| Welcome to the Weekly Fix, where technical factors and emotions collide. I'm cross-asset reporter Katie Greifeld. From Beijing dragging down -- and then propping up -- its equity markets, to a certain zero-fee trading app going public, to Bitcoin rising from the ashes, you'd be forgiven for forgetting there was a Federal Reserve meeting this week. The most interesting part was how little the messaging changed since last month's hurrah. Policy makers are "making progress" toward reaching the necessary conditions for starting to taper asset purchases, rising inflation is still "largely reflecting transitory factors" and "we're clearly a ways away" from any interest-rate liftoff. But obviously, a lot has changed since the Fed last met in mid-June. In the U.S., concern over the delta variant has reached a fever-pitch, prompting the U.S. Centers for Disease Control to stiffen indoor mask guidance. Yet policy makers didn't use the variant's spread as cover for striking a more dovish tone. Rather, Fed chief Jerome Powell made the point that any new wave probably won't pack as big of an economic punch as previous waves -- and thus, shouldn't alter the tapering timeline.  But delta anxiety is providing at least part of the gas behind the relentless rally in Treasuries, which has baffled strategists and journalists alike -- and apparently, Powell himself. Who among us hasn't blamed technicals for a weird move in yields? In terms of what's been happening in bond markets, I don't think there's a real consensus on what explains the moves between the last meeting and this meeting. We've seen long-term yields go down significantly. Some of it is a fall in real yields, which may have been connected to sentiment around the delta variant and concern about growth. There was also some decline in inflation compensation, which has significantly reversed. And there's also so-called technical factors, which is where you put things that you can't explain.

Transitory or not, the intensity of the price pressures we've seen has taken many by surprise -- in the U.S., inflation is running at a 5.4% annual rate. As a result, Treasury Inflation-Protected Securities returns have trounced just about every other corner of the bond market. But where TIPS go next is starting to divide Wall Street.  As chronicled by Liz McCormick and Anchalee Worrachate of Bloomberg News, you have the likes of Vanguard Group forecasting a future where inflation runs consistently above the Fed's 2% target. In the other corner is BlackRock's head of Americas fundamental fixed income Bob Miller, who thinks the TIPS rally has run its course. "Real yields are quite unattractive," said Miller, who shorted 10-year TIPS by borrowing the securities in the repurchase-agreement market and then selling them. "We are not in the camp that thinks that inflation is going to continue to accelerate at a substantially higher run rate than it has over the past." Supporting Miller's view is the fact that the leaps and bounds made in CPI haven't been matched by a similar acceleration in wage growth. Again, while CPI jumped 5.4% in June versus a year earlier, year-over-year average hourly earnings growth clocked in at just 3.6%. As articulated by BMO Capital Markets strategist Ian Lyngen in a Bloomberg Television interview this week: The one key aspect of this recovery that has been missing thus far is wage inflation. If we see the labor market participation rate continue to be low and there are pockets of labor scarcity over the next few months we might see spikes in wages which would then get the market excited about the idea that inflation could be self-fulfilling but I'll argue even that would fall into the Fed's characterization of transitory.

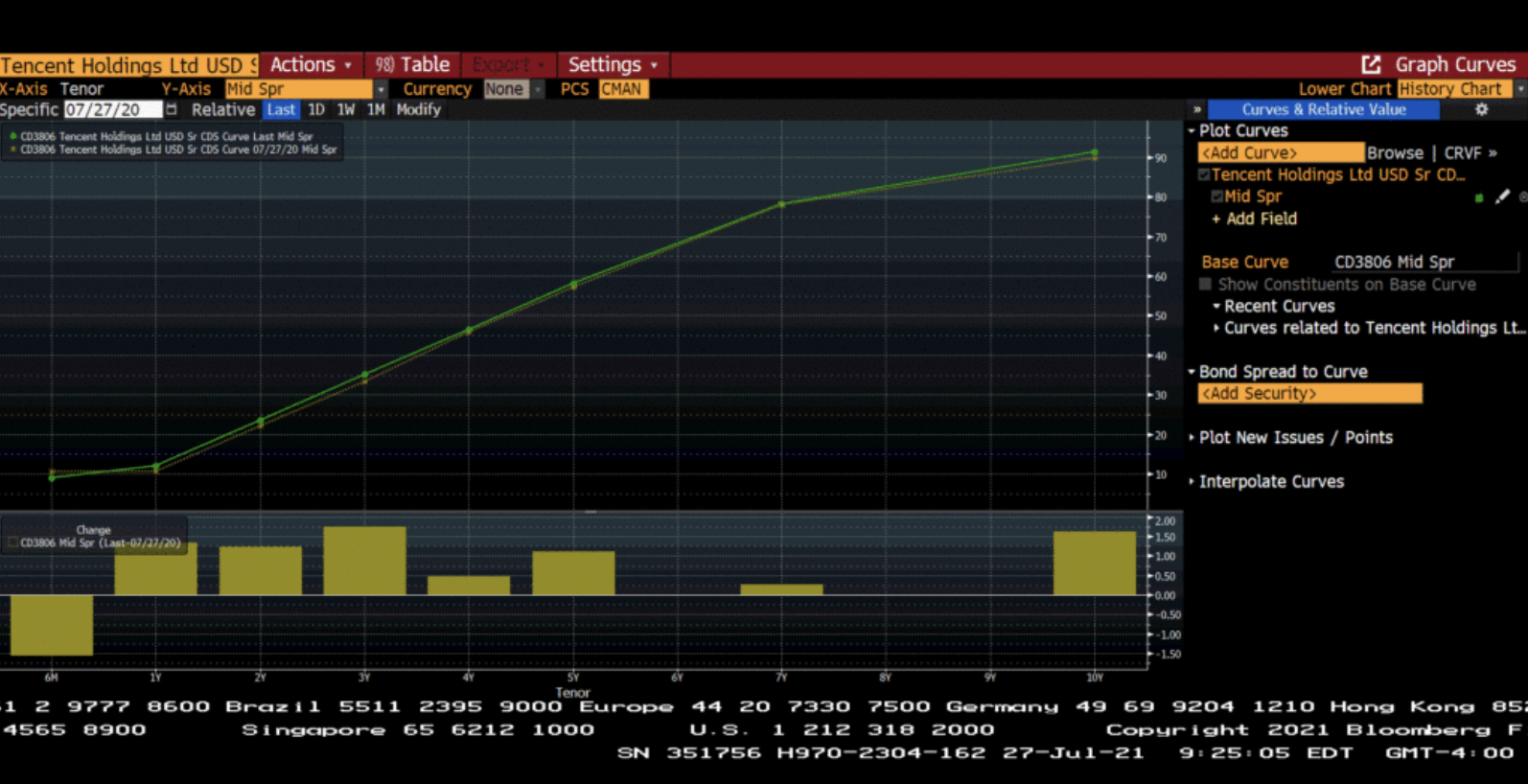

Much has been made of the fact that Treasuries have been a pretty lousy buffer when it comes to cushioning equity market pullbacks. Turns out high-grade corporate bonds are losing their luster as well. JPMorgan Chase strategists crunched the numbers and found than prices on investment-grade bonds and U.S. stocks are the most positively correlated since 1997 on a one-year trailing basis. If you broaden that out to a three-year trailing basis, total returns for the two asset classes are still moving in tandem by the most since 2008. That's a new dynamic: stocks and credit have moved inversely for much of the past two decades, they said. The bad news: that doesn't leave an investor many options when it comes to hedging. The good news: We can blame the Fed, kind of. "HG credit has become more correlated with stocks and thereby also more correlated with the HY bond market," JPMorgan analysts led by Eric Beinstein wrote in a report. "This, in our view, is the result (at least in part) of so much QE-driven liquidity in the market that investors are buying everything: stocks and bonds." That's an easy answer, but it's not the only one. "Exceptionally strong" corporate earnings may be driving a company's share price and debt higher in tandem. We're getting another taste of how strong Corporate America is about halfway through the second-quarter reporting period. Nearly 88% of S&P 500 companies have beaten earnings estimates so far, according to Bloomberg data. No matter the explanation, the fact remains that there's one less tool available to diversify equity risk with. "Traditionally portfolio theory says that bonds are a diversifier for equity market investments," the strategists write. "This has not been the case recently, with the risk that it also remains not the case if/when there is an equity market selloff." China is doubling-down on its crackdowns, but so far, that's barely dented the country's corporate bond market. Beijing has targeted the technology, online education and property management sectors in recent weeks, unleashing a regulatory assault as officials strive to rein in the nation's Internet giants and wrest back control of big data. That dealt a blow to the Chinese stock market, sending the MSCI China Index nearly 20% lower at one point this month. The nation's shares bounced back somewhat this week after Chinese state media set out to soothe investors, while China's securities regulator was said to gather top banks in a bid to restore calm. Throughout it all, bond traders hung tight. Take Alibaba Group Holding and Tencent Holdings -- two Chinese tech giants sitting squarely in Beijing's crosshairs. While the companies' equity shares have crumbled in recent weeks, Alibaba and Tencent credit default swaps -- essentially, default insurance -- have barely budged by comparison. While insurance costs have edged up slightly versus a year ago, it's a small move relative to the wipeout in Chinese equity markets.  Bloomberg Bloomberg To Brendan Ahern, chief investment officer at Krane Funds Advisors, that divergence suggests equity traders are in a tizzy: Stock investors are always looked down upon by math guru fixed-income investors. Why are the people who do the math not worried? Simply because they are doing the math and see that the companies are not being financially impacted by regulation. In my opinion, equity investors are reacting to news and responding emotionally.

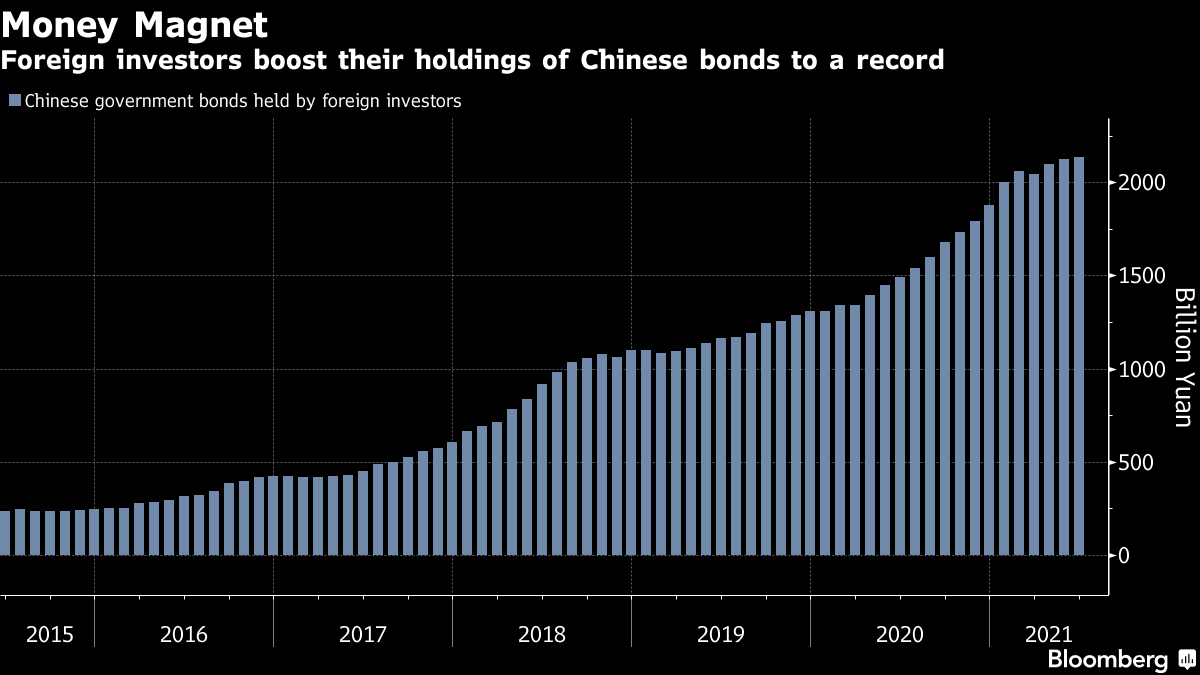

While the country's government debt got caught up in the selloff, Chinese bond bulls are largely undeterred. Yields on 10-year Chinese bonds climbed as high as 2.93% this week -- miles above their U.S. and European counterparts. Those relatively lofty rates have attracted a flood of foreign capital into the Chinese debt market, which only became accessible to overseas investors in the past few years. Foreign funds net bought China's government bonds in all but one month since the start of 2020, pushing holdings to an unprecedented level in June.  Given that Chinese bonds boast relatively high yields and a low correlation to other sovereign debt markets, that influx of international cash likely won't recede as quickly, Ashmore Group's London-based deputy head of research Gustavo Medeiros told Bloomberg News's Ye Xie. Chinese bonds are the only major bonds in the world that will actually provide a proper protection in a global systemic event because it's the only central bank in the world that still has a big bazooka. And Chinese bond yields are trading at a higher level than the European or U.S. bonds.

Everyone Is Losing It Over Inflation. Except Financial Markets Apollo Books $1.6 Billion Gain Selling Hospital Chain to Itself Scarlett Johansson Sues Disney for Streaming 'Black Widow' |

Post a Comment