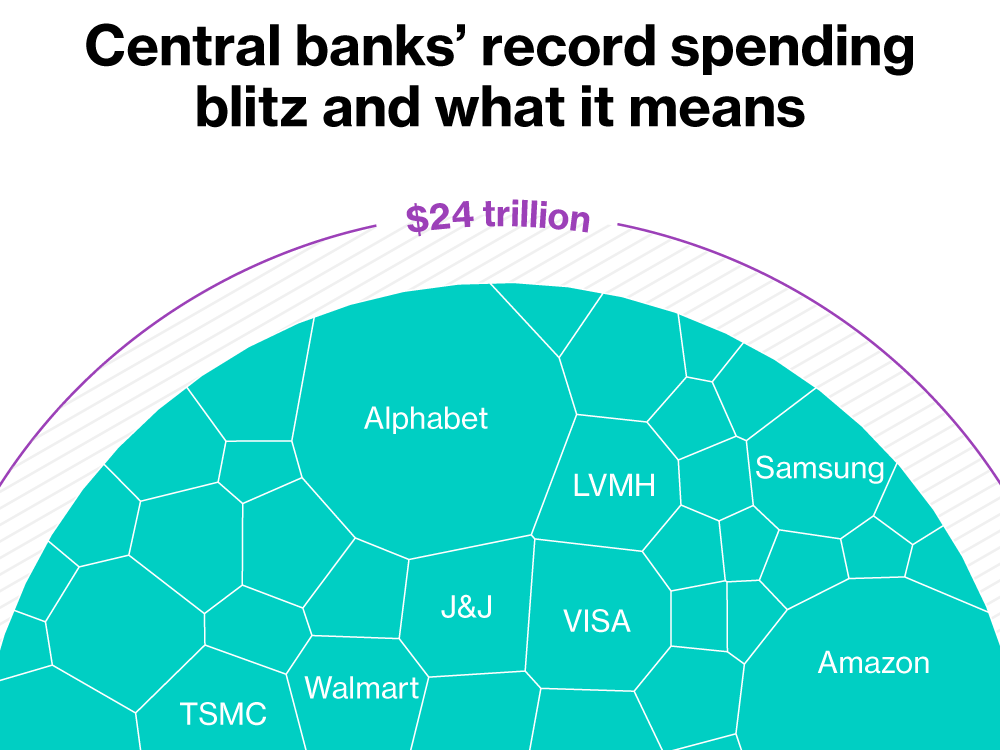

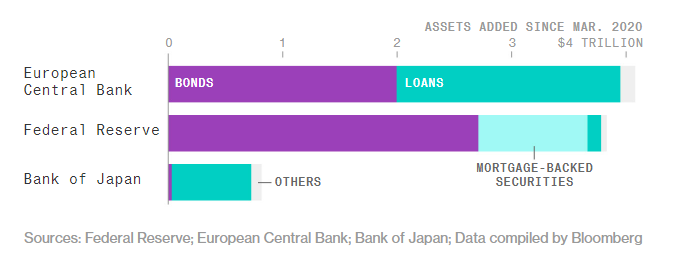

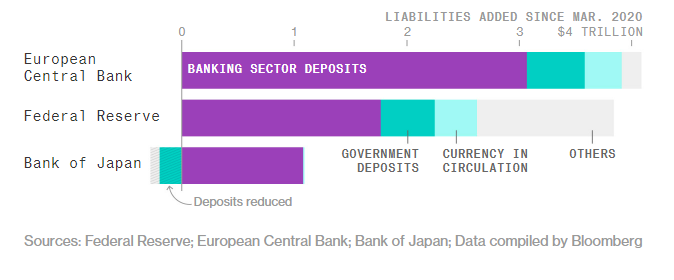

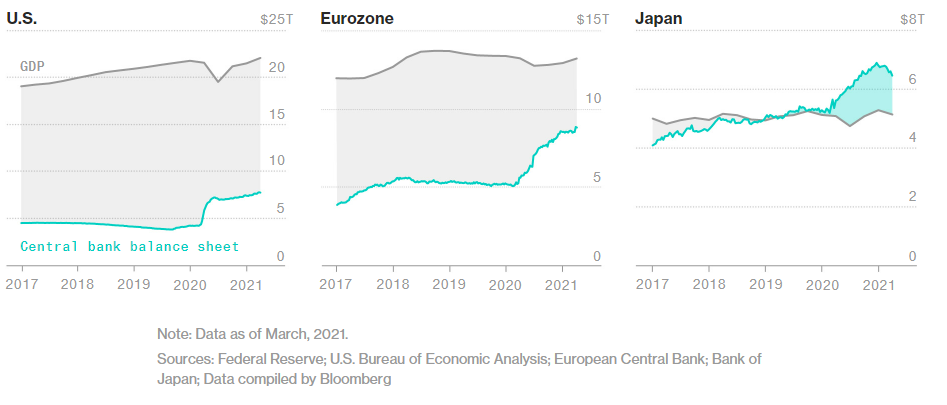

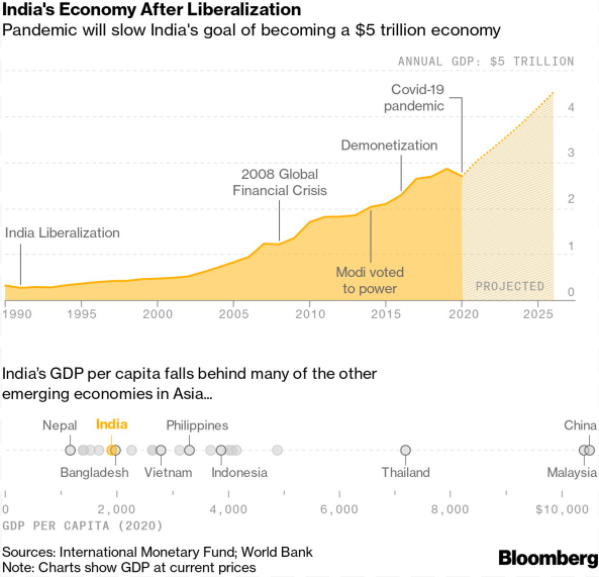

| Hello. Today we look at the Covid buying blitz by the world's biggest central banks, India's stalling reforms, and the global growth outlook. The Big BingeSince the start of the pandemic, central banks in the U.S., Europe and Japan have been on a $9 trillion spending spree that's turned them into the ultimate market whales with combined assets of $24 trillion. That equates to the total market value of dozens of the world's biggest and best-known companies. Another way to think of it: Printed in $1 notes, that would make more than six stacks reaching from the Earth to the Moon.  Now, talk is shifting to winding down the banks' massive monetary stimulus and the challenge that presents for the economies they support. So where did all the money go? The trio bought a lot of bonds, helping their governments fund stimulus programs. The Federal Reserve bought a higher proportion of mortgage-backed securities, desperate to shore up a sector that caused so much trouble during the global financial crisis of 2008. The European Central Bank and Bank of Japan did more with loans, keeping businesses afloat, workers in jobs and preventing bad debts from piling up.  A look at the liabilities side of the ledger shows a lot of that has ended up as bank deposits, keeping lenders flush with liquidity. Getting that money pumping through the economy will be key to sustaining the recovery as central banks dial back stimulus.  Some worry inflation will spike because of all the cash injected into the economy. Others are concerned about the outsized influence of central banks in free markets. The BOJ, for instance, owns almost half of all the outstanding Japanese government bonds and its balance sheet is now larger than the economy. The Fed and ECB would need to keep buying at their current clip for years to approach that level.  So what comes next? Fed officials weren't ready to communicate a timeline for scaling back purchases due to uncertainty on the economic outlook, a record of their June gathering showed Wednesday, though they did want to nail down a plan in case they have to move sooner. The BOJ is spending less on exchange-traded funds, but it has pledged to keep buying bonds for as long as needed to revive inflation. As for the ECB, it has promised to keep splashing the cash too, wary of criticism it pulled back too early after the last crisis. Policy makers there have agreed to raise their inflation goal to 2% and allow room to overshoot it when needed, according to officials familiar with the matter, a shift from the previous target of "below, but close to, 2%." The tweak could give officials the justification for sustaining ultra-loose policies for longer. More details are due Thursday. Weaning the world off such huge doses of stimulus will shape the economic and market landscape for years to come. — Malcolm Scott The Economic Scene The devastation caused by Covid-19 in India has highlighted just how much poor health care and infrastructure — often neglected in the boom after liberalization — are holding back the nation and its people. More than 200 million have gone back to earning less than minimum wage, or $5, a day, the Bangalore-based Azim Premji University calculates. The middle class, the engine of the consumer economy, shrank by 32 million in 2020, according to the Pew Research Institute. That means India will be regressing on vital fronts just as its global importance is growing. Today's Must Reads - Coming up | Group of 20 finance ministers and central bankers are gathering in Venice. On the agenda: corporate tax rates, the economic recovery and climate change.

- Tariff talk | The U.S. is discussing whether to move toward imposing tariffs on Vietnam over currency actions that during the Trump era were labeled as unreasonable and restrictive to American firms.

- China stimulus | The State Council signaled the central bank could make more liquidity available to banks in order to boost lending, including by cutting the amount of money they must keep in reserve.

- Tough times | U.K. living standards held up during the pandemic thanks to government intervention, but many including the self-employed and ethnic minorities are facing enduring hardship.

- More jobs | Reserve Bank of Australia chief Philip Lowe highlighted the importance of achieving sustained full-employment "in the low 4s" to fuel wage growth and revive inflation.

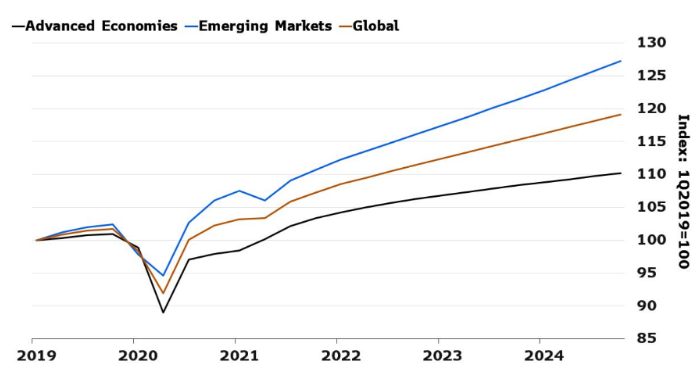

Need-to-Know Research The global economy is entering the fastest stage of the 2021 recovery, according to Bloomberg Economics. After a lackluster start, when fresh waves of infection forced lockdowns in Europe and India, growth sped into the end of the second quarter. With reopening under way, the third quarter should be substantially stronger and momentum largely maintained through year-end. That puts global growth at 6.9% for 2021 as a whole, slowing to 4.9% in 2022. Read the full research on the Bloomberg Terminal by clicking here. On #EconTwitterWhat explains the transatlantic differences in hiring…  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment