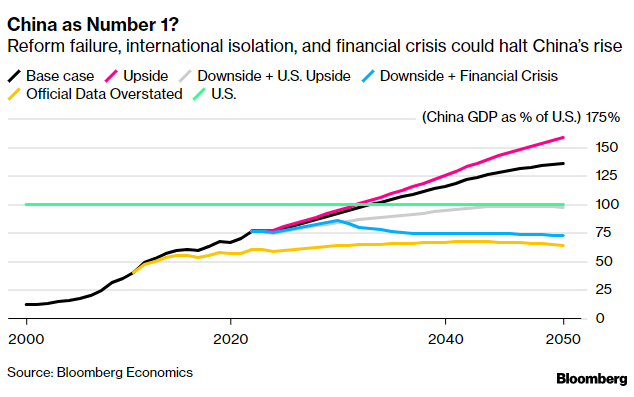

| Hello. Today we look at when (and if) China will become the world's largest economy, surging rental costs in America, and how the proportion of manufacturing workers influences the length of recessions. China's AscentCould America's more than century-long reign as the world's biggest economy be over within a decade? If President Xi Jinping Xi delivers on growth-boosting reforms and his U.S. counterpart President Joe Biden is unable to push through his proposals for renewing infrastructure and expanding the workforce, forecasts from Bloomberg Economics suggest China could grab the top spot as soon as 2031.

But that's a big if. As chief economist Tom Orlik notes, China's reform agenda is already languishing, tariffs and other trade curbs are disrupting access to global markets and advanced technologies, and Covid stimulus has lifted debt to record levels. Under what he describes as a "nightmare scenario" for Xi, China stalls in much the same way as Japan did three decades ago.  Three factors determine an economy's growth rate: the first is the size of the workforce, the capital stock, and productivity, or how effectively those first two can be combined. In each of these areas, China faces an uncertain future, Orlik writes. - China's working age population has already peaked

- Signs of overinvestment means it brings fewer returns

- That leaves productivity as the key, and boosting that will require sometimes painful reforms

Which all brings us to the risk that stalling reforms and international isolation lead to a financial crisis.

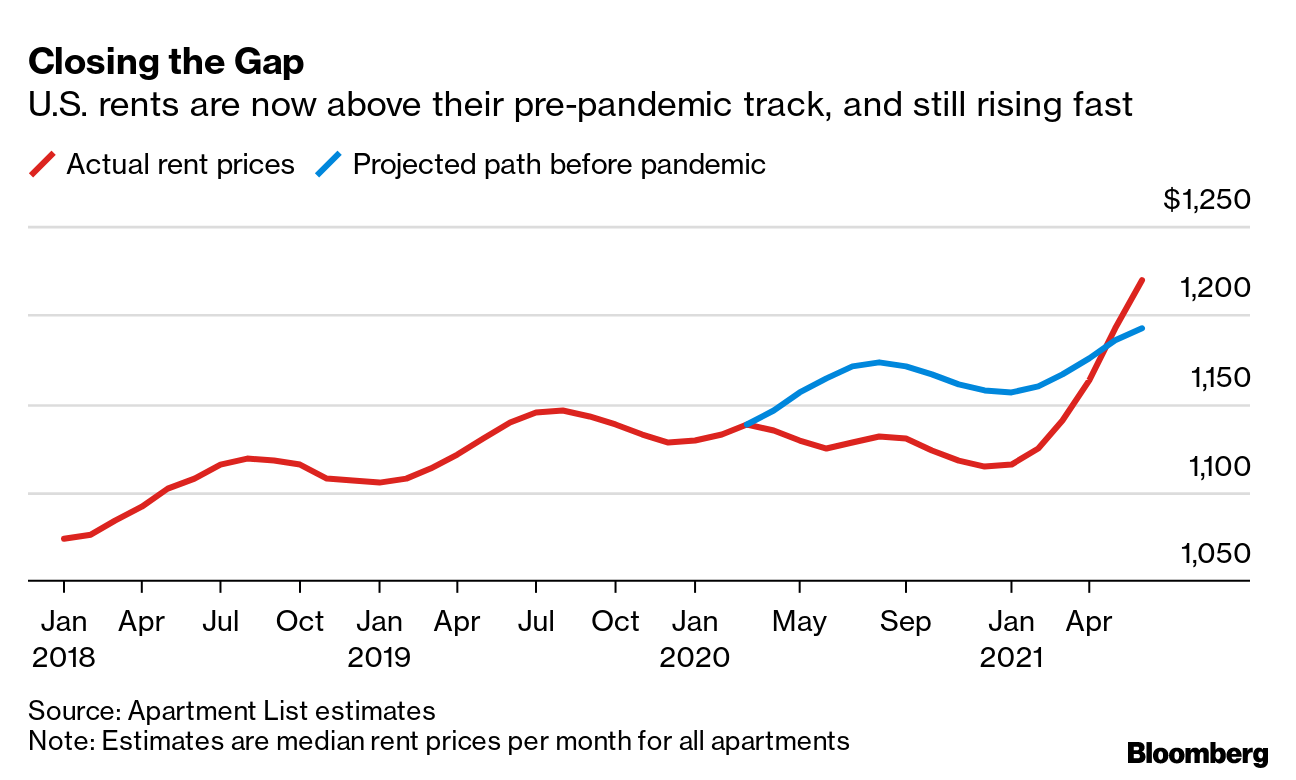

China's credit-to-GDP ratio has rocketed from 140% in 2008 to about 290% now. In other countries, such a rapid increase in borrowing has heralded trouble ahead. — Malcolm Scott The Economic Scene The cost of renting a home is soaring in cities across the U.S., squeezing the finances of low-income households and posing a threat to the consensus that pandemic inflation will soon fade away.

The median national rent climbed 9.2% in the first half of 2021, according to Apartment List, and topped $1,200 per month in June. Today's Must Reads - ECB review | The European Central Bank is entering the final stretch of its biggest strategy review in almost two decades, with officials looking to hammer out key differences over future policy.

- China credit | Defaults are coming to the world's second biggest corporate credit market as Beijing forces more accountability on its weakest companies.

- Baby steps | Australia's central bank took its first steps toward dialing back monetary stimulus by not extending its yield target horizon and announcing a short-term extension of bond-buying.

- Going green | Bank of Japan Governor Haruhiko Kuroda and his board are likely to offer incentives for lending in the battle against climate change when they meet later this month.

- No tantrum | Asian emerging economies are largely in stronger positions than they were back in 2013 when the Federal Reserve sent shockwaves through markets with plans to wind back stimulus.

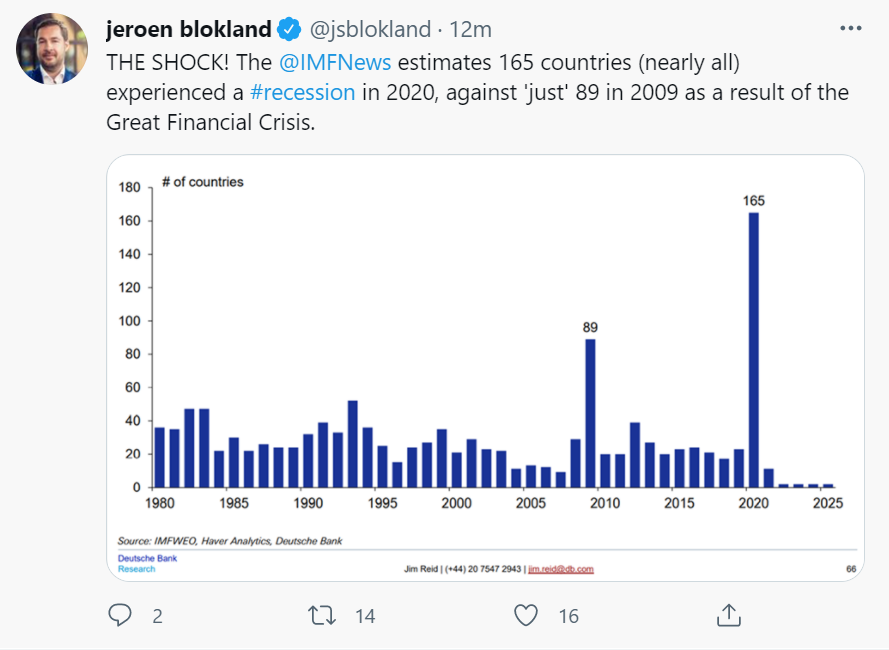

Need-to-Know ResearchIt was the decline in manufacturing jobs which served as the most important determinant of the length and depth of the last three recessions, according to a study published on Monday by the National Bureau of Economic Research. The paper, by Edward E. Leamer of the John E. Anderson Graduate School of Management, found the greater share of manufacturing jobs prior to the slump, the worse the recession and subsequent recovery. On #EconTwitter Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment