| China makes alternative plans for the probe into the origins of Covid-19. U.S.-listed Chinese stocks continue their decline. Singapore steps up scrutiny of expat jobs. Here's what you need to know this Friday morning. China says it's put forward alternative parameters for a second probe into the origins of Covid-19 that should span multiple countries. Beijing's latest move aims to counter a push by the U.S. for a deeper investigation into the theory the virus leaked from a Wuhan lab. Meanwhile, China's ambassador to the WTO, Li Chenggang, said there was scope for Beijing to work with the U.S., the European Union and other Western nations on an agreement aimed at curbing the practices at the heart of the still-simmering U.S.-China trade conflict. Trade ministers from the world's seven largest advanced economies are working on an initiative aimed at reining in Chinese trade abuses such as forced technology transfer, market-changing industrial subsidies and trade-distorting actions by state enterprises. Asian stocks look set for a muted start as traders weigh megacap tech earnings and risks from China's crackdown on private industries. U.S. shares edged up while Treasuries and the dollar fell. Chinese stocks listed in the U.S. declined further Thursday as investors looked past gains by Didi, amid reports the ride-hailing giant was considering going private. Robinhood ended its first day as a public company 8.4% below its IPO price, as plenty of the app's users decided to take a pass. The online brokerage has not yet released data on how many users bought shares, but some cited a lack of faith in CEO Vlad Tenev, who was blamed for the app's January trading halt on meme-stocks that angered customers. Amazon.com second-quarter sales and forecast for the current period fell short of analysts' expectations, suggesting the biggest online retailer's rapid growth through the pandemic is waning as people revert to old shopping habits. Shares fell more than 6% in extended trading. New CEO Andy Jassy has to show investors he can continue the company's rapid sales growth and rising profits beneath the heightened scrutiny of regulators in the U.S. and Europe. Last week, an Amazon job posting was published online seeking a "Digital Currency and Blockchain Product Lead." After Insider reported the existence of the posting, Bitcoin surged to about $40,000.

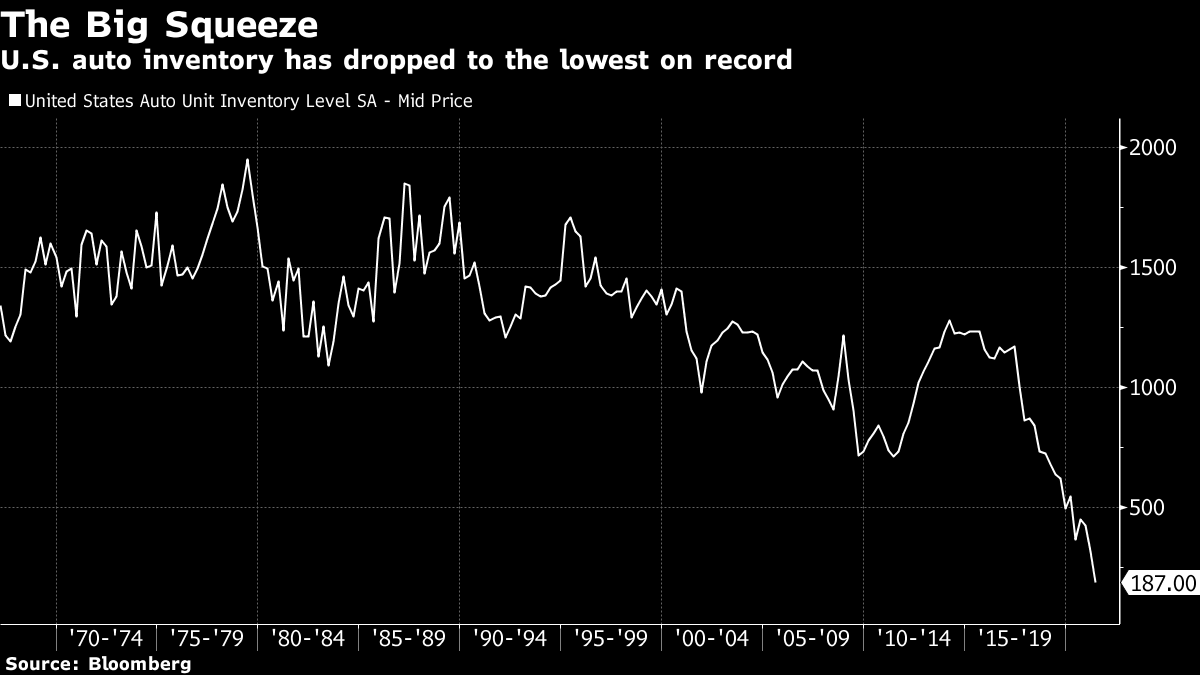

Opposition politicians in Singapore are once again stepping up scrutiny of jobs taken by expats, as the perennial debate about Singapore's reliance on foreign labor intensifies. Some 70% of residents called for strict limits on the number of foreigners coming into the country, according to a recent survey, with press and social media putting the government under pressure to explain its approach. Banks, fund managers and consulting firms are among companies that have come under heightened scrutiny as the government cracks down on suspected pre-selection of foreigners for jobs. For many companies, Singapore's low taxes and modern infrastructure make it one of the most attractive places in Asia to do business — particularly as Hong Kong gets caught in the crossfire of U.S.-China tensions. Tech tycoon Brian Kim has unseated Samsung heir Jay Y. Lee to become Korea's richest person. The founder of South Korean messaging giant Kakao has seen his fortune jump by more than $6 billion this year, propelling him to the top of the country's wealth ranking. Kim is now worth $13.4 billion, according to the Bloomberg Billionaires Index, after Kakao shares rose 91% in 2021 alone. South Korea's second-richest person, Samsung's Jay Y. Lee, has a net worth of $12.1 billion. It's a prime example of how self-made tech entrepreneurs are climbing the rich list in South Korea. This is what's caught our eye over the past 24 hours: There are two ways to read the latest U.S. GDP figures. The first is that the U.S. economy growing at a 6.5% annualized rate in the second-quarter was disappointing given expectations for 8.4% growth. The second way to view it is that the source of the GDP miss — a larger-than-expected drag from inventories as a result of the supply chain shortages we've been talking so much about — sets the U.S. economy up for an almighty boom if and when those issues are finally resolved. As Luke Kawa, my former Bloomberg colleague who's now at UBS, put it on Twitter: "Yesterday's drawdowns = tomorrow's demand."  Take a look at cars to see the extent of the impact of supply chain shortages and the inventory drawdown on the GDP figure. We know that a shortage of semiconductors has hit car production and helped spark the surge in demand for used cars that has pushed up inflation. If fewer cars are being produced, then existing inventories of vehicles get drawn down to satisfy demand. Domestic auto inventories in the U.S. are now at their lowest since records began in 1967. By Barclays' estimates, motor vehicles accounted for about half of the total decline in U.S. inventories in the second-quarter. That means if the semiconductor shortage were to ease, you might expect to see a sizeable restocking of cars, which would in turn add a lot to GDP. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment