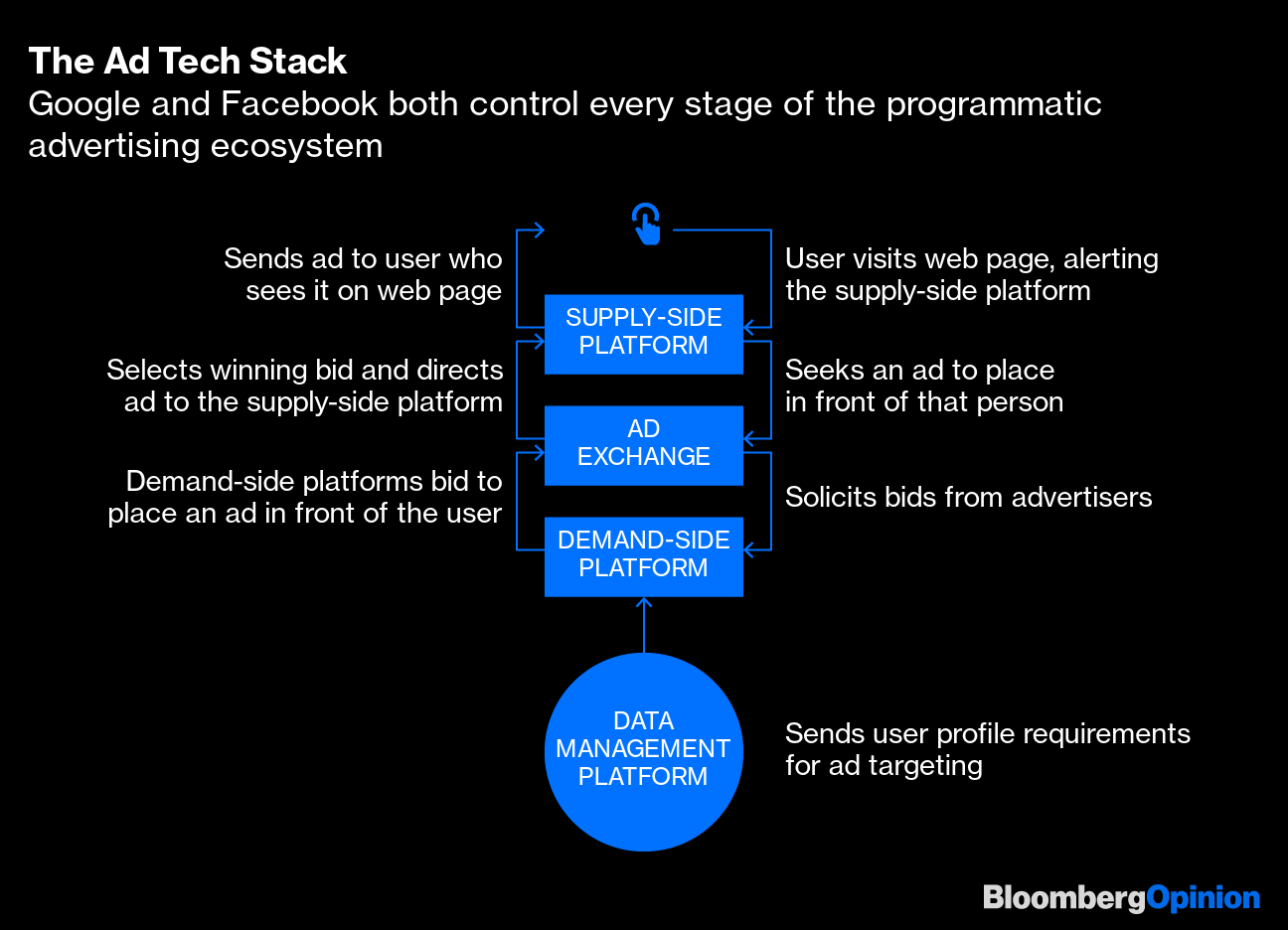

| This is Bloomberg Opinion Today, an infrastructure week of Bloomberg Opinion's opinions. Sign up here. Today's AgendaAnother Successful Infrastructure WeekBecause we live in the dumbest timeline, our government is desperately trying to figure out how to pay to fix our crumbling infrastructure, when the bond market is begging to lend it money at basically 0% interest. But here we are. One pay-for option being kicked around (before being probably kicked into the garbage) is replacing the gasoline tax with a vehicle-miles-traveled tax. This at least has the advantage of being slightly less regressive, as it will capture the growing number of expensive electric cars on the road. (Of course, we want more electric cars on the road, but that's a different headache that can possibly be solved with more tax-code shenanigans, when again, free money in the bond market is just sitting right there.) Anyhoo, Peter Orszag recognizes this is a political and practical stink bomb but suggests a reasonable alternative: simply charging a VMT for all the commercial trucks on the road. This will raise a lot of money, and trucks aren't exactly America's most sympathetic constituency. This is all a long way from the wild government spending many Democrats and people in the stock market expected when President Joe Biden and his party took over the government. As John Authers points out, the market is just starting to absorb this more-frugal reality, along with the slow draining of the liquidity that has kept it afloat for the past several months. As for Dems, they must come to grips with the fact there simply aren't enough votes in the Senate for everything they want to do, writes Jonathan Bernstein — including, one imagines, simply borrowing money to pay for infrastructure.  The content-procurement process is messy. Source: Hulton Archive/Getty Images Netflix Lands a WhaleIn "Moby-Dick," after Pip spends an hour floating on the ocean, he comes a bit unglued, having seen "wondrous depths, where strange shapes of the unwarped primal world glided to and fro before his passive eyes." This also describes the experience of using Netflix when you don't know what to watch: You bob on the surface of a content abyss too vast for your brain to comprehend. Most of it is not great to look at. Netflix may have just solved this problem by teaming up with Steven Spielberg, writes Tara Lachapelle. The man is a tentpole-content machine. Just when you don't think he could possibly have another ("Moby-Dick"-inspired) "Jaws" or "Jurassic Park" in him, he comes up with a "Lincoln" or "The Post." Every now and then he drops a "Crystal Skull" on you, but that's still arguably better than much of the flotsam on Netflix. Disney+, HBO Max and other streamers with shallower content pools, though of generally higher quality ("Mr. Boogedy" aside), now must worry their industry leader will have many more focal points to help subscribers avoid that queasy oceanic feeling. People in Congress Shouldn't Trade StocksDrive drunk often enough, and they take your license to drive. Commit enough felonies, and they disbar you. Cause enough embarrassing scenes at the salad bar, and they will ban you from Golden Corral for life. Somehow, though, we keep giving congresspeople the ability to trade stocks, despite repeated, flagrant insider trading, or at least the strong odor thereof. Enough is enough, Bloomberg's editorial board writes: Members of Congress shouldn't be allowed to trade stocks. Full stop. They have proven they're untrustworthy to meet any other standard, with clever little lizard brains that find every loophole left available to them. No more loopholes. If I can no longer eat the delicious salads at Golden Corral, then lawmakers shouldn't be able to trade stocks. Telltale ChartsThe EU's probe of Google's online ad business hits it where it lives, writes Alex Webb.  Further Reading Further automating commercial flights, as Airbus wants to do, is a dangerous idea. — Tim Culpan and David Fickling The activist that beat Exxon now has a passive-aggressive ESG ETF. — Liam Denning The fervor of Alpine 4's fanbase is evidence the stock market is out of control. — Michelle Leder Studying how Covid causes long-term health problems can help us understand other chronic ailments. — Faye Flam We can't abandon the thousands of interpreters who helped us in Afghanistan. — James Stavridis Just throwing a bunch of charity at a school with no guidance as MacKenzie Scott did is a waste. — Naomi Schaefer Riley Young people working weekends just give away their time without really advancing their careers. — Sarah Green Carmichael ICYMINew York is picking its next mayor. (Howard Wolfson assessed the Democratic candidates.) Bitcoin fell below $30,000. People aren't rushing back to the office. KickersComing soon: ice cream flavored with plastic bottles. (h/t Mike Smedley) Solar power and microbes could produce 10x the protein of plants. Americans aren't so sure hard work pays off. That's a moray. (h/t Alistair Lowe)  Notes: Please send squid and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment