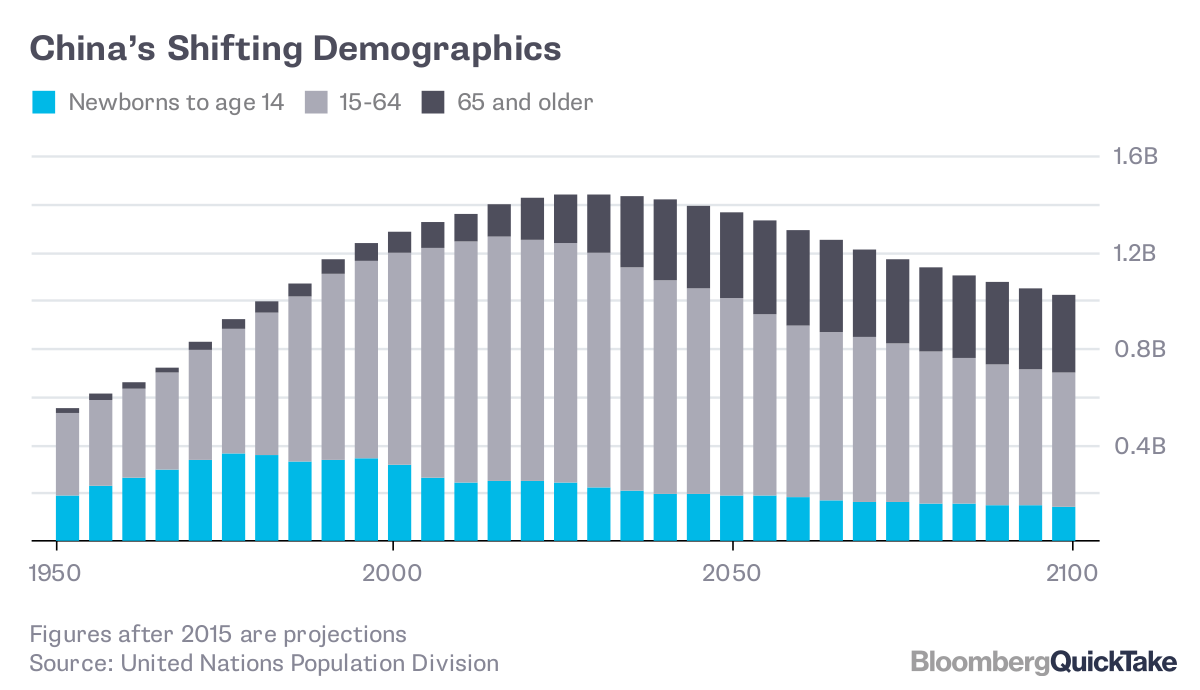

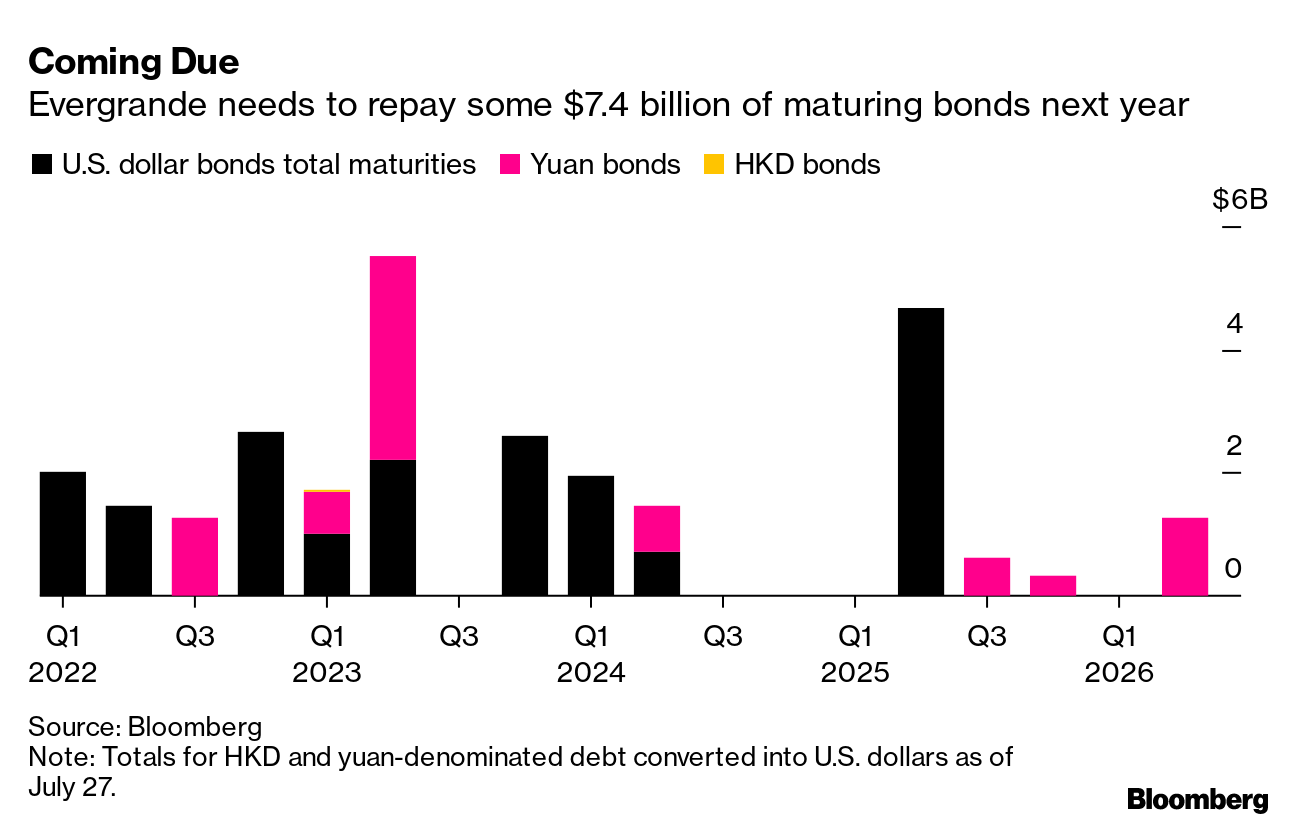

| China's leaders clearly have a vision for what their country should look like. Risks in the financial system should be controlled. Inequality should be reduced. Beijing's authority should go unchallenged. And as recent events have shown, they are committed to making that vision a reality. For the business world, that could ultimately be a good thing if markets become more stable and prosperity more widespread. But in the short term, building that vision will entail a fair amount of pain for some of the country's biggest companies. This week alone, authorities ordered all food-delivery companies — Meituan being the largest — to ensure they pay their couriers at least the minimum wage and to help them with health care and pensions. Shares of Meituan slumped Monday and Tuesday, before staging a bit of a comeback.  Food delivery couriers for Meituan stand during a morning briefing in Beijing on April 21, 2021. Photographer: Yan Cong/Bloomberg Tencent, China's biggest company by market capitalization, got hit twice. First, regulators over the weekend ordered the firm and its affiliates to give up their exclusive music-streaming rights. Then on Tuesday, the company stopped allowing new users to sign up for its WeChat service, citing the need for the super app to undergo a security upgrade in accordance with relevant laws and regulations. Tencent has been so battered it's set to be the world's worst stock bet this month with a $170 billion wipeout. The most shocking move, though, was Beijing's decision to bar for-profit businesses from providing after-school tutoring. That action — fueled by concerns that such services were exacerbating the gap between the rich and poor — was such a jolt because it went far beyond any previous measures. Instead of fining tutoring firms, such as New Oriental or TAL Education, or imposing stricter guidelines, Beijing chose to effectively snuff out an industry worth many billions of dollars. But perhaps the vigor with which China's leaders have acted shouldn't come as such a surprise. After all, they did pledge in December to rein in the "disorderly expansion of capital." With the benefit of hindsight, it seems that was no empty threat. In addition to the wealth gap, there's another reason why the crackdown on after-school tutoring makes sense for Beijing: demographics. China needs more babies if it's going to avoid a significant shrinking of its population. But with the financial burden of raising children heavier than ever, many couples are forgoing a second child. Limiting tutoring for school children to non-profits is one way to reduce that burden. One city in southwestern China began experimenting this week with another method. The city of Panzhihua announced on Wednesday that it will give local families 500 yuan ($77) per child each month if they have a second or third baby. Those payments will continue until the babies are 3 years old. The city will also offer free childbirth services to mothers with local household registrations, and it's also setting up more nurseries near workplaces. While Panzhihua is the first local government in China to offer cash assistance to families, it's unlikely to be the last. With Beijing having pledged to meaningfully lower the cost of child care and to increase the birth rate by 2025, many other cities are likely to follow.  United Nations Population Division United Nations Population Division The increasingly competitive nature of U.S.-China ties means neither side can afford to look weak domestically when dealing with the other. Unfortunately, that also makes it extremely difficult to compromise. That dynamic was on display this week when U.S. Deputy Secretary of State Wendy Sherman met with Chinese Foreign Minister Wang Yi and Vice Foreign Minister Xie Feng in the port city of Tianjin. There, the Chinese side delivered a list of demands, from dropping all tariffs to ending efforts to extradite Huawei's Meng Wanzhou. The Americans also had a litany of complaints, ranging from hacking to the crackdown in Hong Kong. While there seems to be little middle ground left, the two sides are trying. A new Chinese ambassador arrived in Washington this week, for example. It also appears that a bilateral meeting between Presidents Joe Biden and Xi Jinping at the G-20 continues to be something the two sides are working toward. As challenging as the relationship has become, there is just as much motivation to make it work. The headlines have not been kind to Evergrande. The week began with the S&P cutting its rating by two notches on Monday. The next day, the company's board decided against declaring a special dividend, the prospect for which had earlier heartened stockholders. Then came news that two of Evergrande's suppliers said they hadn't been paid, with one seeking about $62 million in a lawsuit. There's reason to think it could get worse. Analysts at UBS pointed out this week that with 77% of its liabilities due in the next 12 months, Evergrande may continue to cut property prices to stimulate sales, thereby eroding its profitability. That's one reason why the Swiss bank cut its 12-month price target for the stock to HK$3.50 — 40% below Monday's closing price.  Also looming on the horizon, meanwhile, is the potential for further policy action aimed at curbing property speculation. In Shanghai, for example, authorities have increased mortgage rates for purchases of second homes. If other cities adopt similar measures, demand for apartments could shrink substantially, and that would be clearly unwelcome for Evergrande. And finally, a few other things that caught our attention: |

Post a Comment