| Powell speech, delta fears and Biden defiant. Fixed-income investors are looking to next week's Jackson Hole symposium for an update on Federal Reserve policy. But today's appearance by Chair Jerome Powell at a town hall for educators may be used as an opportunity to prime the market for what's coming. Data from the Treasury Department yesterday showed that hedge funds dominated buying in June as the inflation trade, which was the theme at the start of the year, ran out of steam. The outbreak of the delta variant of Covid-19 is seeing some areas of the U.S. hitting death rates comparable to November's peak. In Florida, an average of 203 people a day are dying with confirmed or suspected covid. President Joe Biden's administration is set to offer booster shots as soon as next month. New Zealand is back in lockdown after a single virus case there. The Chinese port at Ningbo remains partially closed, which is worsening congestion at other container handling facilities. Hong Kong tightened travel curbs, meaning visitors would have to spend up to 21 days in quarantine on arrival. Japan is set to expand its state of emergency in parts of the country until Sept. 12. Biden offered a defence of his decision to withdraw from Afghanistan while admitting that the Taliban takeover happened faster than expected. He is probably keen to get the debacle behind him as the administration seeks to get his economic agenda through Congress. Any signs that those bills risk getting delayed would be seen as a negative by markets. In Kabul, the Taliban has announced an amnesty and reportedly urged women to join government. The S&P 500 Index's recovery to a new record high yesterday seems unlikely to be repeated today as fears over the delta variant's economic impact are coming to the fore. Overnight the MSCI Asia Pacific Index dropped 1.1% while Japan's Topix index closed down around 0.5%. Chinese tech shares slumped. In Europe the Stoxx 600 Index was 0.1% lower at 5:50 a.m. Eastern Time. S&P 500 futures pointed to a slide at the open, the 10-year Treasury yield was at 1.227%, oil was under $67 a barrel and gold gained. July retail sales are expected to show a 0.3% decline when the data is released at 8:30 a.m. Industrial and manufacturing production at 9:15 a.m. may show a small improvement. Powell's town hall is at 1:30 p.m. Federal Reserve Bank of Minneapolis President Neel Kashkari also speaks later. Walmart Inc., Home Depot Inc. and Krispy Kreme Inc. are among the companies reporting results. Here's what caught our eye over the last 24 hours. A persistent theme of the past few years is the disconnect between the U.S. large-cap stock market and just about everything else. This was especially true yesterday when the S&P 500 finished at another record high -- it's officially doubled from the March trough -- even after European and Asian shares closed lower.

Bearish signals are everywhere in trading today amid fears over the spreading delta variant. Government bonds are rallying. The dollar is up. Most notably, the New Zealand dollar saw its biggest intraday drop since May after the government announced a lockdown on a single virus case. Even junk-bond yields, which have been steadily tightening in nearly perfect lockstep with the equity rally since late 2020, have widened lately.

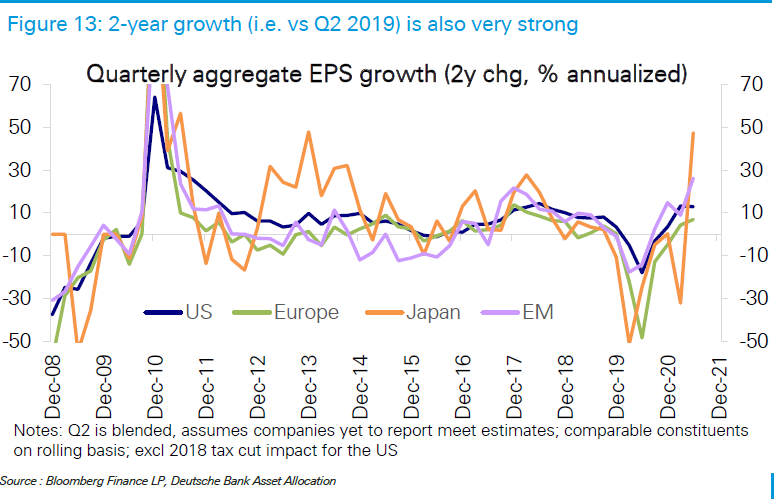

One explanation is for the resilience of equities is earnings. As Deutsche Bank strategists noted Monday, the earnings beats across U.S. stocks are showing the widest breadth ever. Remarkably, the two-year profit growth rate is rising, a sign the strength isn't just due to base effects from the pandemic. These spectacular results are largely true across the world, but the U.S. has the additional benefit of a tech-heavy sector weighting that has burnished the top-down metrics. Of course, those numbers are backward-looking, but analysts have also been upgrading their earnings estimates.  Source: DB Source: DB

The takeaway from recent years has been that U.S. large-caps are now something of their own beast, less cyclically driven and an allocation almost distinct from other equity markets that's become the go-to investment in a low-rate world. U.S. stock futures are in the red today, so it looks like they can't be entirely decoupled from the real world. But let's see what the dip buyers get up to.

Follow Bloomberg's Justina Lee on Twitter at @justinaknope Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment