| The U.S. has no plans to resume regular high-level economic dialogue with China. Netflix is branching out into video games. And Singapore's local virus cases reach a 15-month high. Here's what you need to know. Treasury Secretary Janet Yellen and her staff have no plans to resurrect the regular U.S.-China economic dialogue that governed ties between the two nations during the Bush and Obama administrations, continuing for now the suspension put in place under President Donald Trump. A spate of U.S. actions in recent days — including a planned warning to American businesses in Hong Kong, new import controls for China's Xinjiang region and talks about a digital trade agreement that would exclude Beijing — underscore how Biden plans to extend and even deepen Trump's more confrontational approach. Former Vice President Mike Pence is calling on Biden to further toughen his stance on China, including delisting Chinese companies that don't meet U.S. accounting standards, withholding research funds and demanding that China reveal the origins of the coronavirus pandemic. Asian stocks look set for a steady start after Federal Reserve Chairman Jerome Powell signaled more U.S. economic progress is needed before stimulus is pared back and as traders await key China growth data. A raft of key Chinese reports are due, including GDP growth, amid a debate on whether the Asian nation's economic rebound from the pandemic is peaking. Futures inched lower in Japan and Australia and were steady in Hong Kong. U.S. contracts fluctuated after the S&P 500 and Nasdaq 100 both closed slightly higher on Powell's reassurance on accommodative policy and reiteration that elevated inflation will likely moderate in coming months. Treasuries rallied and the dollar retreated. Netflix is planning an expansion into video games and has hired a former Electronic Arts and Facebook executive to lead the effort.

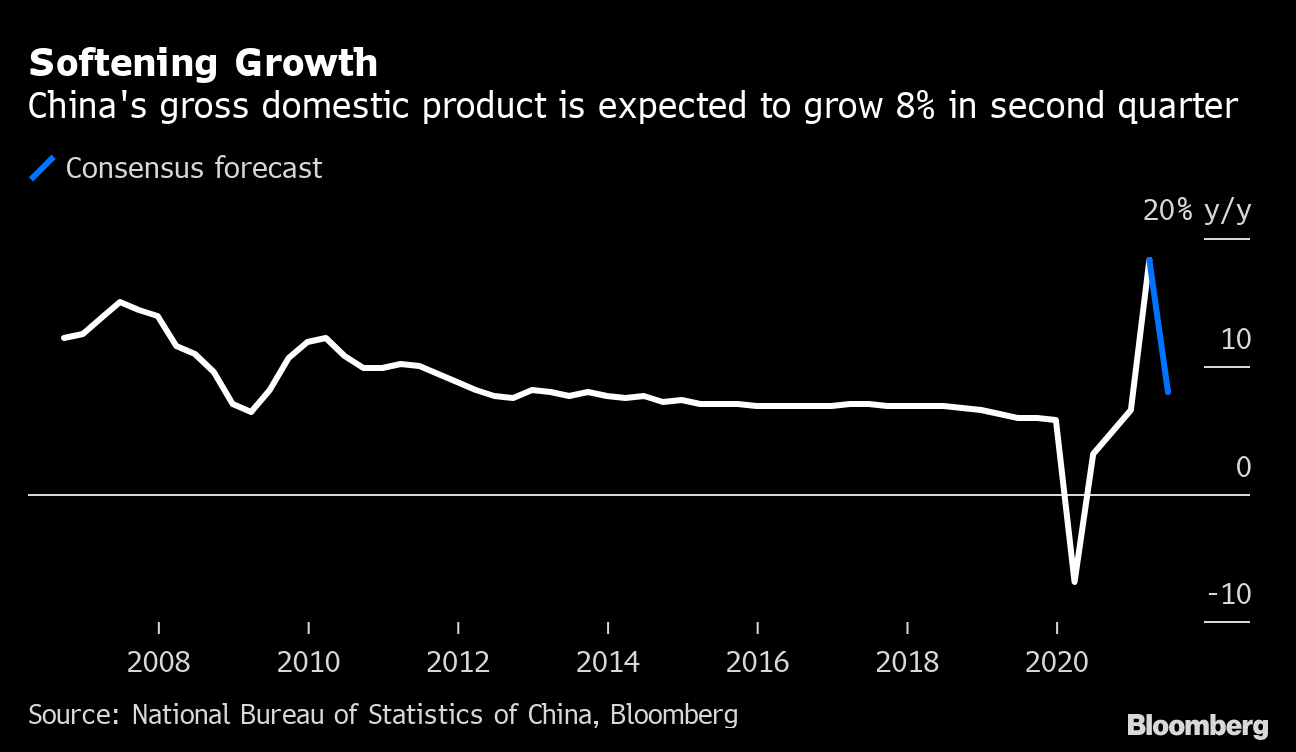

Mike Verdu will join Netflix as vice president of game development, reporting to Chief Operating Officer Greg Peters, the company said on Wednesday. Verdu was previously Facebook's vice president in charge of working with developers to bring games and other content to Oculus virtual-reality headsets. The games will appear alongside current fare as a new programming genre and the company doesn't currently plan to charge extra for the content, said a person familiar with the situation. Singapore's local virus cases reached a 15-month high on Wednesday with 56 new cases amid a worsening cluster at karaoke lounges, though its health minister said this wouldn't affect the city's closely-watched reopening plans. Indonesia surpassed India's daily Covid-19 case numbers, marking a new Asian virus epicenter, while Australia's Sydney is now in the third week of a strict lockdown that on Wednesday was extended until at least July 30. Meanwhile, Moderna hopes to replicate its success with its Covid mRNA vaccine on other diseases, including flu, HIV and cancer. The foreign ministers of India and China on Wednesday agreed to continue discussions over the ongoing border standoff that started last May in their second in-person meeting in less than a year. India's Subrahmanyam Jaishankar met China's Wang Yi on the sidelines of the Shanghai Cooperation Organisation Council of Foreign Ministers conference in Dushanbe, Tajikistan. The two ministers had a "detailed exchange of views" on the current border situation in the northern Indian territory of Ladakh and on other bilateral issues, the Indian foreign ministry said in a statement. The leaders' agreement to continue talks comes less than a month after India shifted 50,000 more troops to its China border. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayThe big news this morning is that the Biden administration won't resurrect the U.S.'s old economic dialogue with China. So even after the departure of Trump, U.S.-China trade relations are a long way from healing. Meanwhile, today also marks a sort of "Super Thursday" for China, with the new reserve ratio requirement (RRR) coming into effect, plus the scheduled release of second-quarter GDP data, which is expected to show a slowdown as some of the country's export boom tails off (expectations are for 8% growth year-on-year versus 18.3% seen in the first quarter). All of which has me thinking about China's current Covid containment strategy. Borders are still shut even as a significant portion of the population has been vaccinated, and there don't seem to be any real signs of that changing anytime soon. At first glance, U.S. trade relations and movements in money market rates probably don't appear to have a lot to do with Covid restrictions. But the more I think about the situation as a whole, the more I wonder if political and economic considerations will mean China is disincentivized to open up for the foreseeable future.  For the past few years, China's economic strategy has been focused on controlling capital outflows and boosting domestic consumption. Covid has been helpful on both those fronts, forcing Chinese to stay in the country to spend and preventing them from traveling to the rest of the world and taking their money with them. The yuan has strengthened thanks to reduced capital flows, the export boom and a surge of money coming into the country from outside (with Chinese government bonds now a hot commodity for foreign portfolio managers). Given the current state of China's relations with Western powers like the U.S., it hardly seems like engagement with the outside world is a priority for Chinese policymakers. With that background, you can see why China might be encouraged to maintain its strict "zero tolerance" Covid policy for a lot longer. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment