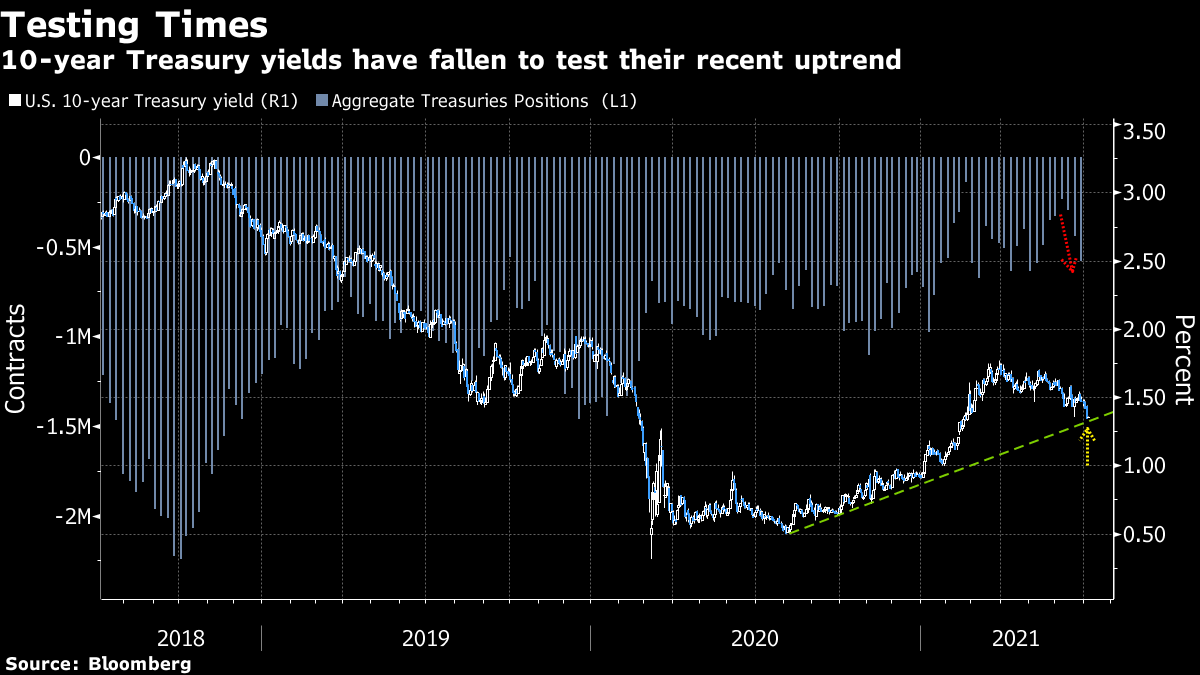

| Good morning. U.S. stocks run ends, Nomura shakeup, Pentagon contract scrapped. Here's what's moving markets. Run SnappedU.S. stocks snapped a seven-session winning streak Tuesday to post a small decline and crude oil slid after OPEC+ discussions were scrapped amid infighting. Most Asian stocks later fell and Treasuries held an advance on concerns about the economic recovery from the pandemic, virus variants and China's scrutiny of the technology sector. Yields have dropped to a four-month low as a gauge of U.S. service-sector activity faltered, with short covering exacerbating the move. Traders are looking ahead to the Federal Reserve minutes Wednesday for more clues on when the U.S. central bank may begin tapering the substantial asset purchases. Keep an eye on gold markets. Archegos LegacyThis year's Archegos Capital Management blowup claimed a scalp as Nomura pulled the plug on a chunk of its hedge fund business. Japan's biggest brokerage will stop offering cash prime-brokerage services in the U.S. and Europe, and has given some clients about six months to find a new provider, according to people familiar with the matter. The pullback comes after Nomura notched up some of the biggest losses from the implosion of the U.S. family office built by Bill Hwang, taking a $2.9 billion hit, and trailing only Credit Suisse Group AG among banks posting the biggest losses from the family office collapse. Pentagon DealThe Pentagon scrapped a $10 billion cloud-computing contract awarded in 2019 to Microsoft, indicating it plans to divide the work between the company and its rival Amazon.com instead. That comes after several years of wrangling between the government and some of the biggest U.S. tech companies over the pact. Amazon shares extended gains on the news. The original contract, known as Joint Enterprise Defense Infrastructure, or JEDI, was intended to evoke "Star Wars" imagery. It was to serve as the primary data repository for military services worldwide. Cozy BearRussian government hackers, part of a group known as APT 29 or Cozy Bear, are said to have breached the computer systems of the U.S.'s Republican National Committee last week, around the time a Russia-linked criminal group unleashed a massive ransomware attack. It's not known what data the hackers viewed or stole, if anything. The exploits are a major provocation to President Joe Biden, who recently warned Russian President Vladimir Putin about cyberattacks. Coming Up…European futures are pointing to a higher open for stocks, defying the drop in much of Asia where investors fretted over over the delta variant and China's scrutiny of the technology sector. While it's a slow day for earnings, there will be updates from Shell, recruiter Robert Walters, house-builder Vistry Group and iron ore miner Ferrexpo. The June Fed minutes are set to be the highlight of the eco day, along with the U.S. Job Openings and Labor Turnover Survey, or JOLTS, report. Dealmakers will converge on the Sun Valley Conference in Idaho, an annual retreat that has been described as "summer camp for moguls" and starts today. Tim Cook, Jeff Bezos and Mark Zuckerberg are all on the invite list. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningOnce again the Treasury market has confounded bearish consensus. The 10-year yield fell to its lowest since February on Tuesday and is now testing the uptrend in place for about a year. The 30-year yield dropped to test its closely-watched 200-day moving average. While many commentators pinned the moves on poor U.S. services data and a risk-off day for equities, in reality the data was strong in absolute terms and stocks were little changed. There was nothing to justify an 8-basis-point move in benchmark bonds. That suggests positioning and indeed a rough proxy for that -- net short speculative Treasury futures positions across the curve -- has been increasing in recent weeks, though can hardly be seen as excessive as it is well below levels seen in recent years. Perhaps Treasury investors see a bigger risk of an OPEC+ supply agreement breakdown than the oil market does -- a slump in crude would certainly weigh on inflation expectations and boost bonds. In any case, whatever the reason, benchmark yields are now closer to 1% than the 2% many strategists have penciled in for the end of the year. And with the year-long yield uptrend now in play, the Treasury market reaction to Fed meeting minutes due Wednesday will be very interesting indeed.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment