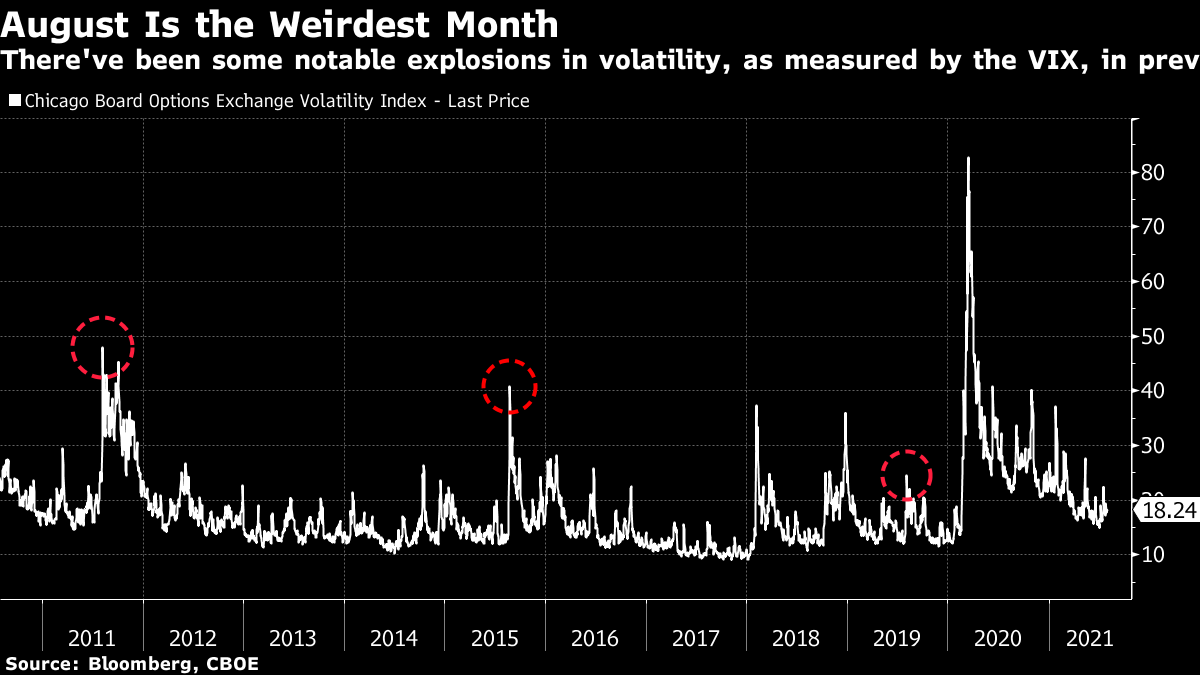

| Traders are creeping back to China markets. The forecaster who predicted India's Covid peak sees a new wave coming. Why big money isn't leaving Hong Kong. Here's what you need to know this Monday morning. China's securities regulator called for talks with its American counterpart after the U.S. Securities and Exchange Commission halted the initial public offerings of Chinese companies. The U.S. regulator had said it would suspend any Chinese IPOs until companies improved their risk disclosures. Meanwhile, a recovery in Chinese stocks following a meltdown at the start of last week underscored how investors in emerging markets have few alternatives that are as big and liquid. Traders piled a net $975 million into Chinese exchange-traded funds last week, more than all other developing nations tracked by Bloomberg combined. And after 40 years of allowing the market to play an expanding role in driving prosperity, China's leaders have remembered something important — they're Communists. The goal now is common prosperity and national security. Asian stocks look set for a steady start to the week as traders weigh China's tightening grip over a range of industries and continued disruption from the delta Covid-19 strain. Futures rose in Japan and Australia Monday but dipped in Hong Kong. U.S. equity contracts edged up after Wall Street fell Friday, including a slide in Amazon.com, amid concerns that earnings growth at technology companies has peaked. Ten-year U.S. Treasury yields slipped back toward 1.20%. Bitcoin over the weekend reached the highest price since mid-May and was trading around $41,000. Minneapolis Fed President Neel Kashkari said the spread of the delta variant of Covid-19 could keep some Americans from looking for work, potentially harming the U.S. recovery, while Florida became the country's new epicenter. Meantime, Thailand is set to expand its quasi-lockdown measures to regions hardest-hit by the pandemic and home to about 40% of the population. In Australia the central bank chief Philip Lowe faces the awkward prospect of having to walk back a taper announcement made only a month ago, as a resurgence of the coronavirus continues to confound the expectations of policy makers. And the forecaster who predicted India's Covid peak sees a new wave coming. Finally, are Covid vaccines working? Here's what the real world tells us. The U.S. formally blamed Iran for a deadly attack on an Israel-linked oil tanker off Oman, warning of an "appropriate response." "We are working with our partners to consider our next steps and consulting with governments inside the region and beyond on an appropriate response, which will be forthcoming" Secretary of State Antony Blinken said in a statement Sunday. Blinken's condemnation came after Israeli Prime Minister Naftali Bennett and the U.K. foreign secretary said Iran were responsible for the attack. None of the statements offered direct evidence. The sister of North Korean leader Kim Jong Un said planned joint military exercises between South Korea and the U.S. will "cloud" inter-Korean relations, Yonhap News Agency reported. North Korea will "closely watch" if South Korea goes ahead with the drills, reports said, citing a statement from Kim Yo Jong via the Korean Central News Agency. Kim Jong Un and South Korean President Moon Jae-in had agreed in letters to restore relations, improving the prospects for a breakthrough in an extended stalemate in nuclear talks. This is what's caught our eye over the past 24 hours: Welcome to the first trading day of August, or as I like to refer to it, the weirdest month in markets. I'm not sure whether it's down to sheer coincidence or the number of senior traders who take their annual two-week holiday around this time, but August has a history of sudden spikes in volatility. Think back to the sell-off of August 2011, or the drama of August 2015, when the surprise devaluation of the Chinese yuan rocked markets. As Michael Purves at Tallbacken Capital Advisors notes today: "Even 2019's August had a substantial spike in volatility — from about 14 to as high as 28. August can steal September's presumed thunder (pardon the pun); and as August starts to unfold, care is warranted."  Of course, the last month of summer can be a snoozefest too. But with many areas of the world now experiencing an uptick in Covid cases and the CBOE's Volatility Index creeping higher in recent weeks, it seems like something to watch out for. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment