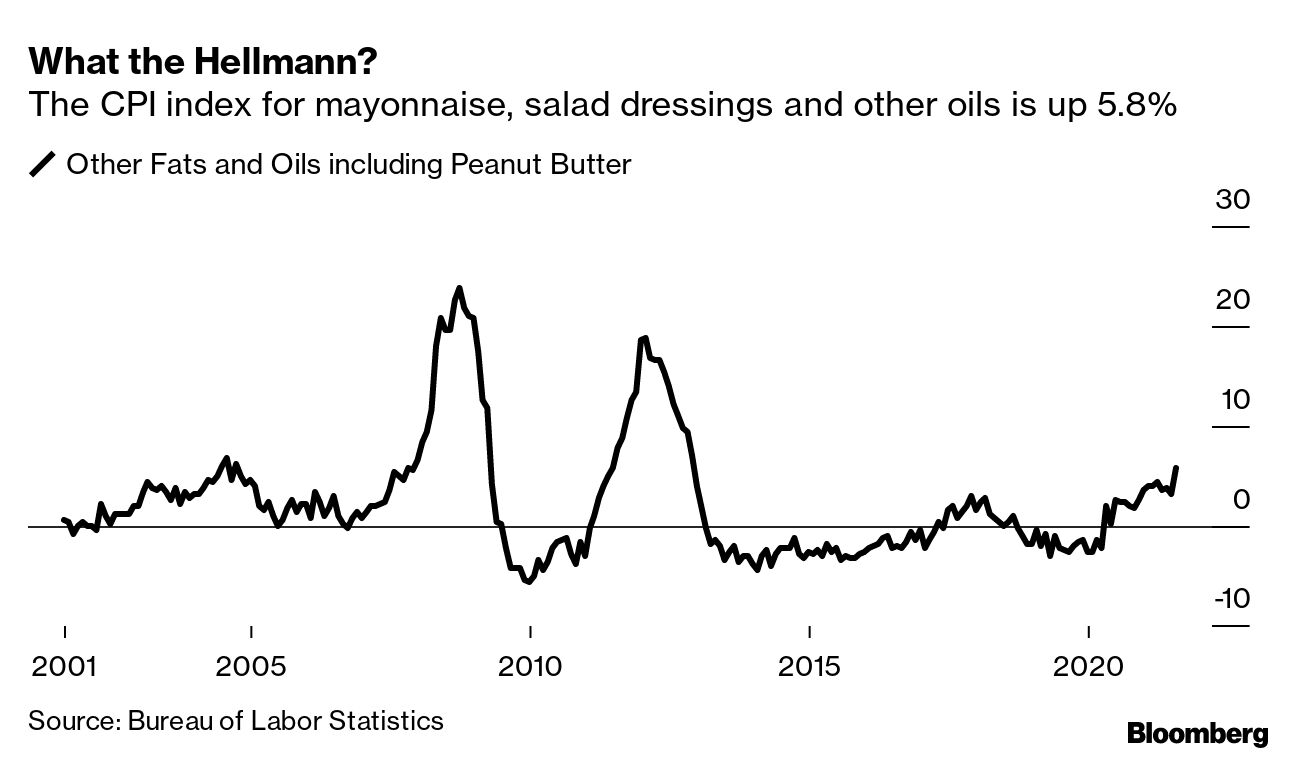

| There are still 1,500 Americans in Afghanistan. China's regulatory crackdown has curbed the outlook for growth. The window is closing to determine the origins of the Covid pandemic. Here's what you need to know this morning. The latest U.S. intelligence report on the origins of Covid-19 is inconclusive and does not rule out the possibility of a lab leak — a conclusion that could further stoke tensions between Washington and Beijing. Meanwhile, an embattled group of scientists charged by the WHO with studying the beginning of the coronavirus pandemic is pleading for support for its work, but says a new approach that includes a focus on the lab-leak hypothesis would take too long to gather fading evidence. After being criticized for not thoroughly addressing the potential that it could have leaked from a nearby lab, they now plan to seek evidence of the virus before it was detected in Wuhan in December 2019, as well as surveying wildlife that could have harbored the pathogen. In other virus news, Hong Kong has no plans to boost the city's lackluster vaccination effort; Delta Air tells staff to get vaccinated or pay a $200-a-month surcharge; and the EU is considering reimposing travel restrictions on the U.S. The U.S. departure from Afghanistan is leaving the Pentagon with at least $6 billion in unspent funds for the now-defunct Afghan Security Force, and a potential fight over how to spend the money. Meanwhile, the first wave of some 9,500 refugees set to flee the Taliban takeover of Afghanistan has reached a New Jersey military base. And the U.S. knows of about 1,500 Americans who are still in Afghanistan, but doesn't believe all of them are seeking to leave the country, says Secretary of State Antony Blinken. U.S. diplomats have spoken to about 500 of those people and are "aggressively" trying to reach the others, Blinken said. Asian stocks are set for a mixed start as traders await more clues about the regulatory outlook in China as well as the Federal Reserve's approach to paring stimulus. Futures rose in Japan but dipped in Australia and Hong Kong. U.S. contracts fluctuated after the S&P 500 and Nasdaq 100 edged up to records. The 10-year U.S. Treasury yield climbed ahead of the Jackson Hole meeting, which may offer fresh insight on how the Fed intends to scale back bond purchases. The dollar was little changed. The rebound in Chinese stocks listed in the U.S. fizzled. Beijing's sweeping crackdown on private industries is continuing to color sentiment and complicate the outlook for the world's second-largest economy. China's ongoing campaign to clamp down on industries ranging from steel to education to property has roiled financial markets and curbed the outlook for growth. Economists say authorities will need to carefully manage the pace and intensity of regulation against an economy weakening faster than expected this year following fresh virus outbreaks. Meanwhile, the SEC chief has a warning for hundreds of Chinese companies that have raised billions of dollars in U.S. markets: Submit to more scrutiny soon or get kicked out. However, retail traders are piling into China stocks in dip-buying mode, net purchases of Chinese tech shares in New York in the past five trading sessions topped the $400 million mark. Japan's Yoshihide Suga moved closer to being re-elected ruling party leader and remaining prime minister as backroom power broker and leader of a top faction, Toshihiro Nikai, said his group would support him. Party officials this week were set to decide on the date of the Liberal Democratic Party vote, which is expected next month. Elsewhere in Japan, Western Digital is in talks to merge with Japan's Kioxia in a deal that could unite two technology storage providers. The deal, which could be worth more than $20 billion, may be reached by mid-September and would create a bigger competitor for Samsung in the market for memory chips used as storage in portable devices and computers. This is what's caught our eye over the past 24 hours: Earlier this month the price of mayonnaise suddenly burst into the public's collective consciousness after the owner of a neighborhood restaurant in North Carolina told a local news channel that he was "paying $200 more a week in mayonnaise." The stat was soon picked up by the Twitter account of the North Carolina Republican Party, which added a comment about "Bidenflation." At the same time, some social media users pointed out that with the Consumer Price Index (CPI) coming in at 5.4% year-on-year in July, the restaurant would have to be going through gallons of the fatty filling in order to be spending an additional $200 a week.  So what exactly is going on with mayo prices? I decided to dig deep into mayoinflation, the results of which you can read on the Odd Lots site. I won't go into all the details of what's happening here, but suffice to say, if you're interested in the inflation debate it's worth reading and reveals a wider point about inflation. We tend to talk about it from a macro perspective, as a cohesive whole. But the measure is ultimately a collection of individual prices, each of which tell their own micro story of supply and demand. |

Post a Comment