The aftermath of Wednesday's Federal Reserve update reverberated through the stock market on Thursday, spurring a breakdown in commodity prices.

| THU, JUN 17, 2021 | | | | DOW | | NAME | LAST | CHG | %CHG | | AAPL | 131.79 | +1.64 | +1.26% | | JPM | 151.76 | -4.51 | -2.89% | | MSFT | 260.90 | +3.52 | +1.37% | |

| | S&P 500 | | NAME | LAST | CHG | %CHG | | F | 14.77 | -0.25 | -1.66% | | AAPL | 131.79 | +1.64 | +1.26% | | BAC | 39.80 | -1.82 | -4.37% | |

| | NASDAQ | | NAME | LAST | CHG | %CHG | | AAPL | 131.79 | +1.64 | +1.26% | | AMD | 84.56 | +4.45 | +5.55% | | MSFT | 260.90 | +3.52 | +1.37% | |

| |

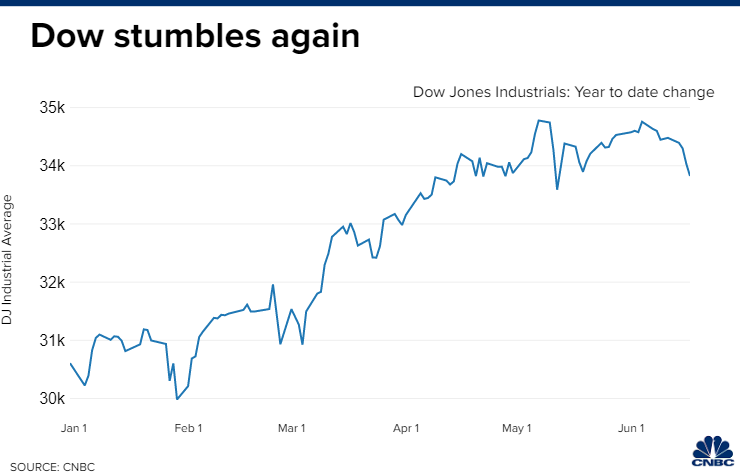

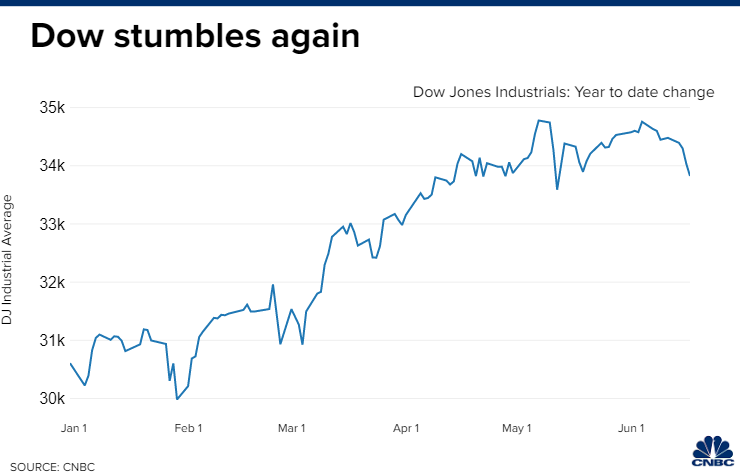

The aftermath of Wednesday's Federal Reserve update reverberated through the stock market on Thursday, spurring a breakdown in commodity prices. The Dow Jones Industrial Average fell about 210 points, weighed down by the materials sector amid a sell-off in copper, lumber, oil and other commodities. Dow Inc. and Caterpillar fell about 3% apiece. The S&P 500 closed around the flat line. After months of gains, commodities ripped lower as China announced steps to cool off rising prices. The decline was widespread, with futures prices for palladium, platinum and copper tumbling. U.S. oil prices settled down more than 1% to $71.04.  The Fed's increased projections Wednesday for inflation and rate hikes also could be contributing to the decline by putting upward pressure on the dollar, which typically trades inversely to commodities. "The U.S. dollar is probably reacting to bond yields moving higher yesterday and the prospect of an earlier tapering which would slow the supply of US dollars and this has led to a sizable decline in commodity prices across the board," Leuthold Group's Jim Paulsen told CNBC. "Commodities have been a popular investment in the last year as investors have been adding some portfolio protection against inflation." Meanwhile, the Nasdaq Composite rallied nearly 0.9% as investors moved into Big Tech stocks. The so-called FAANG names all closed in the green. |

Post a Comment