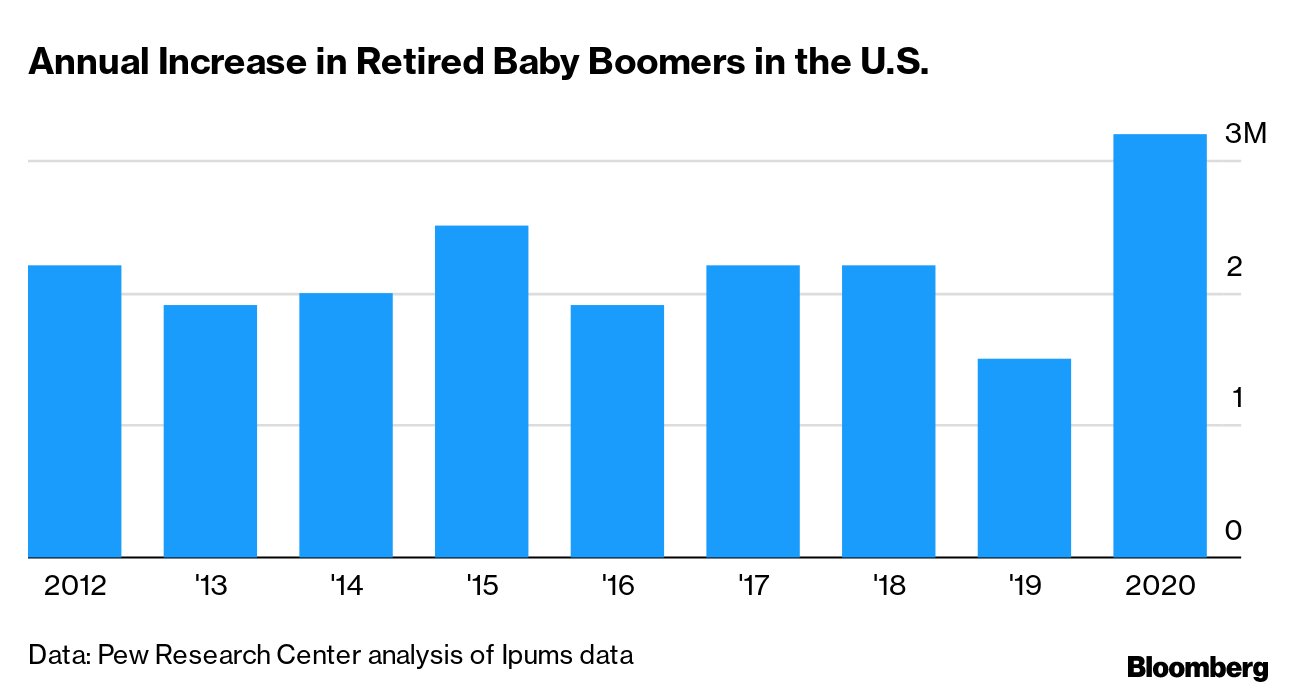

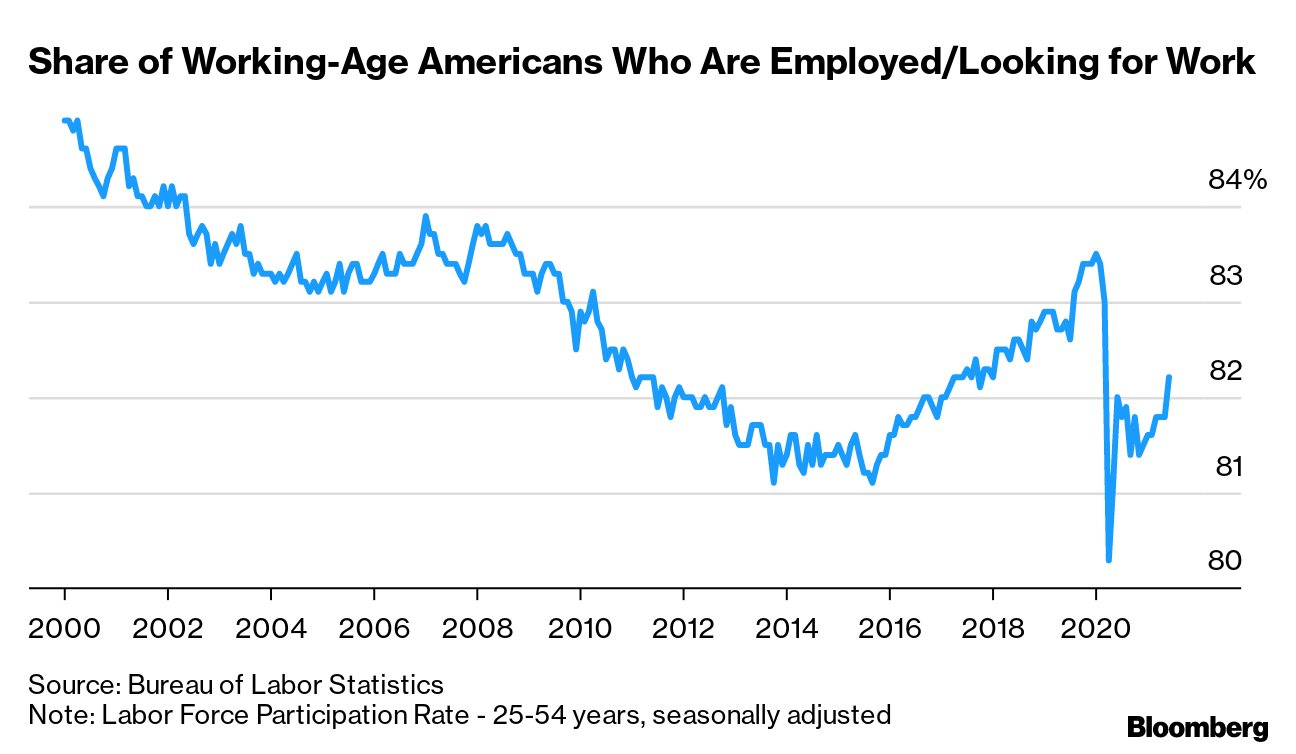

| Hello. Today we look at the missing-worker phenomenon in the U.S., Europe's energy shock and what may trigger the beginning of the end of the Federal Reserve's current asset-purchase program. The U.S. economy has bounced back from the worst of the pandemic at a remarkable rate, but a disturbing trend in the job market has left economists, policymakers and investors wondering: Where have all the workers gone? The latest monthly jobs report, out Friday, is forecast to show the U.S. added about 875,000 to payrolls in July. That would be a healthy jump, the biggest in almost a year. What's worrying is the labor force participation rate — a measure of the share of working-age Americans who are employed or looking for work.  The measure has been stuck near the lowest level since the 1970s for almost a year, with little likelihood of moving up anytime soon. And that's set to restrain the recovery potentially for years to come. Among the factors holding back the American job market, I report with Katia Dmitrieva: Demographics Baby boomer retirements more than doubled in 2020 from the previous year, while the working-age population — Americans between the ages of 15 and 64 — shrank for a second consecutive year. A higher rate of Boomer retirements could "have a really potentially detrimental effect on economic recovery if that high-production, high capacity, highly experienced group of people is out," said Hannah Grieser, marketing manager at labor market analytics firm Emsi Burning Glass.

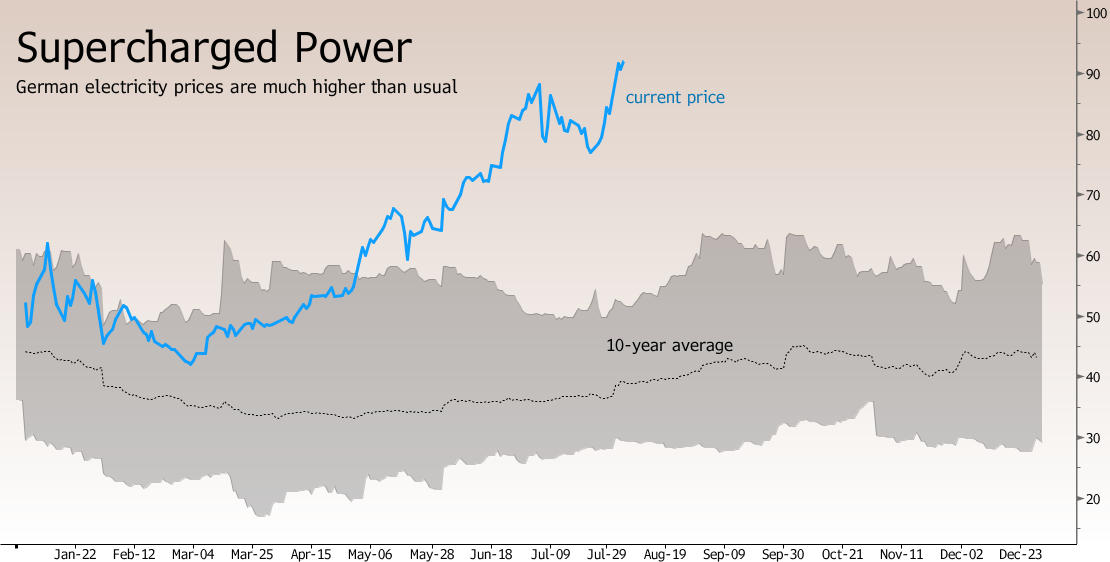

Drug Crisis Drug overdose deaths jumped 29% in 2020, to a record 92,183 amid economic hardship, forced isolation and interruptions to health and social services. Things were already bad before the pandemic. The authors of a May 2018 research paper from the Federal Reserve Bank of Cleveland estimated that prescription opioids accounted for 44% of the decrease in men's labor force participation between 2001 and 2015. Automation Virus concerns have accelerated a trend away from in-person contact and toward technology. According to Oxford Economics, 45% of the 7 million jobs the U.S. was missing as of June versus the pre-pandemic peak are vulnerable to automation — led by food service, retail sales, and manufacturing. Child Care Millions of parents — primarily women — left the labor force when schools and day care centers shut down last year. Some families have adjusted to living on a single income, meaning one parent might decide not to return to work. Meanwhile, the rising cost of child care could mean some parents opt to stay at home rather than spending a large share of their pay on day care or after school program fees. "We need to work as a society to make sure people find their way back into the labor force,'' Federal Reserve Chair Jerome Powell said July 15. "We lag all of our peers in labor force participation now, which is not where we want to be as a country." —Olivia Rockeman  After lockdowns forced Basel Hamzeh to close his cafe in a trendy Berlin neighborhood for months, the 53-year-old is confronting a fresh crisis: high energy bills. The cost of natural gas and electricity has surged across Europe, reaching records in some countries, as businesses re-open and workers return to the office. In Germany, wholesale power prices have risen more than 60% this year, leaving the owner of the Frau Honig cafe in Friedrichshain with no option but to raise prices of everything from cappuccinos to cinnamon rolls. Read the full story here - Coming up | The Bank of England may shake markets today with a review of how it might eventually withdraw stimulus. The Czech central bank is set to raise interest rates again and outline even more hikes. Meanwhile, Egypt and India — which doesn't meet until tomorrow — are likely to leave rates untouched.

- Aggressive action | Brazil's central bank delivered its biggest interest rate increase in nearly two decades and promised to quickly reintroduce a restrictive monetary policy to tame above-target inflation.

- Taper talk | Fed Vice Chairman Richard Clarida said the central bank is on course to pull back on the massive support it is providing to the pandemic-damaged economy, starting with an announcement later this year that it is paring bond purchases and moving on to a liftoff in interest rates in 2023.

- Trade winds | Extreme weather in China is becoming the latest challenge to global supply chains, as a heavy typhoon season threatens to further delay goods stuck at some of the world's busiest container ports.

- German rebound | Factory orders rose in June, bolstering the recovery in Europe's largest economy as an easing of pandemic restrictions supported business activity across sectors.

- Enduring wealth gap | The social architecture formed over more than three centuries of White rule has maintained South Africa's position as the world's most unequal society, according to the Thomas Piketty-backed World Inequality Lab.

Despite the missing-worker phenomenon detailed above, the U.S. labor market has moved about a third of the way back toward full employment since December, Bloomberg Economics estimates. If it continues to improve at its recent pace for the next several months, it will have progressed more than halfway to full employment, David Wilcox and Andrew Husby estimate. And that, in turn, should clear the way for the beginning of the end of the Fed's current asset-purchase program, they write Thursday. The threshold officials set for the taper to begin was "substantial further progress" toward the Fed's goals — not attainment of full employment. But the metrics have never been specified. As a reference point, Wilcox and Husby focused on closing half of the gap between where the labor market was in November and where it was at the peak in February 2020. Their analysis of labor trends suggests the next several monthly job reports should get the economy to that mark. Read the full research on the Bloomberg Terminal Taking a closer look at South Korea...  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment