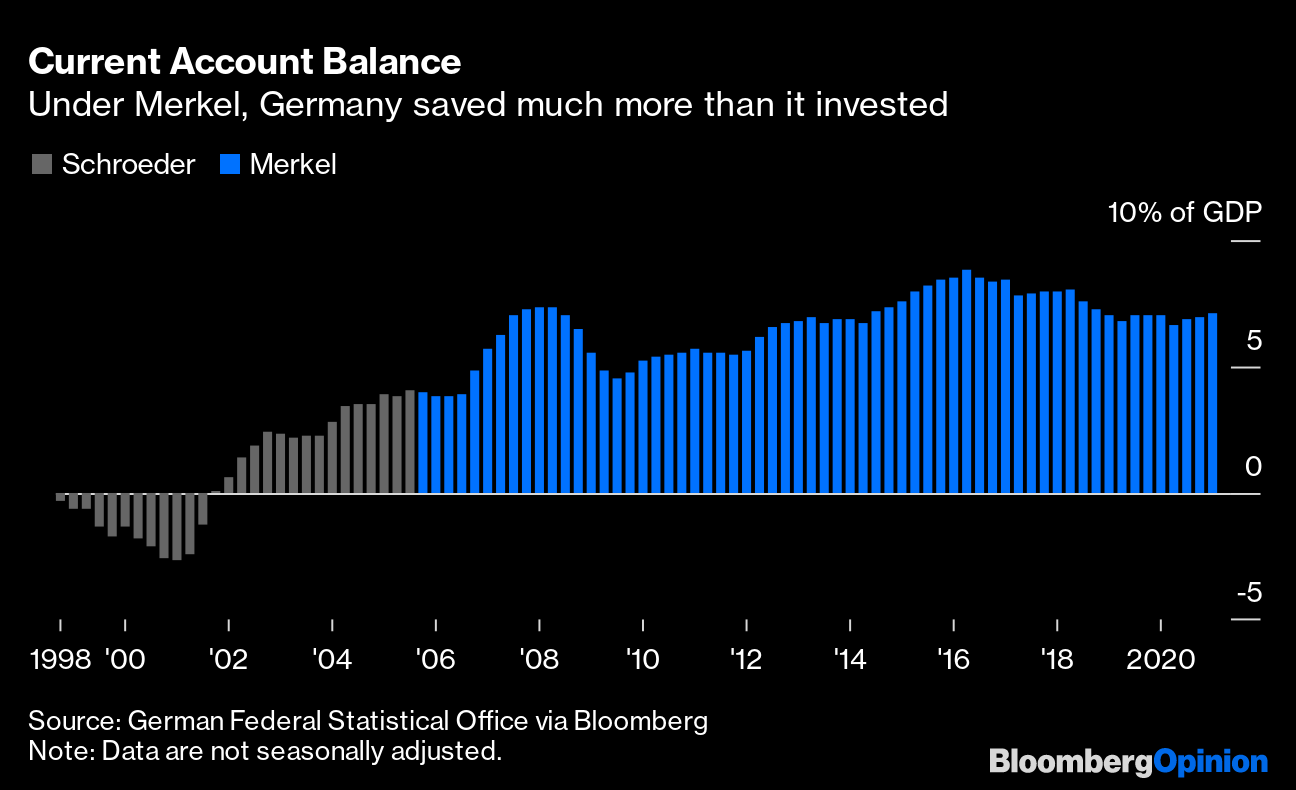

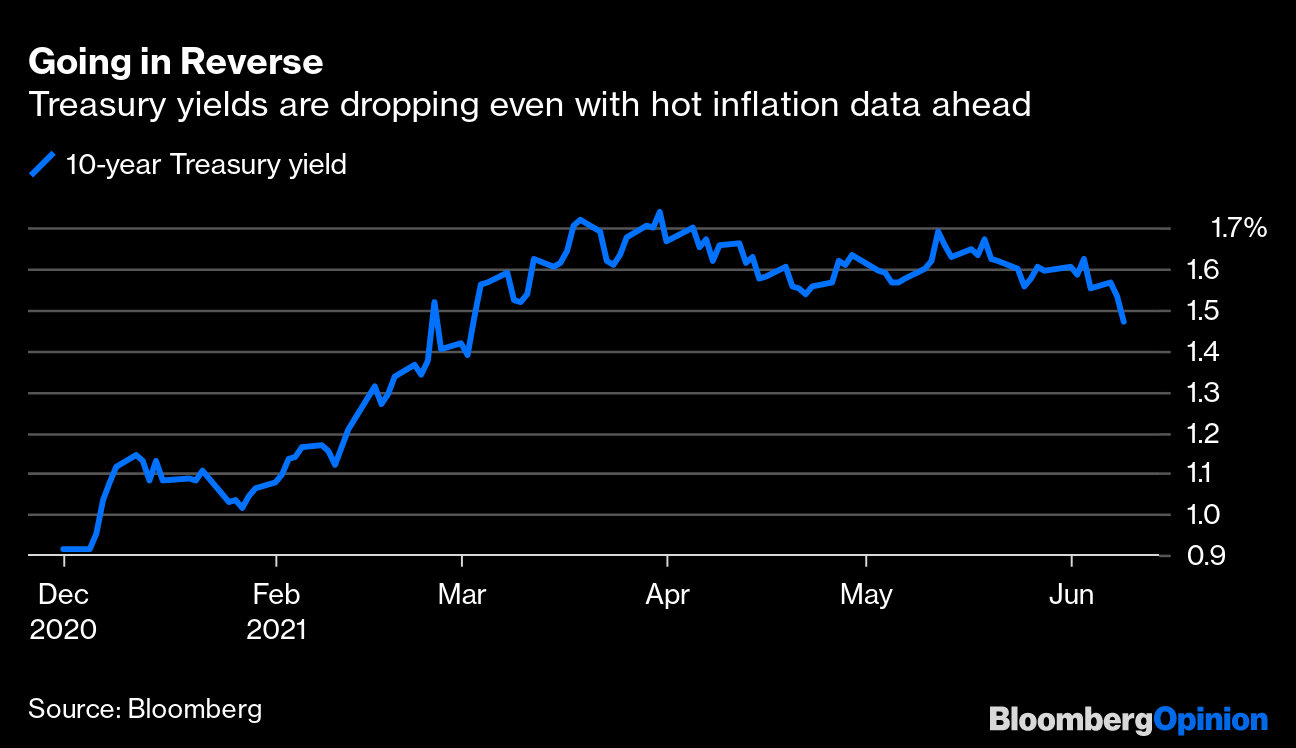

| This is Bloomberg Opinion Today, a Schrödinger's box of Bloomberg Opinion's opinions. Sign up here. Today's AgendaCovid's Not Dead YetThe coronavirus pandemic seems to be in a state of quantum superposition. Like Schrödinger's cat, it is both alive and dead, depending on who's looking. In the U.S. and U.K., where large numbers of people have been vaccinated, it seems mostly dead. Not dead-parrot dead, but at least changing from Schrödinger's tiger to Schrödinger's unfriendly house cat that scratches up the furniture and also you're allergic. Former FDA chief Scott Gottlieb, a sensible observer throughout this disaster, tells Michael R. Strain he sees Covid-19 becoming like the flu, both in its seasonality and fatality rate. He figures Americans will be fully back to work and school by the fall and then face a new Covid wave in the winter. But with widespread vaccinations, it shouldn't be worse than a bad flu season. Sounds kind of nice. But in the developing world, vaccinations are lagging badly, giving the disease too many chances to evolve. The scariness of India's "delta" variant may be overhyped, but it seems both more transmissible and severe than others, writes Sam Fazeli. Vaccines are effective against it. But it could make Covid more tiger-like again for unvaccinated Americans and Brits, including young people. So developed countries must get far more serious about vaccinating the rest of the world to stem further deaths, mutations and economic damage. President Joe Biden promising to give the world 500 million Pfizer doses is a great start, but it's only a start. Former U.K. Prime Minister Gordon Brown writes this Friday's G-7 meeting is a chance for countries to commit to more such concrete action and spending. The world's biggest countries must pony up to the best of their ability, as they have with other emergencies. This cat is still very much alive and dangerous. Further Covid Reading: China's secrecy about Covid's origins is just par for the course. It doesn't mean it's covering up a lab leak. — Adam Minter A Unified Theory of Meme StonksWe've been trained to call every financial trend that feels extreme a "bubble." Stocks, bonds, real estate, crypto, AMC, baseball cards — everything — has been declared a bubble lately. But what do we know about bubbles, kids? Not the SpongeBob kind of bubble, which causes mischief and never dies. But the real-world kind of bubble, which inflates instantaneously and vanishes just as quickly? Does this really describe, say, cryptocurrencies, much less Treasury bonds? Robert Shiller, in conversation with John Authers, suggests it's better to think of runaway asset classes