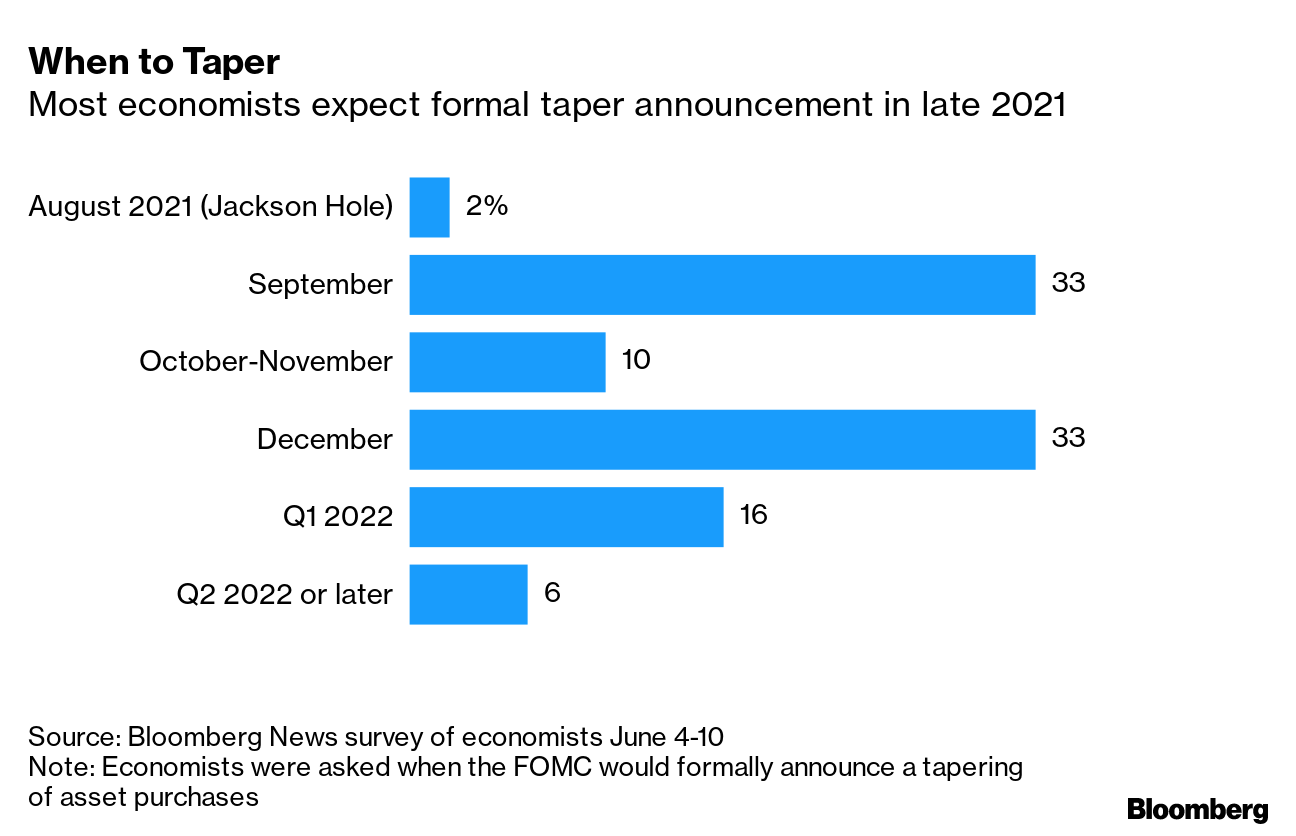

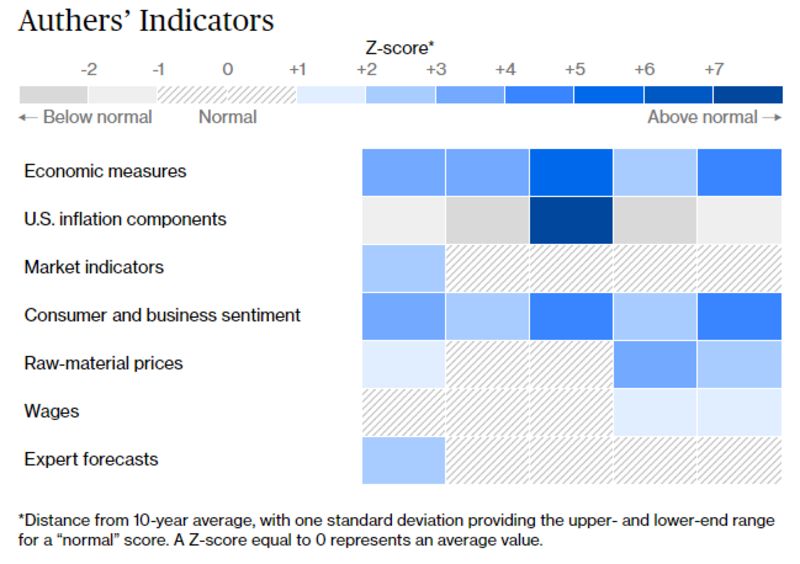

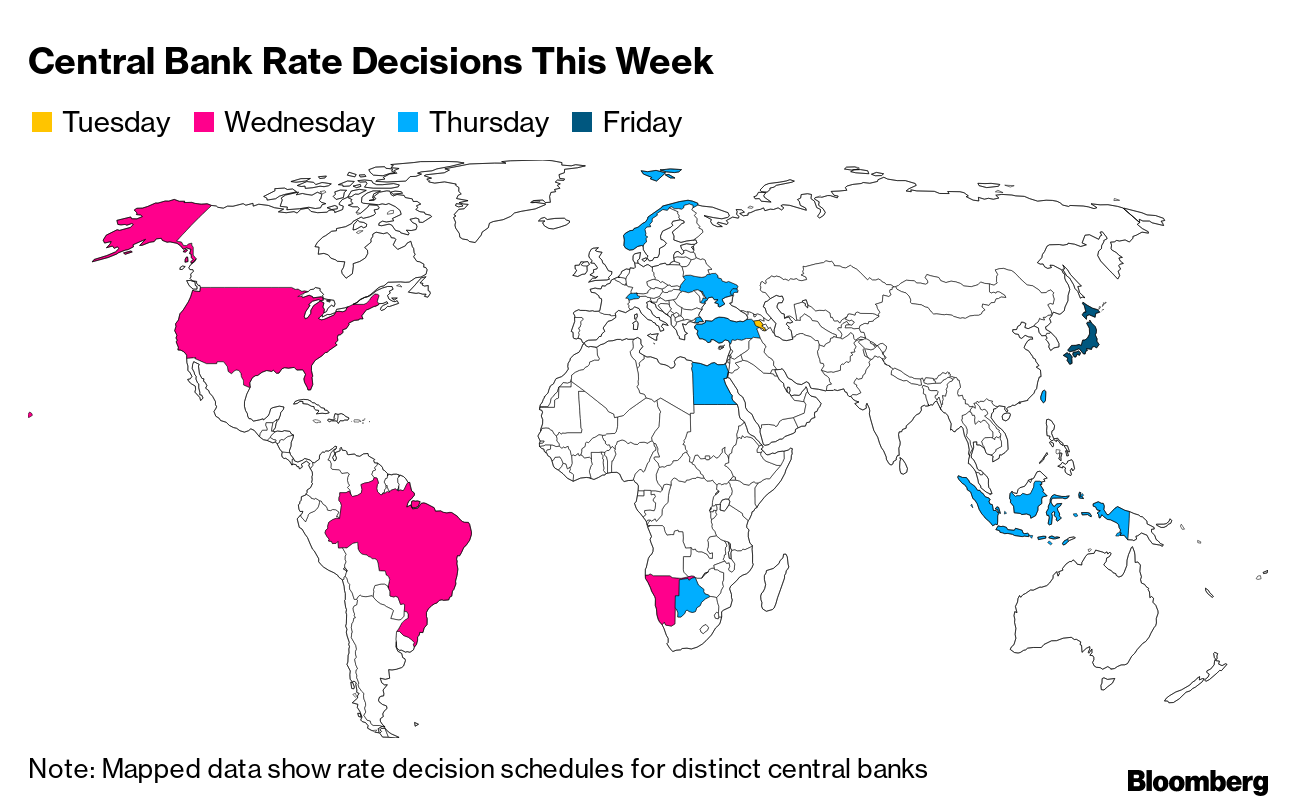

| Hello. Today we look at this week's meeting of Federal Reserve officials, what other central banks are doing, and examine how automation impacts U.S. wage inequality. The Fed on HoldThe Federal Reserve is set to keep monetary policy ultra-easy this week, but Chairman Jerome Powell and his colleagues still have much to discuss. Officials are likely to finish their gathering on Wednesday by signaling they will keep their current stance in place through the summer. Rock-bottom interest rates and bond-buying remain the order of the day. Providing them some room to do so, as we reported last week, is the fact that markets are increasingly buying Powell's argument that the current inflation shock will pass. The status quo may not last for too much longer and Powell will come under pressure from the post-meeting press conference to detail his outlook.  Economists surveyed by Bloomberg reckon the Fed will indicate a plan to scale back bond purchases in August or September, perhaps at the annual Jackson Hole conference. The consensus view may also shift this week to show officials projecting at least one interest-rate hike in 2023, earlier than the 2024 liftoff previously viewed as most likely. But, these are all baby steps and are still to be made. This week, the betting is policy makers will reaffirm plans to only adjust purchases once the economy achieves "substantial further progress" toward their employment and inflation goals. Three Bloomberg articles show the reasons to hold off, for now:  All told, Fed officials will have a rich discussion this week even if they decide to do nothing for the summer. —Simon Kennedy The Week Ahead It's not just the Fed setting policy this week. Central banks in a quarter of the Group of 20 and covering more than a third of global economic output will make decisions. Brazil is poised to increase its benchmark on Wednesday, while Norwegian officials may on Thursday reiterate the need for a cycle of monetary tightening to begin there later this year. Others, from Japan to Turkey to Switzerland, will probably keep their policies unchanged, albeit for different reasons and at highly contrasting settings. For a full rundown of the week ahead, click here. Today's Must Reads - G-7 divisions | Even with President Donald Trump gone, there are still tensions among the Group of Seven leaders. China's economic might was one concern and a summit failed to form a united front.

- Hikes ahead | Central bankers from two eastern European Union countries signaled they may stage the bloc's first major interest-rate hikes next week, with Hungary likely to increase its benchmark in quarterly steps and the Czech Republic possibly taking action to prevent the factors driving global inflation from sending consumer prices spiraling out of control at home. Meanwhile in Latin America, the Chilean central bank is also holding out the possibility of a rate hike at one of the upcoming meetings, according to its president, Mario Marcel.

- European optimism | Fears the European labor market would be scarred by the pandemic have receded, welcome news for a region bedeviled by high structural joblessness.

- Expensive bottlenecks | Delivering goods may hit pocketbooks by boosting general prices. Transporting a 40-foot steel container of cargo from Shanghai to Rotterdam now costs $10,522, 547% higher than the seasonal average over the last five years. Meanwhile, South Korea posted record sales in logic semiconductors last month, amid a global shortage of chips.

- 'Mattress money' | Remember all the toilet paper people hoarded at the start of the pandemic? Turns out they hoarded cash and other easy money, too, and for the same reason: survival instincts.

- Who's returning to the office? Turns out it is the youngest and newest staff who are most keen, worried about seeing their careers stall unless they head back to their desks.

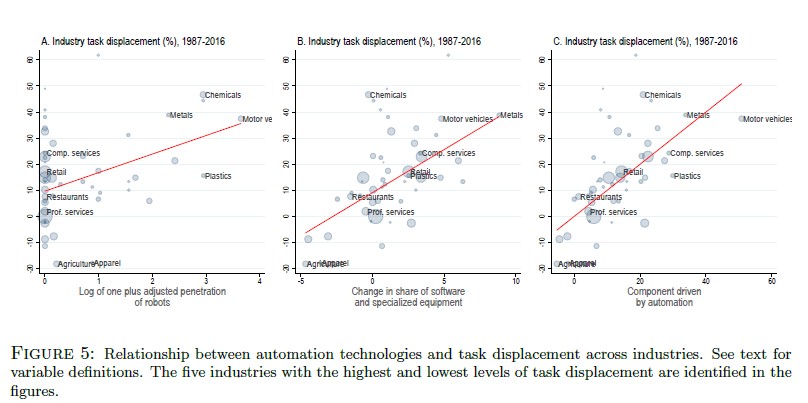

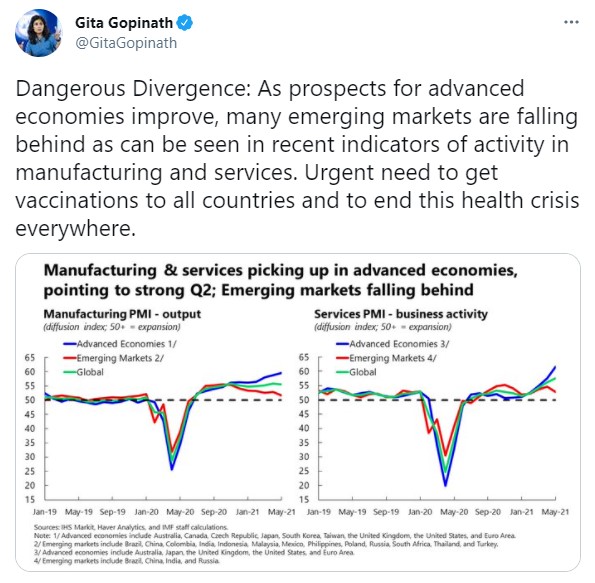

Save the DateWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Need-to-Know Research As much as 70% of the change in U.S. wages over the last four decades is accounted for by the relative declines in the pay of worker groups specialized in routine tasks in industries experiencing rapid automation, according to a new study by economists Daron Acemoglu and Pascual Restrepo. "Automation technologies expand the set of tasks performed by capital, displacing certain worker groups from employment opportunities for which they have comparative advantage," they wrote. They also found major changes in wage inequality can go hand-in-hand with modest productivity gains. On #EconTwitterHere's the latest warning of a divering economic recovery.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment