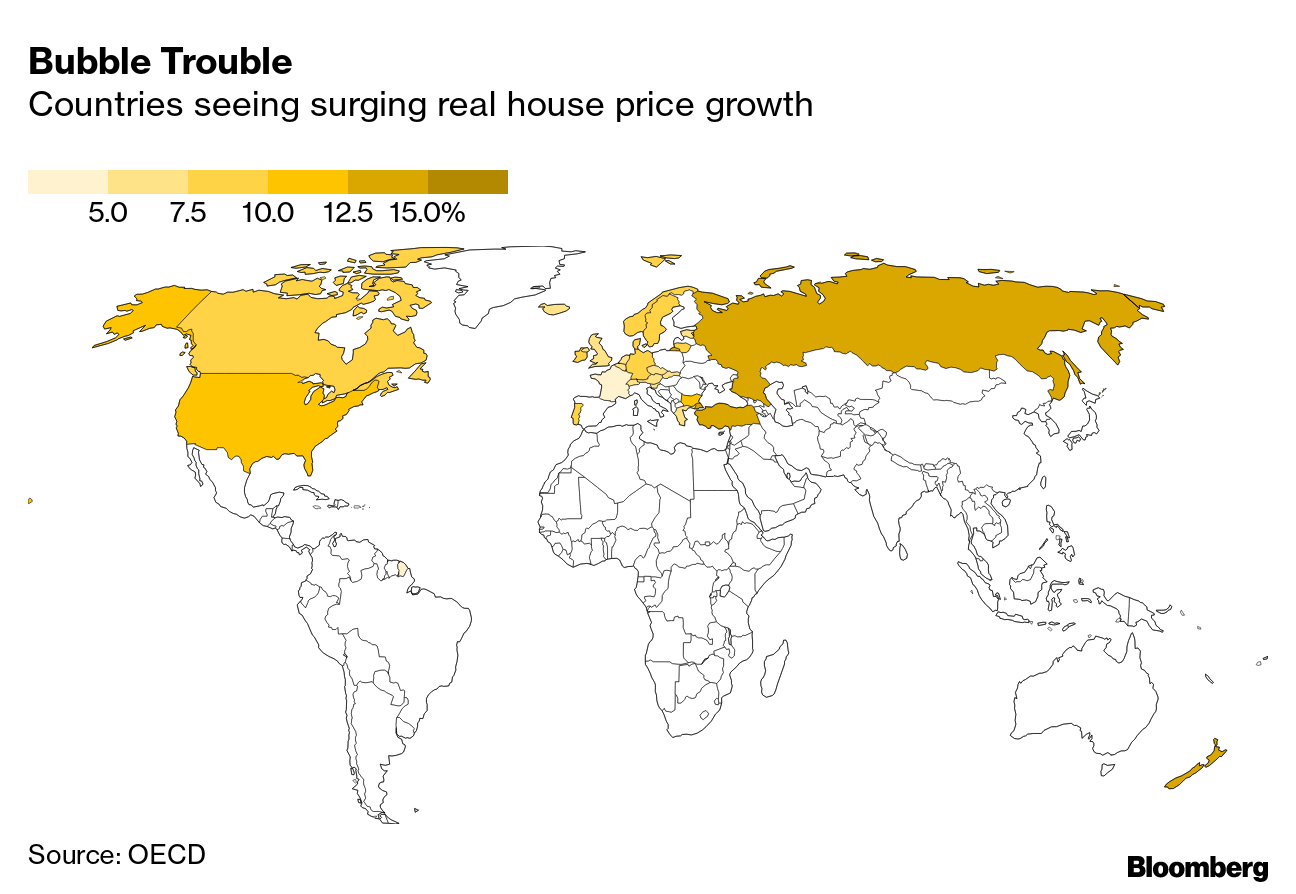

| Hello. Today we look at housing risks bubbling away in the world economy, how Nigeria's flailing economy risk weighs on Africa's future and examine the 'Trump effect' on immigration. Bubble TroubleThe world's next economic crisis may already be brewing.

That's the worst-case takeaway from fresh research by Bloomberg Economics that ranks the world's frothiest housing markets based on key indicators such as price-to-rent and price-to-income ratios.  New Zealand, Canada and Sweden rank as the frothiest housing markets, with the U.K. and the U.S. also near the top of the risk rankings. "A cocktail of ingredients is sending house prices to unprecedented levels worldwide," said economist Niraj Shah. "Record low interest rates, unparalleled fiscal stimulus, lockdown savings ready to be used as deposits, limited housing stock, and expectations of a robust recovery in the global economy are all contributing."

Still, with rates still low, lending standards generally higher than in the past, and more regulatory policies in place, the trigger for a crash isn't obvious, according to the analysis. Shah said the period ahead will more likely be characterized by cooling rather then collapsing. "When borrowing costs do start to rise, real estate markets — and broader measures put in place to safeguard financial stability — will face a critical test," Shah wrote.

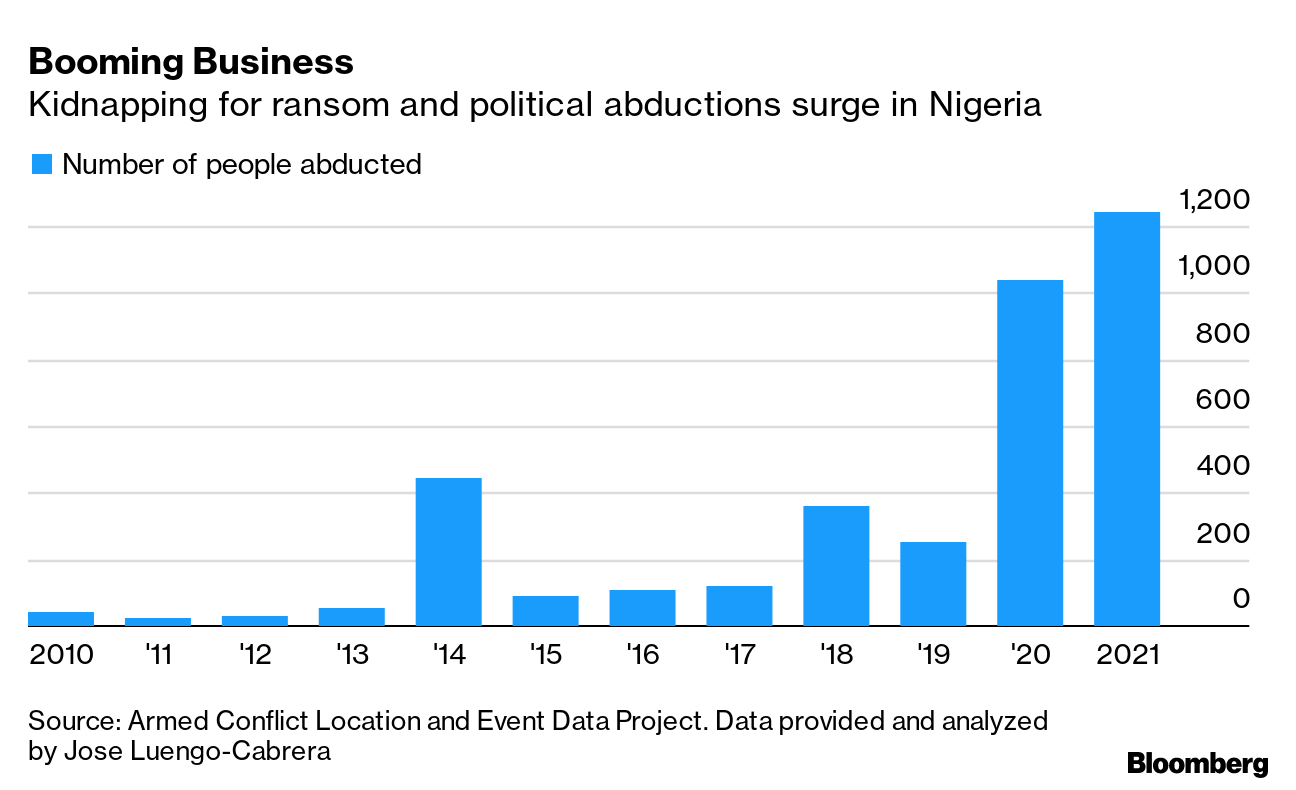

Some authorities are already worried. New Zealand's finance minister Grant Robertson added house prices to the central bank's monetary policy remit despite both the bank and the Treasury Department advising it would have little impact, emails released to Bloomberg show. Bloomberg Terminal readers can access the full report here. — Malcolm Scott The Economic Scene Policy missteps, entrenched corruption and an over-reliance on crude oil mean Nigeria — which makes up a quarter of Africa's economy — risks becoming the continent's biggest problem. A dangerous cauldron of ethnic tension, youth discontent and criminality threatens to spread more poverty and violence to a region quickly falling behind the rest of the world. The economy has yet to recover from the oil crash of 2014, and is unlikely to do so anytime soon. Today's Must Reads - Missing jobs | The global job shortfall from the pandemic is seen by the International Labour Organization to be 75 million this year. That's a reason policy makers aren't expecting lasting inflation.

- The Federal Reserve's future | U.S. central bankers are inching toward the start of a long road to normalizing their relationship with the rest of Washington and Wall Street after spending the past 15 months providing unprecedented help.

- Brazil's battle | Central banker Roberto Campos Neto has yanked interest rates higher this year and may do so again this week. But inflation risks aren't receding.

- Swiss prices | Switzerland's central bank doesn't need to worry about emerging price pressures even as it runs the world's lowest benchmark. Inflation there remains well below 1%.

- Asia outlook | The Bank of Japan is convinced it doesn't need to take any further measures to improve the functioning of the government debt market for now, people familiar with the matter told Bloomberg. Australia's central bank sketched out scenarios for its quantitative easing program.

- The U.K. delay | The government's decision to push back a lifting of coronavirus restrictions by four weeks is unlikely to delay Britain's recovery from the worst recession in 300 years. Dan Hanson of Bloomberg Economics said he doubts it "will have a material impact on the trajectory of the economy."

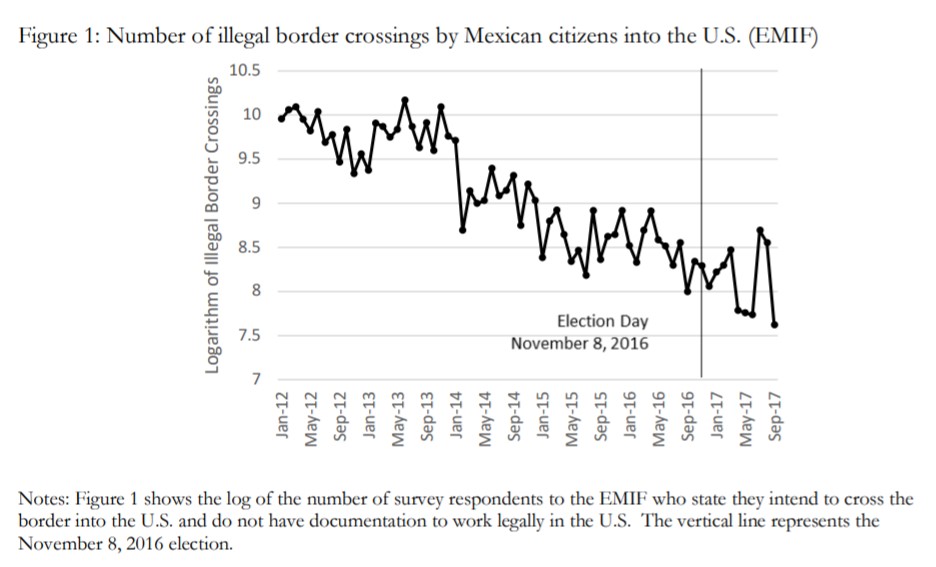

Save the DateWatch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today's greatest problems. The conversations will explore what matters, what's next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here. Need-to-Know Research For all President Donald Trump's saber-rattling, his 2016 election had no effect on the overall of unauthorized Mexican workers into the U.S., economists Mark Hoekstra and Sandra Orozco-Aleman write in a study published by the National Bureau of Economic Research. But Trump was able to reduce immigration among deported Mexicans and at least temporarily among Central Americans. "The absence of an overall impact on the migration decisions of undocumented workers from Mexico — and the apparently temporary nature of the effect on Central Americans — highlights how large the perceived marginal benefits from immigrating to the U.S. are," Hoekstra and Orozco-Aleman wrote. On #EconTwitterExamining the interactions of economic, political and cultural populism.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment