| Welcome to the Weekly Fix, the newsletter with some serious rising star potential. I'm cross-asset reporter Katie Greifeld. Two sides to every tradeTraders are still grappling with existential questions about the Federal Reserve's path forward after last week's dot-plot bombshell—a task made no easier by an absolute parade of Fed speakers over the past few days. Case in point: New York Fed President John Williams told Bloomberg Television on Tuesday that liftoff is "still way off in the future" and the central bank isn't close to tapering bond buying. The following day, Atlanta Fed president Raphael Bostic said the taper decision may come in the next few months and he expects the Fed to first hike rates in late 2022. Chair Jerome Powell himself weighed in, telling Congress that the central bank will wait for "actual evidence of actual inflation" before lifting rates.  The back-and-forth is hammer-locking both stocks and bonds. Benchmark 10-year Treasury yields are practically unchanged from pre-meeting levels around 1.49%, despite swinging in a 24-basis-point range. The S&P 500 has drifted about 0.5% higher, after sliding as much as 2%. Meanwhile, analysts are of two minds when it comes to navigating the Treasury market. Rates strategists from TD Securities and Bank of America both characterized last week's Fed meeting and updated dot plot projections as a "hawkish pivot" in research notes this week. However, the two banks took opposite ends of the trade. TD's Priya Misra and Gennadiy Goldberg recommend wagering that the five- to 30-year yield curve will re-steepen from here, arguing that last week's dramatic flattening "looks extreme and was likely driven by a positioning washout." They initiated the paper trade at 121 basis points, with a target of 150.  On the other side is Bank of America, where analysts led by Mark Cabana posit that the 5s30s curve will continue to compress from here, albeit at a "more gradual pace." Underpinning that view is the belief that improving economic data will hit the belly the hardest as traders price in a less-accommodative Fed. As they exit the five-year segment, that yield rises in a bear-flattening move. Judging by this week's trade, it's still a line-ball call. This stretch of the curve is sitting almost smack bang in the mid-point of this week's high and low, at 118 basis points—though it's well shy of its pre-Fed levels above 140. Unstoppable IGWhile Treasuries have run hot and cold over the past few weeks, the rally in corporate bonds never stopped. High-grade spreads to Treasuries tightened to just 81 basis points last week, the lowest since 2007, according to Bloomberg Barclays index data. They've barely moved since. It's easy to look at that size and scope and conclude that all the juice has been squeezed out of investment-grade credit. However, from a purely relative-value standpoint, blue-chip bonds could be viewed as appealing, according to BMO Capital Markets. It requires some imagination and back-of-the-envelope math, but rewind to early 2018. Investment-grade spreads were trading around 85 basis points, while 10-year Treasury yields hovered near 2.8%—a roughly 30% yield enhancement, according to BMO's Daniel Belton.

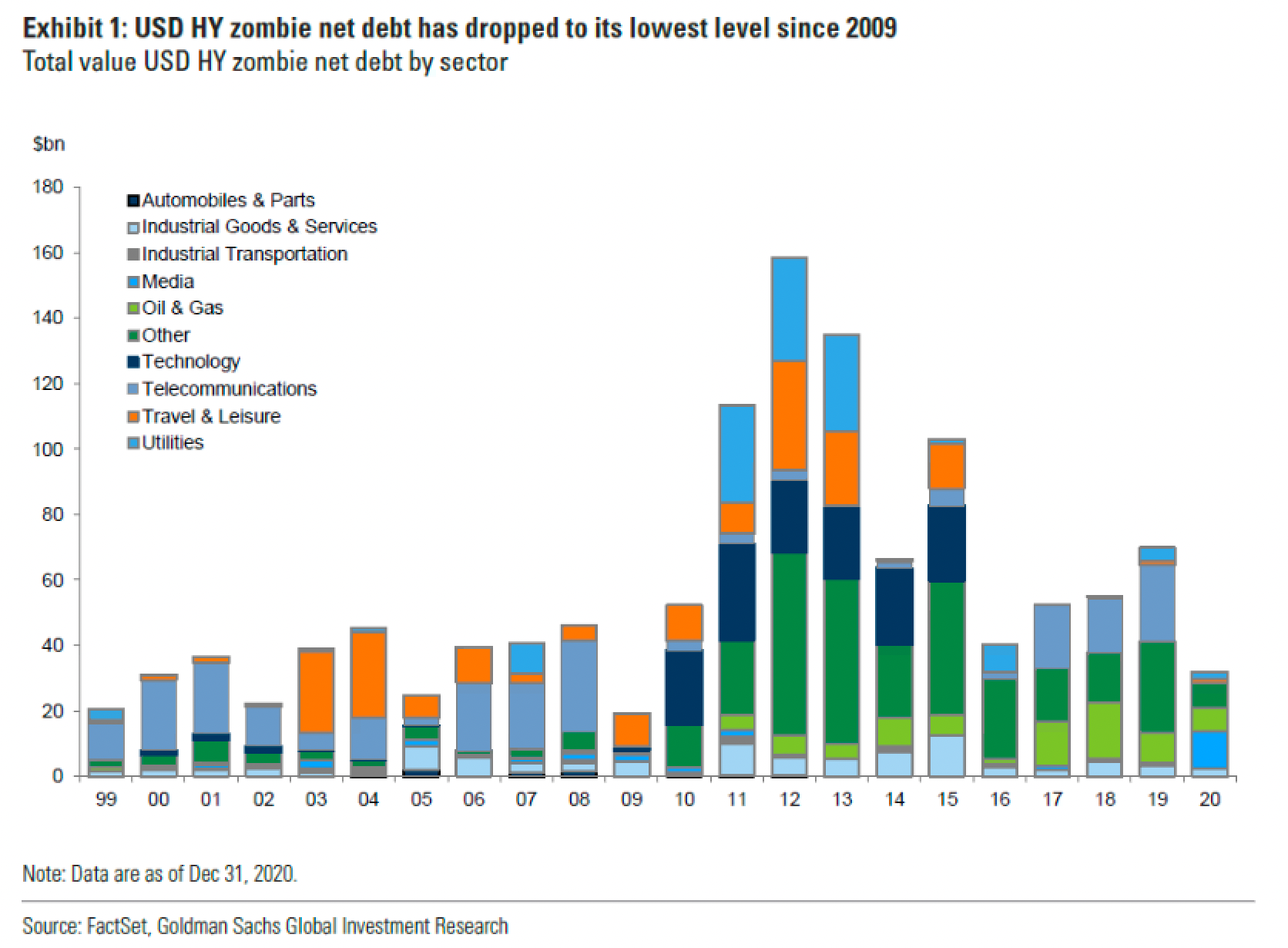

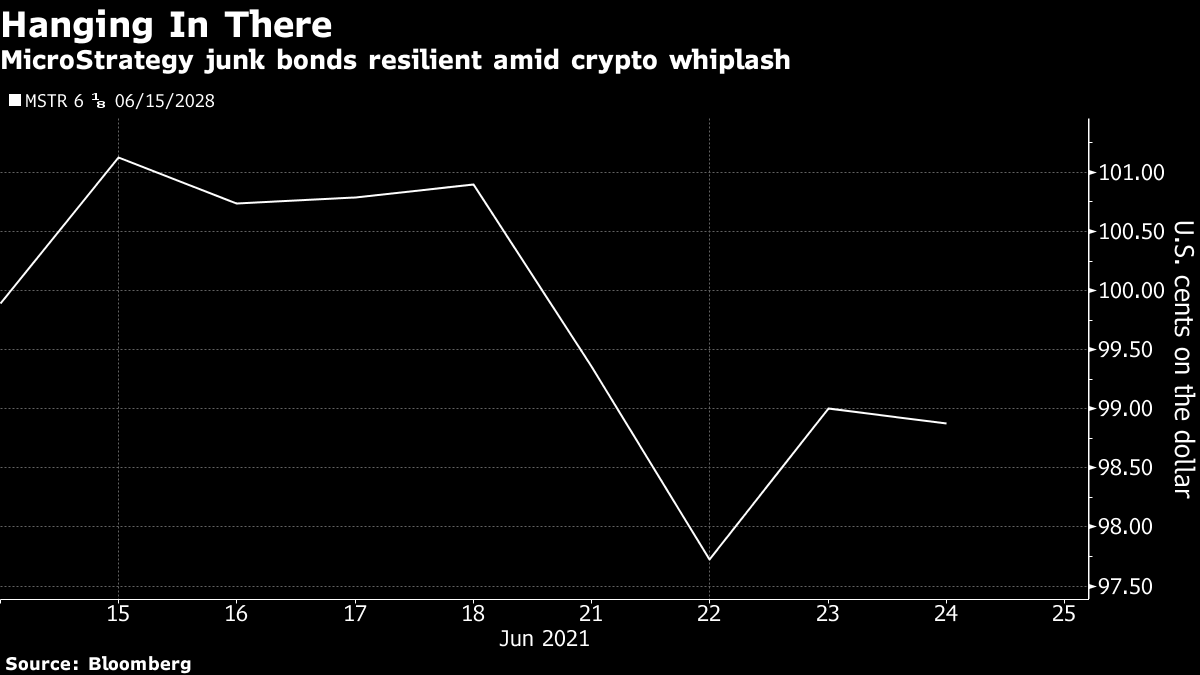

Apply that pickup to today's Treasury yields, you'd be looking at high-grade spreads of around 43.5 basis points, Belton said—well below the all-time low of 54 reached in 1997.  "Compared to Treasuries, spreads are actually significantly more attractive today than they were back in 2018, despite being at the same outright spread level," Belton said on a BMO podcast earlier this month. Of course, this is more a thought exercise than it is a forecast—Belton doesn't actually expect spreads to grind quite that low at any point in this cycle. But it suggests that even at 14-year lows, spreads could feasibly tighten even further from here. Where that catalyst may come from is anyone's guess. Inflation anxiety has eased somewhat in the wake of the Fed's suspected hawkish pivot at last week's meeting—that could be good news for the duration-heavy high-grade index. Another positive could be an ebbing of the relentless wave of new supply as that long-awaited summer lull kicks in. The long-duration undeadThe high-yield bond market remains hot. So hot, in fact, that issuers are up and leaving. The ranks of rising stars are swelling at a record pace, with nearly two junk-rated borrowers upgraded for every downgrade by S&P Global Ratings this year. As stars rise, zombies die. The tally of high-yield debt issued by so-called zombie companies—those whose earnings don't cover their interest payments—actually dropped from $70 billion at the end of 2019 to just $30 billion at the end of 2020, the lowest level since 2009, according to Goldman Sachs.  Bloomberg Bloomberg As pointed out by Bloomberg News's Tracy Alloway, that throws a big wrench in the bear-mantra that extraordinary monetary stimulus has "unleashed a wave of cheap money that's resulted in an army of undead corporate entities." Instead, Goldman argues that defaults combined with a record-setting wave of issuer upgrades has helped whittle down zombie debt. What's more, the overall number of zombie issuers has fallen. Goldman estimates that a single issuer was responsible for the total zombie sum at the end of last year. So that would suggest that you can put away your pitchforks. But… as Lisa Abramowicz deftly argued in a Bloomberg Opinion column last week, those ratings might not hold up when interest rates rise. Ultra-cheap financing costs are a big reason why shaky issuers look more capable of repaying their debt. Consider Moody's Investors Service's justification of its Ba3 rating on MicroStrategy Inc.'s junk bond issue: While "leverage is extraordinarily high, the company has a very low cost of borrowing," which "enables strong interest coverage as well as free cash flow generation."  It'll be interesting to see how these dynamics play out should the Fed follow through with a 2023 liftoff. The average duration for the Bloomberg Barclays U.S. high-grade index is currently 8.7 years, up from just 7 at the end of 2018. For the junk equivalent, duration is about 3.9 years, compared with just below 3 at the beginning of 2020. "While this company may be triple-B right now, in a higher interest-rate environment they may not be," Gene Tannuzzo, global head of fixed income at Columbia Threadneedle Investments, told Abramowicz. "This is tricky, especially if a company has a lot of debt to roll over." Eyes on $6,000Speaking of MicroStrategy, the software company-turned-corporate-crypto-cheerleader continues to delight. The company bought an additional $489 million worth of Bitcoin this week at an average price of about $37,617 per coin. The timing was a bit comical, as the crypto proceeded to plunge below $29,000 the following day. Bitcoin has recovered to only around $35,000 since, meaning that this latest Bitcoin binge may trigger another writedown for the company. MicroStrategy's shares have been slammed even harder than Bitcoin. The stock is down 10% on the week, while the world's largest cryptocurrency is only underwater by about 2.5%. Interestingly, the company's junk bonds—issued with the sole purpose of funding Bitcoin purchases—have been especially resilient amid the crypto chaos. The 6.125% coupon 2028 notes dipped to a new low of just below 98 cents on the dollar as Bitcoin skidded out on Tuesday, and have since clawed back to 99 cents.  But it's a fun thought experiment to consider what happens to MicroStrategy's $500 million junk debt should Bitcoin really start to suffer. We learned this week that the company owns over 105,000 Bitcoins, which it purchased at an average price of $26,080 per coin. So they're still in the black on their overall bet, though those gains were nearly vaporized this week. S&P Global Ratings thinks the pain point is much lower. In assigning a B- rating to MicroStrategy's junk issue earlier this month, the credit-rating firm identified $6,000 as 'yikes' territory: "We think a bitcoin price of less than $6,000 would likely lead the company to undertake a distressed exchange prior to the maturity of its convertible debt, at which point we would consider lowering our rating. If the bitcoin price remains in its recent range, MicroStrategy will have the flexibility to pursue additional leveraged bitcoin purchases at the current rating."

So, watch this space. Bitcoin has halted its death spiral, but remains well below its February's dizzying heights of nearly $65,000. And with environmental concerns around mining building, while China intensifies its crypto crackdown, it certainly feels like the bears are circling. Bonus PointsGun-Accessories Maker Scraps Junk-Bond Sale After ESG Blowback The Fed is reaching for Legos to explain why some price rises will probably prove temporary Subramanian Versus Golub on Inflation Bets: 'Don't Be a Chicken' |

Post a Comment