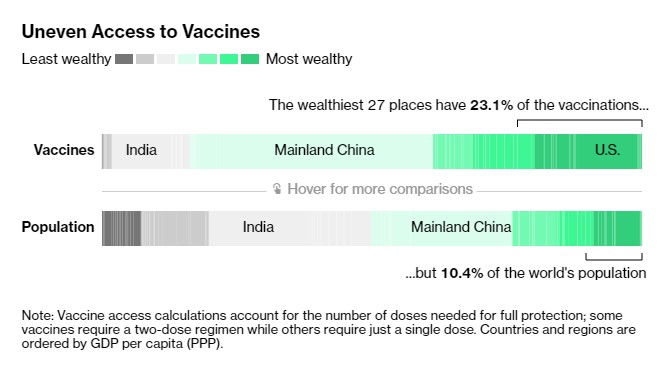

| Hello. Today we look at some of the big issues that will shape the global economy in the second half. What MattersThe global economy is in vastly better shape at the start of the second half of 2021 than it was six months ago, thanks to a powerful combination of mass vaccinations and massive stimulus. The latter half of the year is now set to resolve a host of outstanding questions. The world remains gripped by the pandemic, with billions of people yet to get vaccinated and some of the inoculated still falling ill.

The fast-spreading delta variant has delayed relaxation of strictures, limiting the return to the office and travel. Locations that seemed to have shaken off virus — like Sydney — re-imposed lockdowns. A stubborn virus could portend booster shots, of both vaccines and policy stimulus. It also pushes out the prospect of normality resuming — which is key for a sustainable recovery.  - Is Inflation Really Temporary?

The eye-popping 5% surge in U.S. consumer prices in May will prove a short-term phenomenon, argue the Federal Reserve and most economists. Similar inflationary bursts have been witnessed elsewhere and are ascribed to a bumpy reopening of global supply chains, which may sort itself out as logistical kinks are addressed and pent-up demand wanes. But some warn that some of the price pressures will last. Recent data show supply-chain disruptions for semiconductors are getting worse, not better. A surge in inflation expectations — a dynamic that nobody really has a good grip on, as Rich Miller writes today — then risks a self-fulfilling prophecy, with prices spiraling even higher. Much pivots on how quickly employment recovers across the top economies in coming months.

Economists are predicting Friday's labor market data in the U.S. will show meaningful improvement after two months in which forecasts were undershot. If wages keep gaining too that suggests demand will be supported. However, most economies are displaying signs of labor shortages. Explanations include mismatched skills, an inability to work because of health worries or childcare needs and suspicion that government support is too generous.

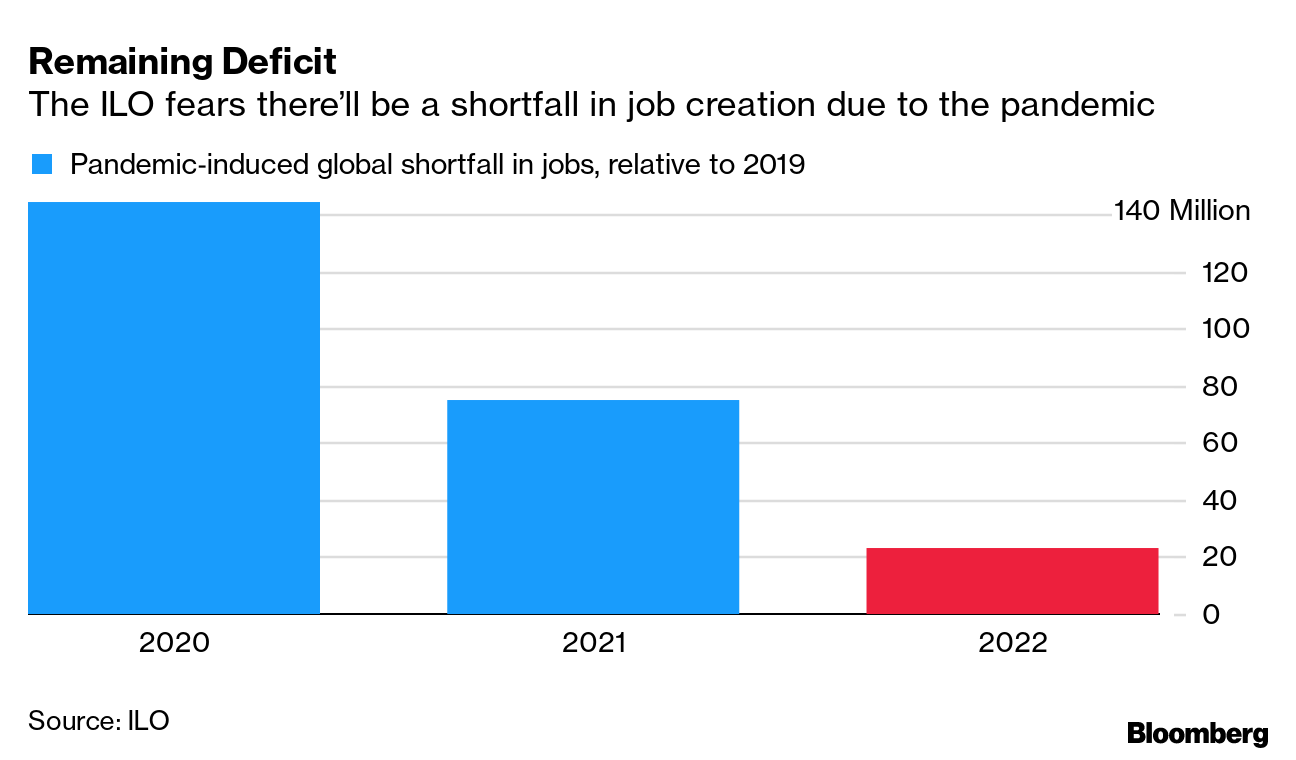

The shortages may pass. Yet, the global employment shortfall from the pandemic is still predicted by the International Labour Organization to be 75 million this year.  - Is There an Urge to Splurge?

Second-half forecasts for robust recoveries rely in part on expectations for consumers to disgorge a share of savings they've accumulated during the pandemic. Americans alone had an extra $1 trillion-plus stockpile in May compared with the start of 2020. But the last crisis showed how consumers can be hesitant to ramp up their spending after a shock. In China, retail sales disappointed lately. - How Fast Will the Exit Be?

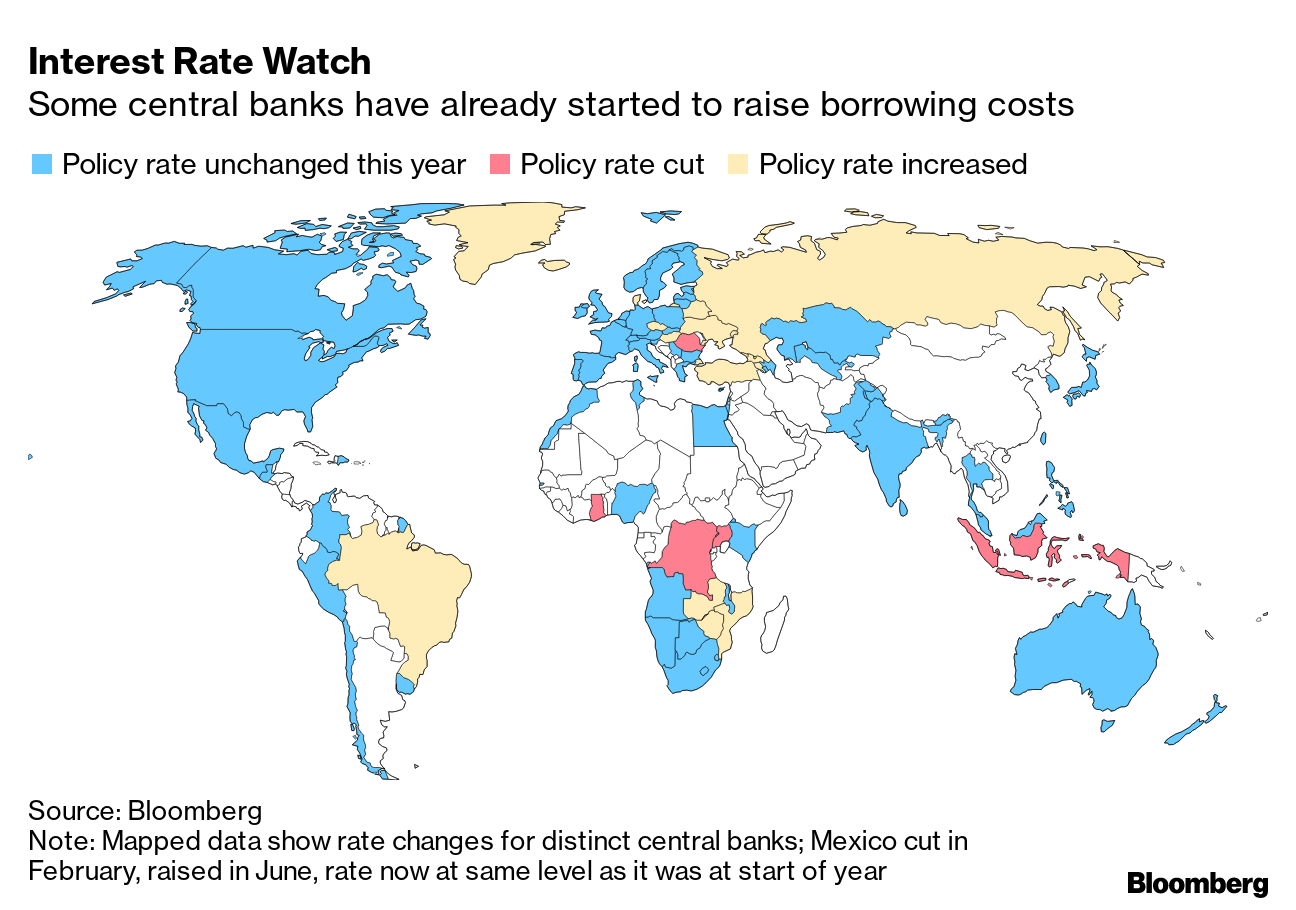

The beginning of the end of easy monetary policy seems upon us. Some central banks, including Brazil's and Russia's, have raised interest rates. Federal Reserve officials are starting to debate how and when to slow asset-purchases, perhaps starting with mortgage-backed securities. The People's Bank of China is trying to curb credit growth. Not all are eying the exit. The Bank of Japan and European Central Bank are staying loose.

However, policy makers will need to move gradually and communicate carefully given the inflation questions and that many intended to run their economies hot to help boost hiring. If demand continues to surprise to the upside, however, they may quicken their shift to tighter policies.  - Will Governments Keep Spending?

After years of political stalemate, analysts anticipate U.S. lawmakers will enact the biggest infrastructure investment package in decades. Optimists envision a productivity jolt that could lift a mediocre growth trend. Still, a deal is by no means certain, as strains over a bipartisan pact showed last weekend and President Joe Biden wants to spend even more. Elsewhere, Europe's 750 trillion euro recovery program is coming on stream and Italian Premier Mario Draghi insists euro-area fiscal rules can't return to how they were before the crisis. Talks over a global minimum corporate tax and Washington's review of its trade relationship with China are also expected to conclude in the second half. Besides the profound effects they will have on human lives, answers to these questions will determine the course of economies and financial markets. Will HSBC win the day with its 1% year-end forecast for 10-year Treasury yields? Or will Bank of America be popping the New Year's champagne having correctly called a punch through 2%? Tune back in six months. —Chris Anstey and Simon Kennedy - Got tips or feedback? Email us at ecodaily@bloomberg.net

- Check out the latest Stephanomics podcast, where Stephanie Flanders is joined by two of the biggest names in the financial world: billionaire investor Ray Dalio and former U.S. Treasury Secretary Lawrence Summers. Hear their opinions on just how hot the U.S. economy is running, where they think bubbles are building and why they contend that government officials need to take the threat of inflation seriously, and do so right now.

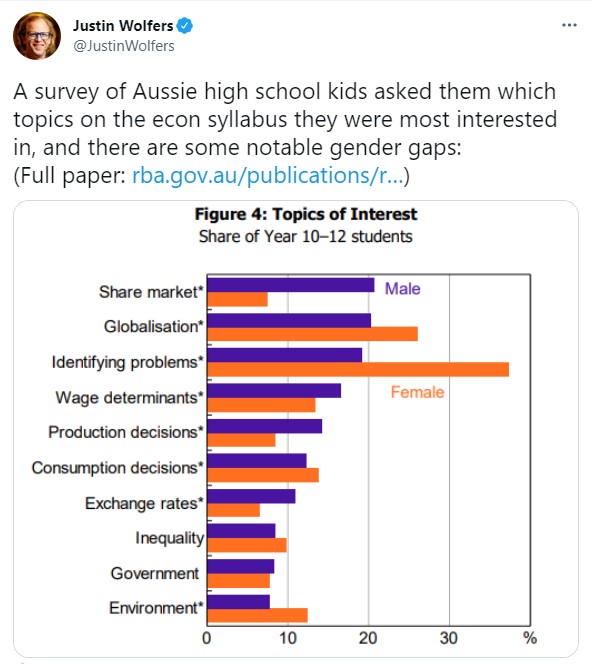

Today's Must ReadsNeed-to-Know ResearchGoldman Sachs economists are still betting that the expiration of unemployment insurance benefits in the U.S. will increase the supply of labor in coming months, restraining the wages of low-paid sectors whose workers make up a disproportionate share of those still receiving aid. But if stronger wage growth at the foot of the income scale persists that could fan inflation. The Goldman economists reckon every 1 percentage point of out-performance in law-end wage growth boosts inflation outside of food and energy by up to 15 basis points. On #EconTwitterWhat high school girls and boys want to get very different things out of their economics syllabus — at least in Australia.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment