| Hello. Today we look at China's criticisms of Federal Reserve policy, its potential investments in Afghanistan and the Asian giant's "Volcker Moment." China has never been a fan of quantitative easing and is becoming increasingly critical of the massive monetary and fiscal binge undertaken by America and other developed economies in response to the pandemic. Saddled with huge debts accrued from its own spending blitz after the last global economic crisis back in 2008, Chinese policy makers have been determined not to make the same play this time — even if that means slower economic growth.

By contrast, America, Europe and other developed nations have taken the opposite tack, realizing they probably could have gone harder back then, so they're doubling down this time. It's a policy reversal that's driving China's top leaders to conclude they're better off charting their own policy path — even if that's at odds with the Federal Reserve.

As Tom Hancock writes, the Communist party's politburo has pledged "greater autonomy" of macroeconomic policies, signaling a willingness to add stimulus as China's recovery loses steam.  So on the eve of Jackson Hole, where Fed officials will discuss when and how they should start tapering bond purchases, China is playing an unlikely role as the defender of conventional monetary policies.

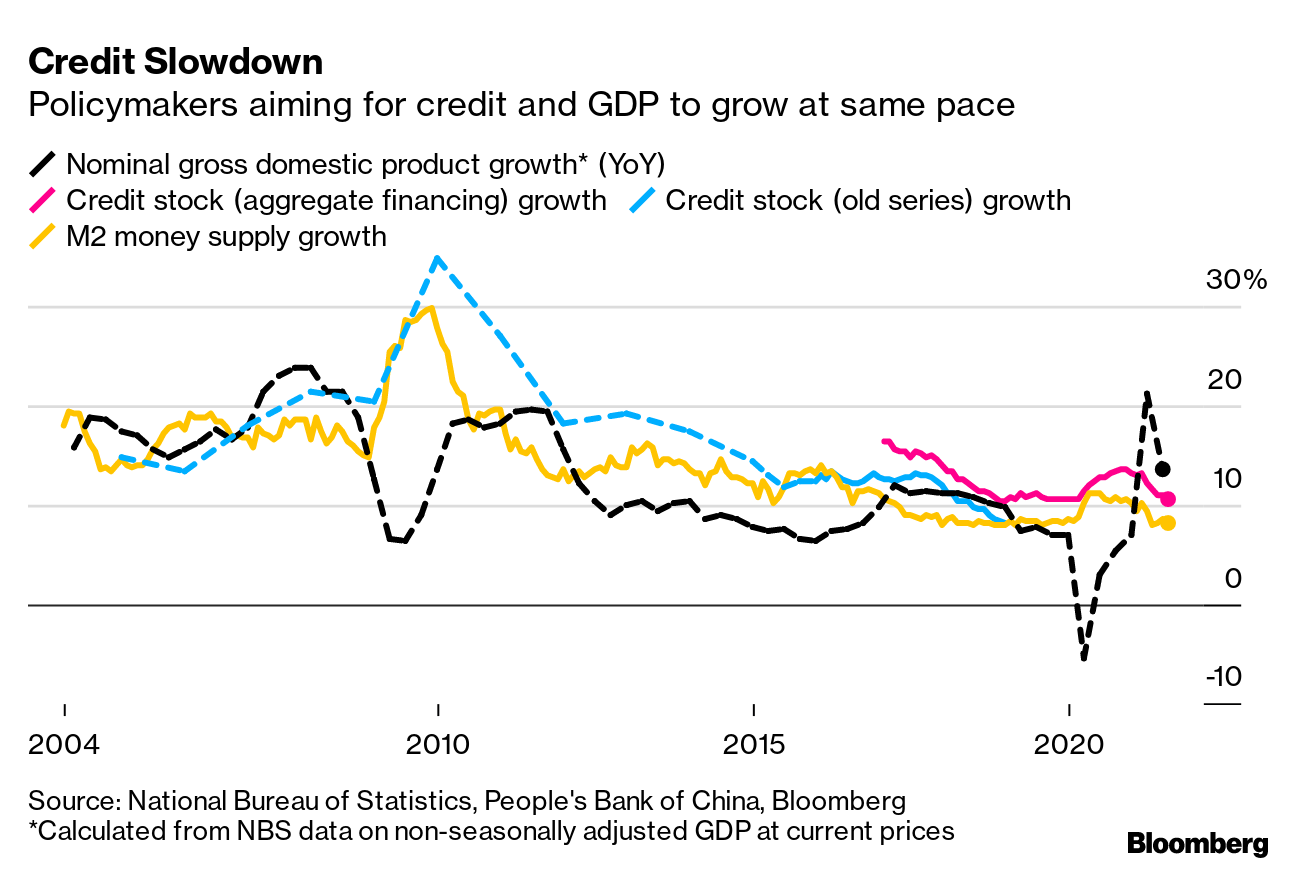

The U.S. faces the "most severe" inflation risks of any major economy due to the large deviation between the growth of its money supply and GDP since the pandemic, the People's Bank of China said recently in its quarterly monetary policy report. On Tuesday, Governor Yi Gang said he'll aim to match money supply and nominal economic growth rates.

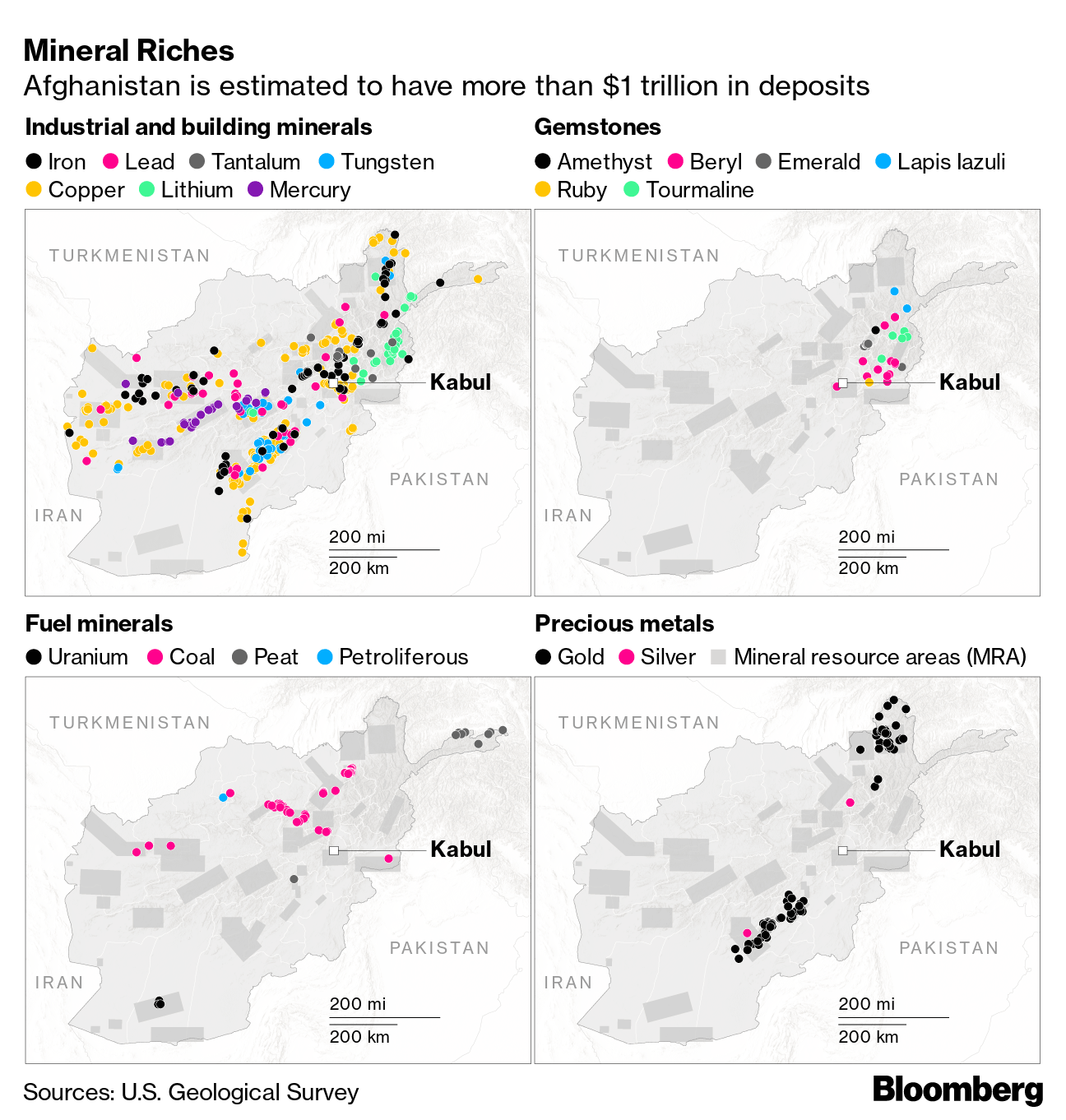

If the U.S. does start tip toeing away from its crisis policy settings as the recovery deepens and the PBOC is adds stimulus as its recovery passes the peak, the world's two biggest economies will be on divergent paths again. In the past, such a deviation has led to capital outflow pressures in China, prompting authorities to curb the movement of money. But that is less likely now because Beijing has worked so hard to open its markets up. With the currency trading more freely these days, depreciation may prove to be the buffer China needs. While that's not the consensus view — Bloomberg surveys expect further strengthening — economists say a weaker yuan would ensue if a Fed taper leads to a stronger greenback. — Malcolm Scott  Afghanistan is sitting on deposits estimated to be worth $1 trillion or more, including what may be the world's largest lithium reserves — if anyone can get them out of the ground. If things go right, China just might try. Such resources are valuable in modern economies driven by advancements in high-tech chips and large-capacity batteries. "With the U.S. withdrawal, Beijing can offer what Kabul needs most: political impartiality and economic investment," Zhou Bo, who was a senior colonel in the People's Liberation Army from 2003 to 2020, wrote in an op-ed in the New York Times over the weekend. - Budget backed | The U.S. House adopted a $3.5 trillion budget resolution after a White House pressure campaign and assurances from Speaker Nancy Pelosi helped unite fractious Democrats to move ahead on the core of President Joe Biden's economic agenda.

- Brazil concern | President Jair Bolsonaro is growing uneasy about Brazil's inflation in the run-up to general elections, but his complaints about rising prices don't mean he plans to interfere with the central bank.

- Wage pressure | Britain's construction, manufacturing and food preparation industries are pushing wages higher across the economy due to a shortage of workers to fill available jobs.

- Car fight | Mexico is warning that the U.S. interpretation of the revamped North American free trade deal that also includes Canada could push automakers to abandon the region due to cumbersome and costly content requirements.

- South Korea | The country could this week become the first major economy in Asia to raise interest rates although the decision is seen as a coin toss.

- Come work | The labor constraints jeopardize essential U.S. services such as trash pick-up, and exacerbate shortages in demanding jobs like 911 dispatchers that predated the Covid-19 crisis. The solution: sign-on bonus.

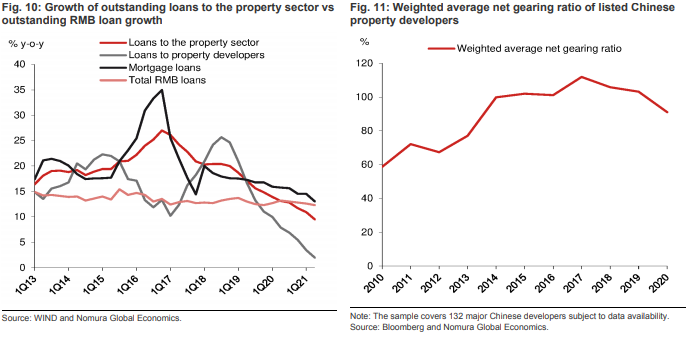

Beijing's unprecedented determination to curb the property sector could be China's "Volcker Moment" as it will cause a "significant" slowdown in economic growth, according to Nomura. Unlike in previous economic down cycles, Chinese authorities look set to tighten property sector policy and tame prices this time, in order to reduce wealth inequality and boost the falling birthrate, economists led by Lu Ting wrote in a report.

Policy makers will be willing to sacrifice near-term economic growth to tame house prices and divert financial resources out of the property sector, which accounts for a quarter of China's gross domestic product, they wrote. How long until this starts undermining the recovery?  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment