| Hello. Today we look at how China is drawing inspiration from Germany's economic model, why American's aren't buying into the recovery and the departure from Kabul of Afghanistan's central banker. Seeking to understand Beijing's regulatory crackdown, some economists are looking over 4,500 miles away to an unlikely inspiration: Berlin. China has turned from "the American way" to "the German way," Chen Li, a senior strategist at brokerage Soochow Securities Co., wrote in a recent presentation that was widely shared on Chinese social media. Chris Leung, chief China economist at DBS Group Holdings Ltd., says Germany is a model as it still has large state-owned banks, a strong manufacturing export sector, and hasn't had a financial crisis since WWII.  While the analogy with Germany has its limits, there are at least three areas of convergence worth pointing out: anti-trust rules, an emphasis on manufacturing over services and its approach to education. - China consulted German experts while writing its anti-monopoly regulations, said Peter Hefele, head of the Asia-Pacific department at Konrad-Adenauer-Stiftung, a foundation affiliated with Germany's center-right Christian Democratic Union party. "They copied a lot from German law."

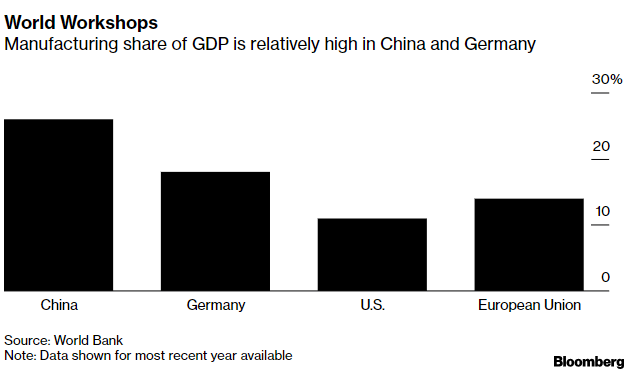

- Beijing's "Made in China 2025" program, with its focus on increasing manufacturing in tech sectors, was inspired by Germany's Industry 4.0 blueprint. "The admiration comes from the idea that Germany has never given up its industrial core, and that it may be more important than the service industry," said Doris Fischer, chair of China business and economics at the University of Würzburg.

- In a draft vocational education law issued this year, Beijing promised a "fusion of industry and education," aping Germany's system, where private companies provide paid internship opportunities. "The only country where I've seen that imitated on a larger scale is China," said Hermann Simon, chairman of German consultancy Simon-Kucher & Partners.

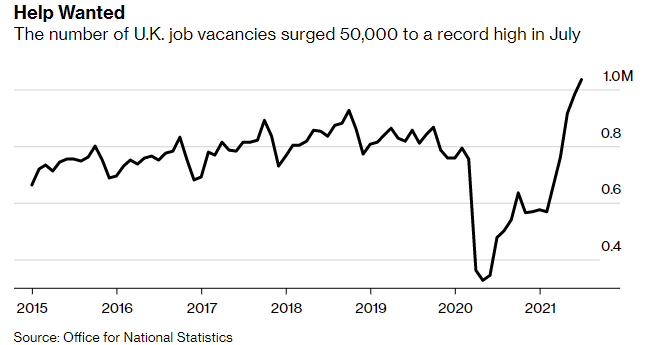

"The departure of Beijing from the Anglo-Saxon model has already begun," DBS's Leung wrote in a note Monday. "The German model is a strong contender as a guiding development model." —Tom Hancock European businesses are stepping up hiring and paying more as pandemic restrictions passed and vaccinations were delivered, data showed on Tuesday.

In the U.K., companies posted more than 1 million new job vacancies for the first time and wage growth hit a record pace.  Meantime, employment in the euro-area increased 0.5% in the three months through June. - Coming Up | Federal Reserve Chair Jerome Powell speaks at a town hall event for educators as markets and colleagues debate when the central bank should start slowing its asset purchases. The U.S. also releases retail sales data.

- Libor risk | The Fed told a judge not to scrap Libor as requested by consumers in a lawsuit because it would pose a risk to financial stability and undermine years of global planning for a transition to a new benchmark for borrowing rates.

- Ready to act | The Reserve Bank of Australia said it will continue to review its bond-buying program and is prepared to act in response to further bad news on the health front that hurts the economic recovery.

- Bottleneck | The biggest U.S. trade gateway with Asia is clogged with the most inbound container vessels in more than six months, threatening to extend transportation delays, bite into profit margins and boost prices.

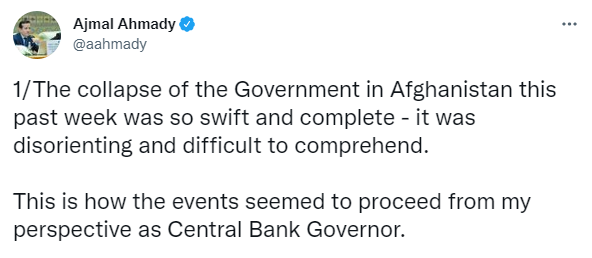

The Swiss National Bank, with holdings in Exxon Mobil and Royal Dutch Shell, could "green" its portfolio without compromising its neutrality versus the market if it sold off its stakes in the heaviest polluters and invested more in competitors with a better emissions record, according to EPFL Professor Ruediger Fahlenbrach and Eric Jondeau of the University of Lausanne. Based on 2019 data they calculated that if the SNB divested companies with the highest carbon intensity representing 1% of the portfolio value and reinvested in firms with the best record in the same sector, total financed carbon emissions would've been reduced by 22%. With more than a trillion dollars in foreign exchange reserves, environmentalists have repeatedly urged the SNB to sell off its "brown" assets. The SNB says its investment policy shouldn't promote or inhibit economic, political and social change. Afghanistan's central banker flees Kabul…  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment