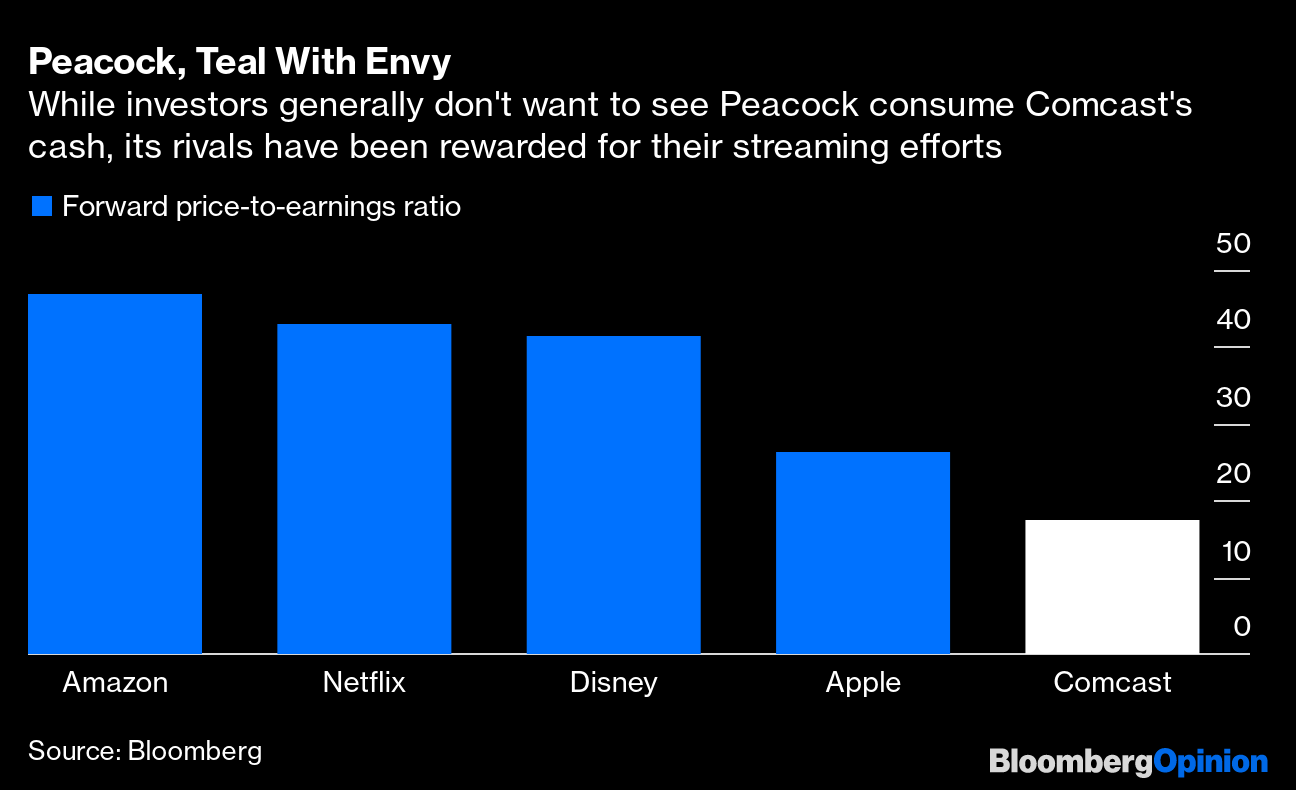

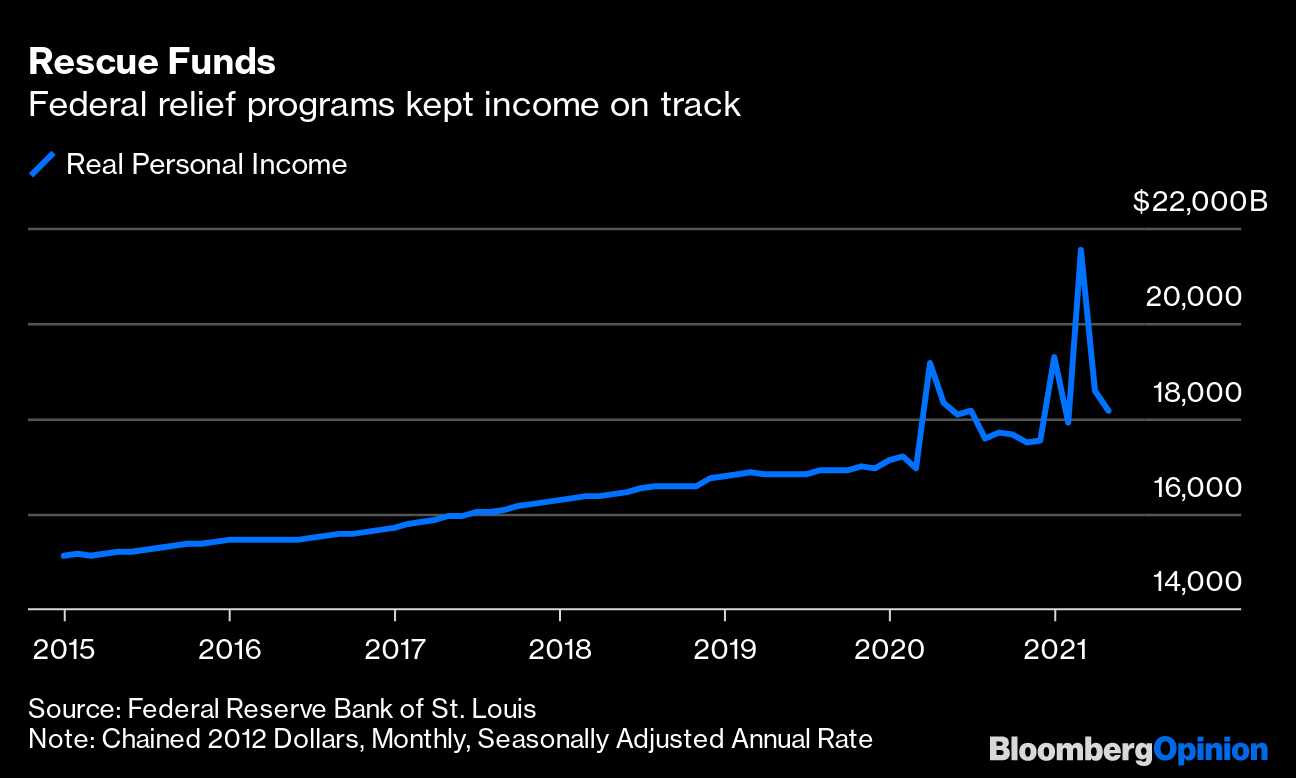

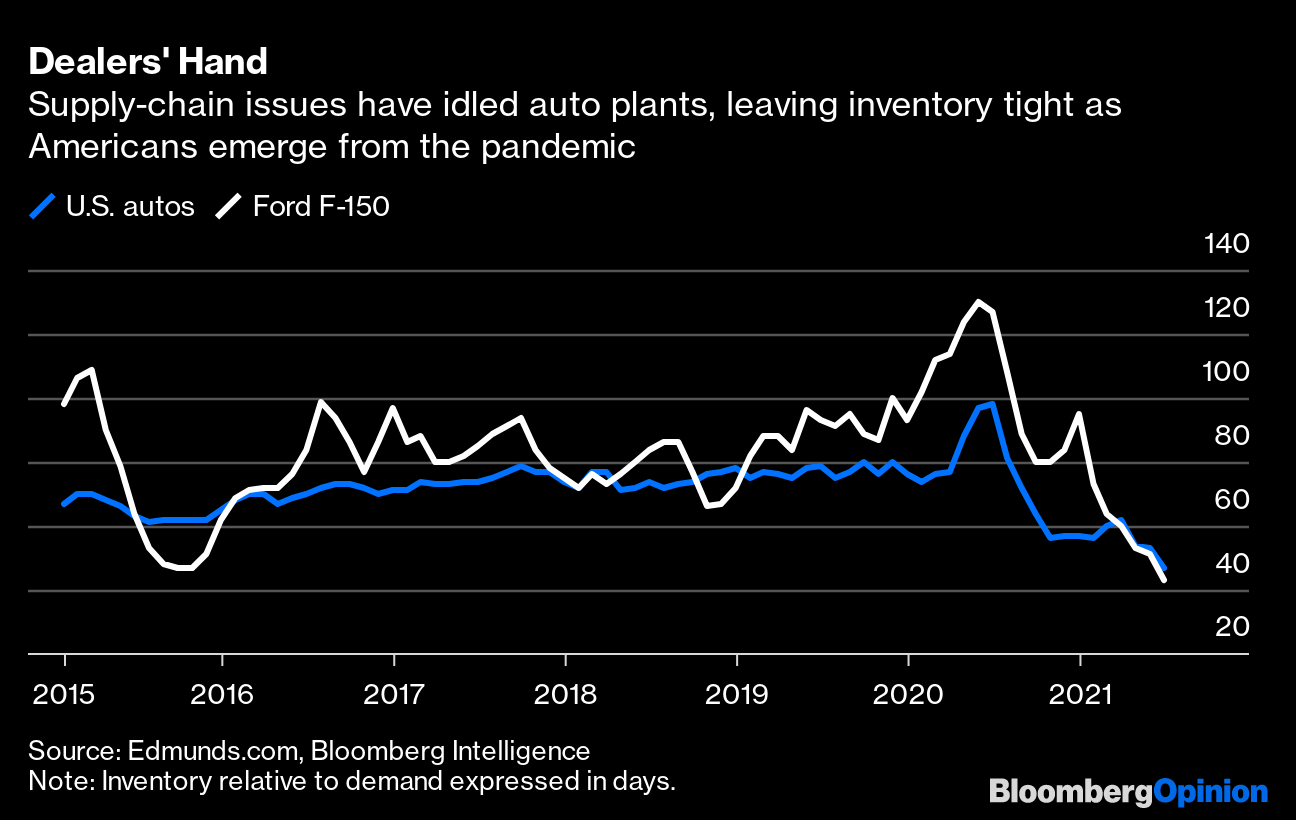

| This is Bloomberg Opinion Today, a bipartisan infrastructure plan of Bloomberg Opinion's opinions. Sign up here.  *Record scratch* *Freeze frame* Yup, that's me. You're probably wondering how I got into this situation … Photographer: Christopher Furlong/AFP/Getty Images Watching America try to pass an infrastructure bill the past few years has been like watching Boris Johnson try to open an umbrella next to the future king of England: It's hopeless and hilarious, but also you worry somebody important might lose an eye. But by golly, America just might be about to do it. Seventeen Senate Republicans joined Democrats in voting to advance a bipartisan infrastructure deal months in the making, and Jonathan Bernstein writes the chances of an honest-to-God, for-real infrastructure bill getting passed are somewhere north of terrible. This will still require the sustained support of pretty much every Democrat and a significant segment of the Republicans in Congress. But Matthew Yglesias writes the GOP would be foolish to kill this deal, as that would only strip moderate Democrats of their last bit of leverage, giving power to the progressives. The door would then be open to ending the filibuster and all sorts of apocalyptic policy repercussions for the GOP, which may still care about such niceties. It may require even more dexterity than opening an umbrella, but it can be done. Further Infrastructure Reading: To help trade, infrastructure and climate, Biden should drop tariffs on low-carbon materials. — Ellen Wald In case you missed it, there was a Fed meeting yesterday. You could be forgiven for not noticing, because nothing really happened. Did Jay Powell say he was worried about inflation or not worried about inflation? Yes! Will the Fed start thinking about talking about making a plan to start tapering its bond-buying sooner or later? Also yes! Whatever. The key takeaway is that bonds and bank deposits will yield nothing forever and ever, amen, writes Lisa Abramowicz. And really, the Fed's refusal to freak out about inflation keeps looking kinda reasonable. GDP growth in the latest quarter was a lot lower than expected, for one thing. That was mostly because of businesses working off inventory, but jobless claims are also still uncomfortably high, with millions still out of work. In fact, Dan Moss surveys the world's economies and finds most of them may already have peaked, with the delta variant of Covid-19 frustrating recoveries everywhere. The Fed could be busy doing something close to nothing for quite a while. Bonus Fed Reading, Brought to You by Bill Dudley: The old cliche about making money in a gold rush is that it's smarter to sell shovels than to mine for gold. Comcast has never heard that cliche, apparently. In the gold rush that is streaming content, Comcast already operates what is basically ShovelMart, selling the Internet access we need to get our streaming-video fix, Tara Lachapelle writes. And yet rather than being content to simply operate this vast and lucrative shovel emporium and pay boring dividends to shareholders boringly, Tara suspects Comcast can't wait to blow a lot of its shovel money on making its Peacock streaming app less terrible by filling it up with more content. It's a bad idea, but Comcast might find the allure of Netflixian stock-market glory irresistible. Then again, almost nothing could be as dumb as making Scarlett Johansson mad by cutting her out of "Black Widow" streaming profits, as Disney apparently did. Tara Lachapelle writes in a second column that such tricky decisions come with the streaming territory. Take note, Comcast.  America has many ways to prevent a wave of evictions, even if the CDC moratorium expires, writes Noah Smith. Direct government benefits, for example, have already been a huge help.  While Tesla's valuation depends on big-picture vision, Ford's valuation, and its future as an EV maker, depends on getting small details right, writes Liam Denning. That includes getting cars to the people who want them.  South Africa is on the brink of collapse, and President Cyril Ramaphosa needs to reform its economy now. — Bloomberg's editorial board Peru's new president isn't off to an encouraging start for those hoping he'd be a centrist. — Clara Ferreira Marques Tomorrow's workspace will be more coffee shop than office. — Conor Sen We're too quick to criticize the CDC. — Tim O'Brien Didi's business model has changed drastically. Maybe it should give that IPO money back. — Shuli Ren Hong Kong's Olympic gold medals are a poignant remnant of the city's fading autonomy. — Matthew Brooker There are probably better deals than the ever-pricier AmEx Platinum card. — Alexis Leondis The Robinhood IPO did or did not go well, depending on your perspective. New York City restaurants are starting to require vaccinations for indoor dining. The Amazon basin is on the brink. Quantum mechanics suggest we don't live in a simulation. Life on Earth may be much older than we thought. Stolen: 1,000 kilos of human hair. Thirty-seven-year-old man wakes up thinking he's 16.  Notes: Please send human hair and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment