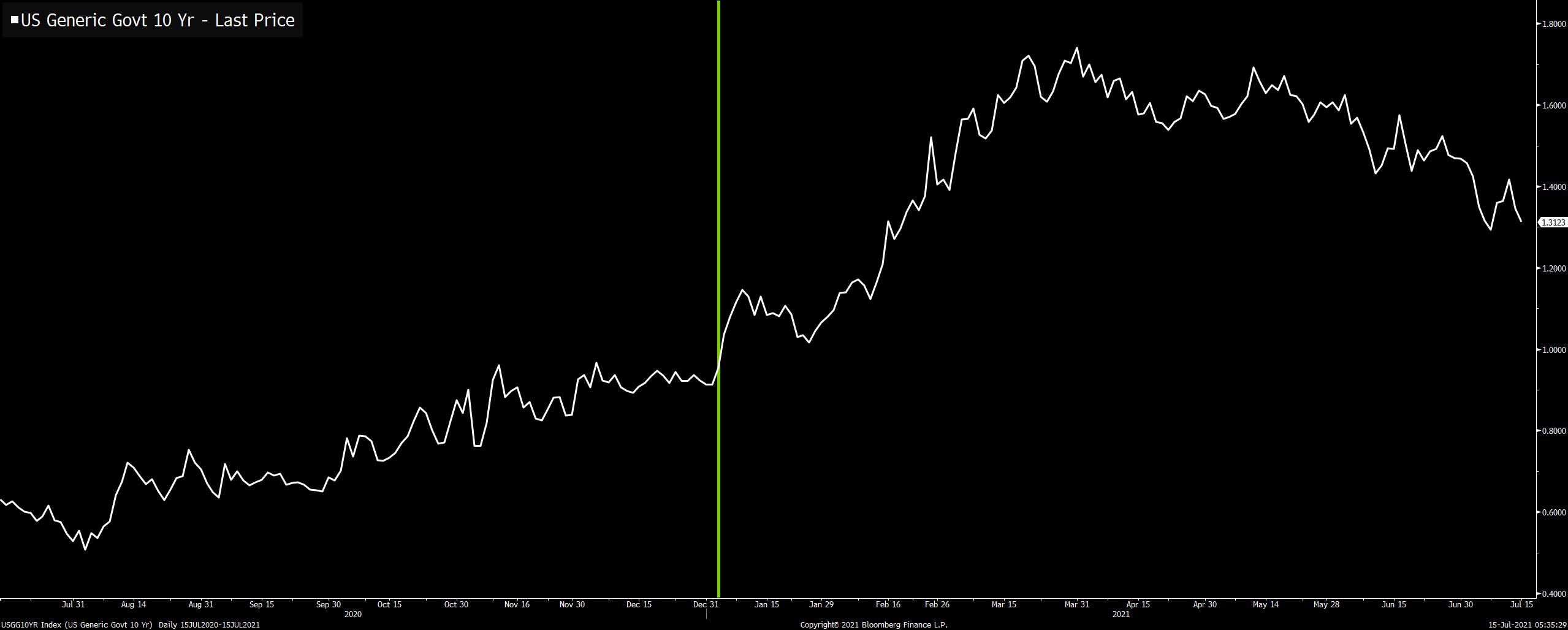

| Biden's package push, Powell's second day, and claims data due. Compromise The $3.5 trillion spending bill proposed by Senate Democrats on the Budget Committee seems to be gaining momentum. President Joe Biden said "we're going to get this done" as he arrived at the Capitol yesterday for talks on the package. Both he and party leaders will need to make trade-offs to get all 50 members of their Senate caucus on board, while being careful not to do anything that might cost them more than a couple of votes in the House, where progressive votes will be pivotal. Powell, againFederal Reserve Chair Jerome Powell gives testimony to the Senate Banking Committee this morning where he is likely to repeat his dovish message from yesterday. Powell pushed back against the idea that the Fed was coming under pressure to act on inflation as he insisted the labor market has a long way to go. While his words may be reassuring to traders, there is s growing trend for them to take their money out of Treasury futures as the outlook is just too uncertain. Claims, earnings The consensus is for weekly initial jobless claims to have dropped to 350,000, with continuing claims falling to 3.3 million last week. The data, released at 8:30 a.m. Eastern Time, would be an improvement in the data after a few weeks of flat or rising numbers. Also this morning, Morgan Stanley rounds out what has mostly been another successful earnings season for Wall Street, with the bank expected to report a $3.1 billion profit in the second quarter. Markets slip Stocks are trending lower this morning as investors assess the latest Fed comments and try to gauge the global economy's prospects in the wake of the latest China grow numbers. Overnight the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 1.2% lower. In Europe, the Stoxx 600 Index had slipped 0.4% by 5:50 a.m. with energy shares leading the losses. S&P 500 futures pointed to a small drop at the open, the 10-year Treasury yield was at 1.316% and oil was trading close to $72.50 a barrel. Coming up... As well as claims data we also get July Empire Manufacturing, the latest Philadelphia Fed Business Outlook and the Import Price Index at 8:30 a.m. Industrial and manufacturing production numbers are at 9:15 a.m. Powell's testimony begins at 9:30 a.m. The busy week for the oil market continues when OPEC releases its monthly market report. German Chancellor Angela Merkel meets President Biden in the White House. U.S. Bancorp, UnitedHealth Group Inc., Bank of New York Mellon Corp. and Alcoa Corp. are among the companies also reporting results today. What we've been readingHere's what caught our eye over the last 24 hours And finally, here's what Joe's interested in this morningIt seems to be just a fact that some people don't like low interest rates. They're associated with housing booms, asset bubbles, and inequality. If you're the type that has a lot of cash, but insists on just holding it in a bank account, investing in nothing, then you don't get paid very much. A lot of the criticisms of low nominal rates are misguided, but they are what they are, and some of those debates are for a different time.

We had a brief period earlier this year when the long end of the curve was moving up sharply, and that was right after the Georgia runoff election, when the Democrats swept both seats, taking control of the Senate.  Basically in that period you had expectations of a mega boost on the fiscal side, and the assumption that the Fed would be sitting on its hands for a long time, letting things run hot until we got back to full employment. This was the set of conditions that allowed yields to really rip. Fast forward to today, there's still ambiguity about the state of the next big spending package, and we know the Fed has grown more anxious about inflation, and so we see this pullback of late. In fact, when the Fed hints at higher short-term rates or tapering (as it did back in June) that just caused rates at the long end to slip even more.

How to get higher rates? The answer is rapid growth that sustains itself and builds on itself over time. Any sort of wishcasting that the Fed will just make them go up by wishing them higher will end in disappointment. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment