tips or feedback? Email us at ecodaily@bloomberg.net

China's economy took a knock from the delta virus outbreak in August, with the services industry contracting for the first time since February last year and manufacturing hit by supply-chain problems, pressuring authorities to provide more economic support. Elsewhere in Asia, manufacturing is coming under pressure as the delta variant weighs on the global recovery. Japan's industrial production fell 1.5% in July from the previous month. Bloomberg's trade tracker also signaled a downturn in global commerce, which until recently has been one of the brightest parts of the world economy over the Covid period. - Fed regulation | President Joe Biden's choice of who will lead the Federal Reserve may come down to a debate about regulating Wall Street. Incumbent Jerome Powell is viewed as the favorite to get another term, but has run into some criticism for easing regulations on big banks.

- Chile rates | The Latin American nation is set to raise its key interest rate by half a percentage point on Tuesday, which would be the biggest hike in a decade.

- Rajan warning | Raghuram Rajan, the former Reserve Bank of India governor, said he is worried the Fed could take too long to slow its asset-purchase program.

- Brazil aid | President Jair Bolsonaro is contemplating a new round of Covid cash handouts for low-income Brazilians as his popularity sinks ahead of next year's elections, according to five officials.

- Record debt | South Korea's smallest budget increase in four years will still push the country's debt load to a record level of more than half the size of the economy, adding to concerns over its sustainability.

- Debunking the Hemline Index | The theory from the 1920s says skirt length can be a leading economic indicator, but current fashion trends show much more.

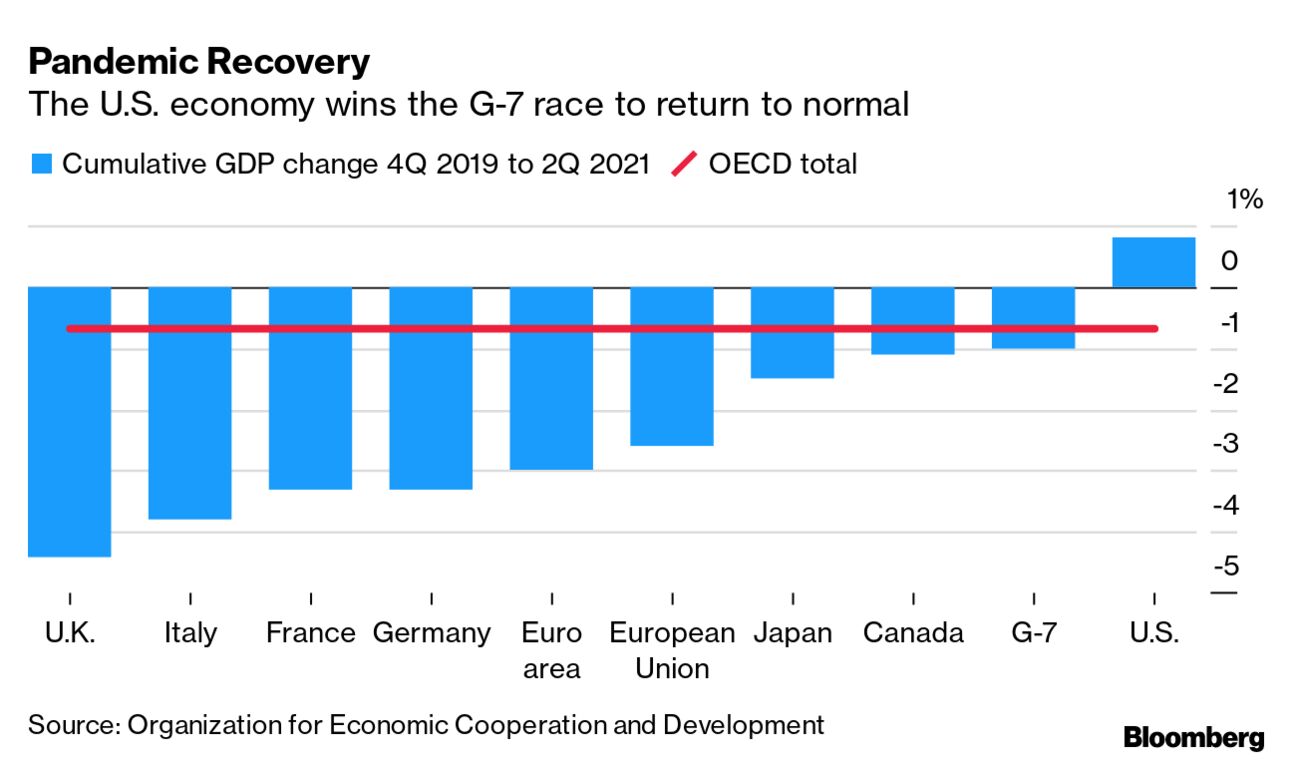

The U.S. is the first Group of Seven economy to return to a pre-pandemic level of output, leaving behind European peers that suffered sharper contractions when Covid-19 struck. According to the OECD's second quarter GDP data, its 38 members as whole also haven't reached pre-crisis readings, even as growth for the group accelerated to 1.6% in the period from 0.6% at the start of the year. While the U.K. recorded the G-7's strongest second-quarter expansion, it has the largest gap to close to get back to activity levels seen before the coronavirus outbreak. Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

Bloomberg New Economy Conversations — China's Tech Crackdown: Join New Economy Forum Editorial Director Andrew Browne on Sept. 8 at 10 a.m. as he analyzes the sweeping regulatory crackdown underway in China. The private sector helped power China's economic rise, but President Xi Jinping seems determined to rein in what he sees as its excesses. Is this transitory or a game-changing shift? Joining Andy are Keyu Jin, Associate Professor of Economics at the London School of Economics & Political Science, and Kevin Rudd, President and Chief Executive Officer of the Asia Society. Register here. |

Post a Comment