in epidemiological terms rather than as bubbles. Crypto and even meme stocks such as GameStop will likely live forever in some form, even when their current mania cools — sort of like Covid hanging around as a seasonal illness. This goes beyond mere semantics; how we think about these viral investments affects how we respond to them and prepare for the next ones. Further Stonks Reading: Now that we've mapped the full life cycle of a meme stock, it's possible to set out to become one. — Matt Levine Good Biden Vs. Bad BidenAmerica's true potentate might be Joe Manchin. But as a thought experiment, let's imagine Biden and the Democrats really run the country and can turn his plans into reality. Would this be good or bad? Allison Schrager comes down on the side of "bad," suggesting his trickle-up economics of taxing the rich to give more money to the poor will stifle innovation. Her suggested innovation? A soupçon of old-fashioned trickle-down economics. But Noah Smith argues Biden's approach of simply sending people cash jibes better with modern economic theory and has so far proven effective at stimulating growth and pulling people out of poverty without hurting employment. Tomato, tomahto. Telltale ChartsAndreas Kluth weighs Angela Merkel's radically normcore regime and decrees she was a good steward of Germany, but too cautious. Her term will mark the end of an era when the country could simply melt into the shrubbery of the international order.  Bonds continue to be blissfully unconcerned about inflation, notes Brian Chappatta.  Further Reading Hyperloops can move people and goods quickly, cleanly and safely, and Congress should encourage them. — Bloomberg's editorial board Lordstown is learning what Tesla has long known: Electrifying cars takes a lot of cash. — Liam Denning Biden and Erdogan are set to meet under tense circumstances. Here's how they can make the relationship more fruitful. — Sinan Ulgen Big passive investors such as BlackRock should be more proactive about corporate governance or sit out proxy fights. — Anjani Trivedi Disruption after disruption has exposed just how vulnerable concentration has made the global food supply. — Amanda Little How to manage your money if you want to freelance full time. — Paco de Leon ICYMIAnother successful Infrastructure Week. Bitcoin could go back to $20,000. People can't get enough of 0% overnight Fed rates. KickersElephants are wandering in China for no apparent reason. They are also napping. (h/t Scott Kominers) Short naps help us learn new skills, a study has shown. Puppies are born ready to bond with people. Anything tastes good in chocolate: cicada edition.  Notes: Please send Balenciaga Crocs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment