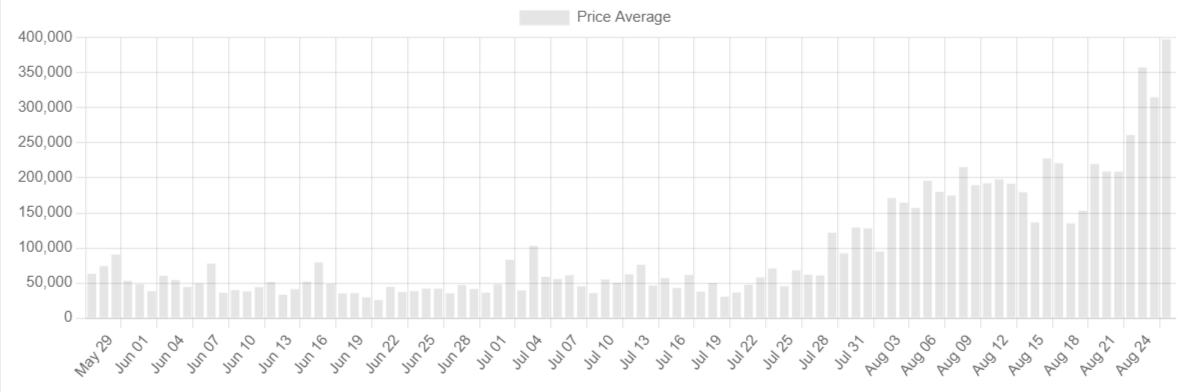

| Corporate America ramps up vaccination campaign, labor-market signal due, and greenwashing fears mount. The number of companies insisting workers get vaccinated continues to increase with Delta Air Lines Inc. saying yesterday that it would levy a $200 monthly charge on employees who refuse a shot. Data shows that the economic recovery is strongest in counties where vaccination rates are highest. The number of new cases continues to rise in the U.S., with the European Union set to make a decision today on whether to reimpose curbs on visitors from America. Elsewhere, India saw its highest case numbers in a month while the outbreak in Australia worsened. There is one last look at the state of the U.S. labor market today ahead of Federal Reserve Chair Jerome Powell's much anticipated speech at the Jackson Hole symposium tomorrow. Initial weekly jobless claims are forecast to come in at 350,000, roughly in line with last week's level. The second reading of second-quarter GDP, also released this morning, may show a slight improvement on the originally reported 6.5% annualized expansion. Deutsche Bank AG's asset-management arm DWS Group's stock plunged as much as 13.1% after U.S. prosecutors opened an investigation into the group's statements on sustainability metrics on some investments. While there has been a trend lately in Europe for banker bonuses to increasingly be tied to ESG — environment, society and good governance — metrics, there have been questioned raised about how DWS stated its credentials. It comes amid industry concerns about how environmental metrics are calculated generally, and whether some carbon offsets are effective at all. Markets are possibly suffering a little deja vu this morning as concerns over the pandemic and a selloff in Chinese tech shares weigh on sentiment. Overnight the MSCI Asia Pacific Index slipped 0.4% while Japan's Topix index closed broadly unchanged. In Europe the Stoxx 600 Index was 0.5% lower at 5:50 a.m. Eastern time with cyclical stocks leading the losses. S&P 500 futures was slightly down, the 10-year Treasury yield was at 1.353%, oil was under $68 a barrel and gold was down. Claims and GDP data are at 8:30 a.m. The busy week for Treasury auctions continues with an auction of $62 billion of 7-year notes at 1:00 p.m. President Joe Biden meets with Israeli Prime Minister Naftali Bennett in Washington. It's a busy day for earnings with Peloton Interactive Inc., Dell Technologies Inc., HP Inc., J M Smucker Co. and Gap Inc. all reporting. Here's what caught our eye over the last 24 hours. On a rainy Saturday in London, I went to the National Gallery in my first visit to an art museum since the pandemic, which is probably just about the perfect activity before a week in which a digital file of a crudely drawn rock sold for $1.3 million and Visa added its first-ever non-fungible token to its collection. How much have tokens representing unique ownership on the blockchain of a digital collectible, known as NFTs, boomed? The average price of a CryptoPunk has more than tripled just this month to nearly $400,000 yesterday, NFT Stats show. One way a Pudgy Penguin fan described the appeal to me in our new NFT feature is that it's the latest "flex" -- like one of those ornate portraits aristocrats like the Doge of Venice might commission. Many of the most popular, from CryptoPunks to Pudgy Penguins, are avatars used for social-media profile pictures. Sure, you can download someone else's and pass it off as your own, but at least most people typically link their ownership back to a wallet and its transaction history on the blockchain. Another sign it's a flex is that there's a very direct, easily quantifiable link between prices and the rarity of the traits of each NFT.  Average prices for CryptoPunks. Source: NFT Stats Average prices for CryptoPunks. Source: NFT Stats So for a person who's living their lives largely online and probably isn't fussed about how they appear IRL, it makes sense that owning an expensive avatar is far more appealing than owning a fancy watch or handbag. One thing I think about a lot is the crypto world has swelled so quickly over the past year thanks to surging prices that it's become somewhat self-sustaining. Many crypto-native millionaires and billionaires like to keep their money within the ecosystem, which is very good at constantly creating new pockets of speculation. Of course it's hard to separate the wheat from the chaff, especially at this stage of the hype cycle and for new NFT projects. That's why Visa went for the CryptoPunks: Its earlier provenance going back to 2017 has now given it a unique forerunner status, a bit like a Picasso for cubism, a blue-chip NFT. Knowing what to pay for a large swath of the NFT universe is much harder. Follow Bloomberg's Justina Lee on Twitter at @justinaknope Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment