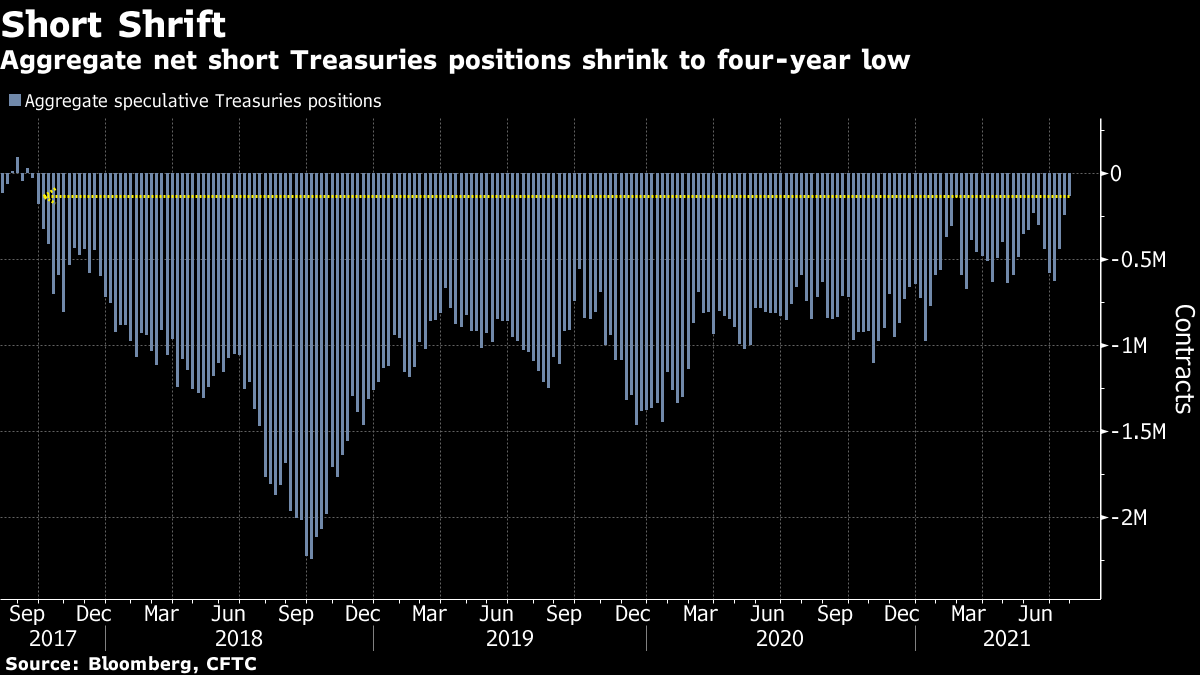

| Good morning. Chinese IPOs, Europe's tourism outlook, Mideast tension rises, Bitcoin drops. Here's what's moving markets. China's securities regulator called for more communication with its American counterpart after the U.S. Securities and Exchange Commission increased disclosure requirements for initial public offerings of Chinese companies. The China Securities Regulatory Commission called for mutual respect and collaboration on the issue in an effort to find a suitable resolution. Chinese equities rebounded Monday, trimming some of the rout last week caused by Beijing's ongoing crackdown on a range of private industries. The SEC said it would require improved risk disclosures. Chancellor Rishi Sunak has urged an easing of the U.K.'s travel restrictions, which he said are damaging the country's tourism industry and the overall economy. In France, tourism is rebounding versus last year, when the pandemic shut borders, with 50 million foreign tourists expected this summer. Meanwhile, the world looks to the U.K. for answers about how delta variant outbreaks might unfold. The U.S. formally blamed Iran for a deadly attack on an Israel-linked oil tanker off Oman, warning of an "appropriate response." The condemnation came after Israeli Prime Minister Naftali Bennett said Iran was "unequivocally" responsible for the attack that left a Romanian and a Briton dead on Thursday. The U.K. foreign secretary issued a similar condemnation. None of the statements offered direct evidence, and Iran denied responsibility. Bitcoin retreated back below $40,000 after climbing over the weekend to the highest levels since May. Analysts blamed profit-taking following a recent rally. The declines put Bitcoin back in the top end of a trading range that's been in place since a cryptocurrency rout in May. Scrutiny of the industry is intensifying, including a push by U.S. legislators for stricter rules on cryptocurrency investors to collect more taxes. European and U.S. equity futures are pointing higher after stocks rose in Asia, where some of the concerns over China's regulatory crackdown eased, at least for now. Heineken, AXA and Ferrari are among highlights in earnings across Europe. HSBC announced an interim dividend after second-quarter profit doubled from a year earlier. And finally, the U.K. is getting ready to roll up its sleeves again amid plans to deliver booster shots to 32 million people starting early next month, according to a report. This is what's caught our eye over the past 24 hours. Bond bulls riding the wave of short covering in Treasuries should be keeping a watchful eye out as the swell abates. Many market commentators have pointed to positioning as a key factor in the recent rally in Treasuries and speculators are indeed slashing bets on bond declines across the curve. An aggregate of net non-commercial positions across all Treasury maturities has shrunk to a four-year low, according to the latest data from the Commodity Futures Trading Commission. Of course the aggregate data masks different positioning -- for example leveraged funds remain long 10-year Treasuries and short the rest of the curve. But taken overall the figures suggest that positioning has now become less extreme and fundamental factors can grow in influence once more in the world's largest bond market.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment