| What's Happening? Brexit may be sparking inflation in the form of pay raises, and the balance of stock trading tips back in London's favor.

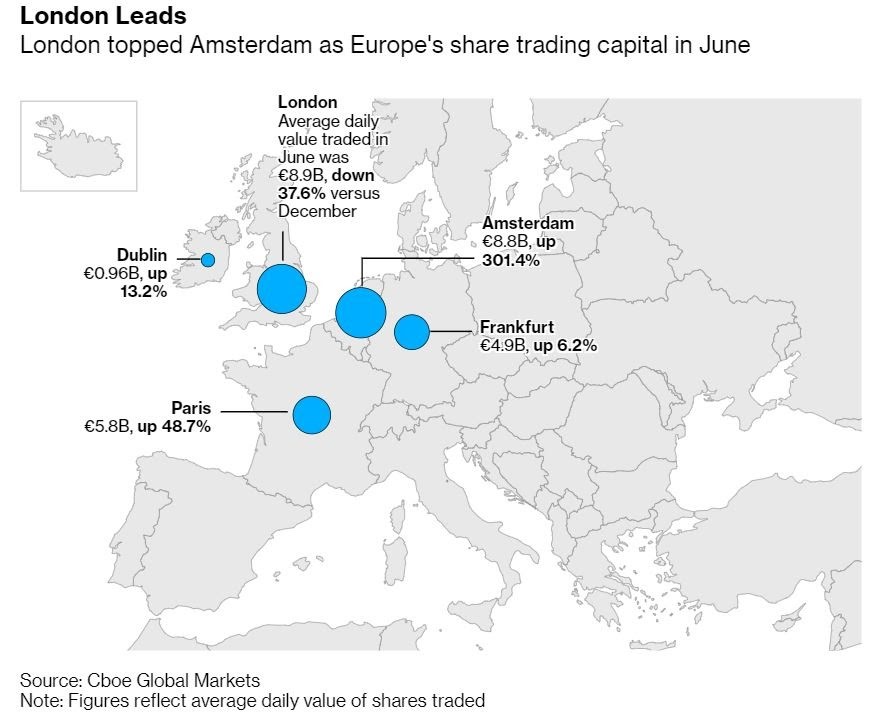

Wage inflation is picking up in the U.K. after tighter migration rules and the pandemic reduced the pool of foreign workers. Libby Cherry reports the results of industry surveys showing companies are raising salaries and offering signing bonuses to get staff into jobs that were once easy to fill. Hospitality, construction and manufacturing are among those finding the biggest difficulty recruiting staff. Dodging a disaster for the U.K., Stellantis plans to convert its only British car factory to make electric vans, ending months of anguish at an almost 60-year-old plant threatened by the economic fallout from Brexit. It adds to the boost last week from Nissan, which is working on a new billion-dollar EV and battery hub in northern England. "It's a huge vote of confidence in our economy, in the people of Ellesmere Port and in our fantastic post-Brexit trading relationships," Prime Minister Boris Johnson said.  A vehicle transporter leaves the Vauxhall plant in Ellesmere Port, England, which is owned by Stellantis NV. Photographer: Anthony Devlin/Bloomberg Brexit Britain's capital-market dreams were bolstered when fintech company Wise debuted on the London Stock Exchange in a direct listing -- the largest ever deal of its kind. Wise's first-day pop brought relief to London, which in recent weeks had high-profile flops like one for the food-delivery startup Deliveroo. A billion-dollar payday may await the U.K. from its share of fines the EU has levied against companies including Google over the years. If the Silicon Valley giant wins an appeal to the EU's General Court — or if that fails, to the European Court of Justice — Google gets the money back and will owe a share to Britain. Becoming the global capital of green banking is the next prize at stake in the post-Brexit war for financial supremacy. Paris is competing with London to dominate this burgeoning world of investment products tailored for environmental, social and governance factors. Bloomberg Intelligence estimates the segment could grow to more than $53 trillion of assets by 2025 -- a sum greater than the global market for corporate bonds. British politicians should back off as regulators overhaul the financial industry's rulebook after Brexit, the U.K. Treasury Committee said in a report. The parliamentary panel said there was no need for extra oversight such as allowing ministers to read regulators' proposals ahead of public consultation. Normal scrutiny in Parliament should suffice, they said. Supply-chain headaches resulting from the agreement on the Irish border struck as part of the Brexit deal need to be fixed urgently, Jeffrey Donaldson told Sky News. It was his first television interview since becoming head of the Democratic Unionist Party last month. He also said that the Northern Ireland protocol risks damaging the nation's economy and should be withdrawn. — Lizzy Burden We aim to keep you up to date on how the U.K. navigates the world after Brexit. Got tips or feedback? You can reach me at eburden6@bloomberg.net. Email us at beyondbrexit@bloomberg.net Chart of the Week London edged back ahead of Amsterdam as Europe's trading hub, regaining its crown for the first time this year. Share trading in London remains far below pre-Brexit levels, and the city's lead over Amsterdam is only a fraction of what it was before the end of the transition period. The shift in trading volumes is unlikely to affect the bottom line for brokers and trading platforms much but is a symbolic fillip for the City, especially after Chancellor of the Exchequer Rishi Sunak set out his program to maintain London as a top financial center. Don't MissWant to keep up?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share Beyond Brexit: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Get More From BloombergYou can find all of our newsletters here, but here are some we think you'd particularly enjoy: Bloomberg is also tracking the progress of coronavirus vaccines and mapping the pandemic. Sign up here for our Coronavirus Daily newsletter and here for our podcast. Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and expert analysis. |

Post a Comment