Stocks fall on Fed update | The ‘talking about talking about’ taper meeting | Biden and Putin Summit

EDITOR'S NOTE

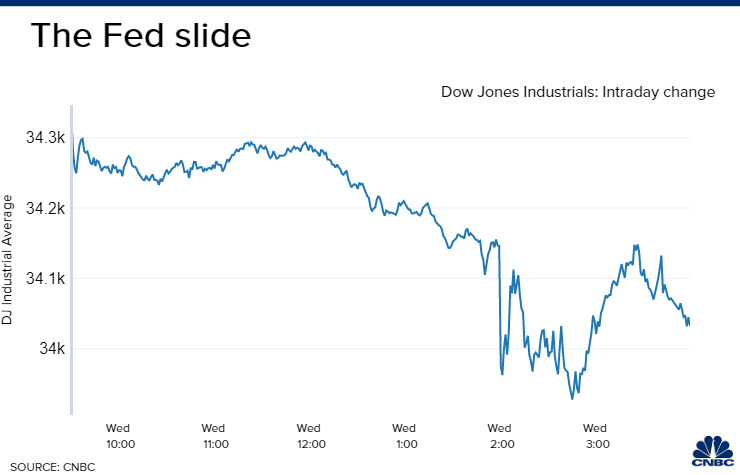

U.S. markets fell on Wednesday after the Federal Reserve lifted inflation expectations and saw rate hikes as soon as 2023 following the Federal Open Market Committee's two-day meeting.

The Dow Jones Industrial Average closed the day 265.66 points lower, or 0.8%, to 34,033.67. The S&P 500 edged 0.5% lower to 4,223.70. The Nasdaq Composite dipped 0.2% to 14,039.68.

Despite the initial jarring reaction from the Fed's forecasts, stocks rallied off of session lows after Fed Chair Jerome Powell reiterated his belief that inflation is transitory and did not provide a timeline on tapering asset purchases.  Powell said the Fed will continue to monitor the progress of economic recovery and will give advance notice before announcing any decisions to taper its bond-buying program.

"You can think of this meeting that we had as the 'talking about talking about' meeting, if you'd like," Powell said when asked about tapering. "I now suggest that we retire that term, which has served its purpose."

The Dow dropped as much as 382 points at one point before Powell turned things around a bit with his comments.

"The market is reacting violently to the Fed's upgrade to the inflation forecast and bringing those two interest rate increases forward, but I'm not sure what they were expecting considering some of the [inflation] numbers," Michael Arone of State Street Global Advisors said. "Perhaps there's some skepticism around the Fed" on its claim inflation is transitory. TOP NEWS

TOP VIDEO

CNBC PRO

SPECIAL REPORTS

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Post a Comment