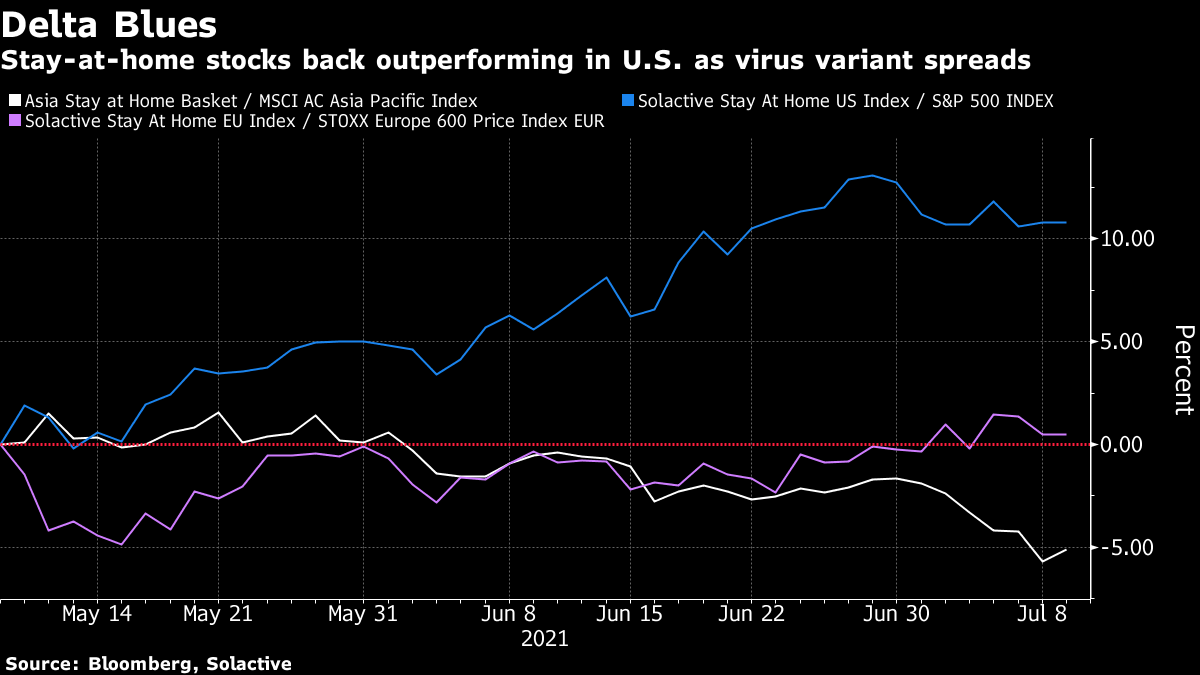

| Good morning. Meme stocks near bear territory amid a broader dip in risk assets, and the EU wants Britain to pay up. Here's what's moving markets. Meme BearsA basket of retail traders' favorite stocks is closing in on a bear-market plunge of 20% as investors shun the most speculative names for safer bets. A group of so-called meme stocks has been pressured over the past month by losses in Reddit favorites like retailer GameStop. The declines come amid signs that the day-trader frenzy that erupted during pandemic lockdowns may be cooling off. Some hedge funds are still licking their wounds from the Reddit crowd's early success, however, with Melvin Capital ending the first half of 2021 down 46%. Down DayBroader markets had a down day Thursday, too, with European stocks dropping the most in about two months as investors shifted out of this year's winners of the reopening trade amid concerns over economic growth and stimulus. The Stoxx Europe 600 Index, which had been hovering just below its record high, closed 1.7% lower amid rising worries that the rapid spread of the delta strain will curb the recovery. Long-term Treasury yields are spiraling lower this week alongside a decline in bond-market inflation expectations. European futures are slightly lower again this morning after drops in the U.S. and Asia. Pay UpThe European Union reckons the U.K. owes it 47.5 billion euros as part of the Brexit settlement, a higher figure than the latter had originally estimated. The assessment is aimed at reflecting the U.K.'s ongoing commitments to EU programs it's still benefiting from, with the two sides continuing to bicker over a number of issues related to Brexit. Take the so-called Sausage War, where officials late last month postponed a clash over British companies selling chilled meats to Northern Ireland. Blacklist ReportIn the latest concerning sign for U.S.-China relations, the Biden administration will add at least 10 Chinese entities to its economic blacklist as early as Friday over alleged human rights abuses and high-tech surveillance in Xinjiang, Reuters reports. It's not yet known precisely how many entities are involved or their identities, the report said, citing two unidentified sources. Coming Up…The G-20 finance ministers and central bankers meet in Venice to wrap up talks on a global minimum tax, with U.S. Treasury Secretary Janet Yellen in attendance. The U.K. reports economic growth data, while Bank of England Governor Andrew Bailey and European Central Bank President Christine Lagarde appear at a panel discussion. Swedish property developer Fabege and Danish insurer Tryg are among companies reporting in a quiet day of earnings. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe relentless global spread of the delta coronavirus variant has triggered counterintuitive investor reactions in different regions. The stay-at-home stock trade -- one of the most prominent equity strategies from 2020 -- has been reignited in the heavily-vaccinated U.S., remains dormant in Europe and is still underperforming in vaccine-laggard Asia. A U.S. stay-at-home index from Solactive has beaten the S&P 500 by more than 10 percentage points over the last two months, while its European equivalent is broadly in line with the Stoxx 600. A Bloomberg-compiled basket of Asian stay-at-home stocks has lagged the regional benchmark by over 5 points. The moves suggest investors see the variant as a particular risk to the U.S. recovery -- even though almost half the population is fully vaccinated -- perhaps an acknowledgement of the difficulty in getting that proportion higher toward herd immunity levels. Traders seem more confident about Europe's pace of vaccinations and relative caution on lifting social distancing requirements too quickly -- at least on the continent. And equity investors still seem willing to give Asian countries the benefit of the doubt in managing the virus resurgence -- even as vaccinations continue to lag in key economies like Japan, India and South Korea.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment