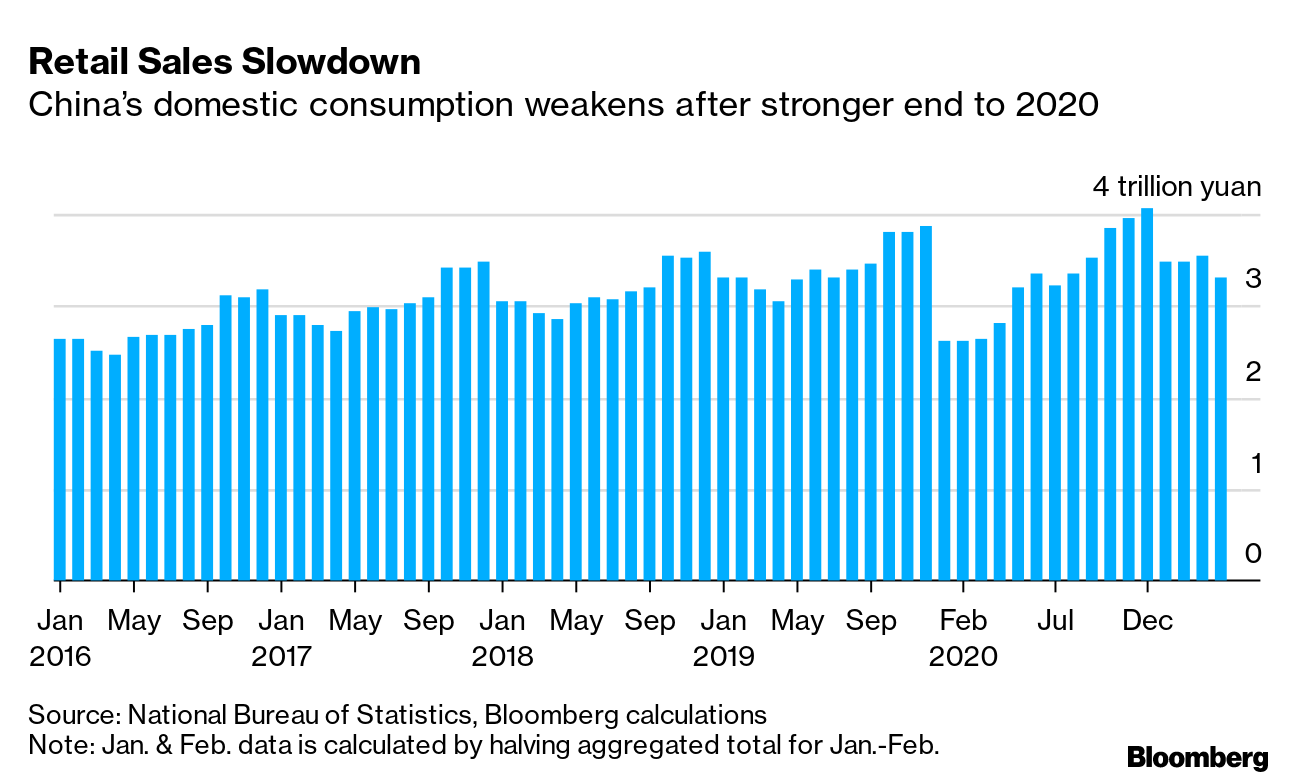

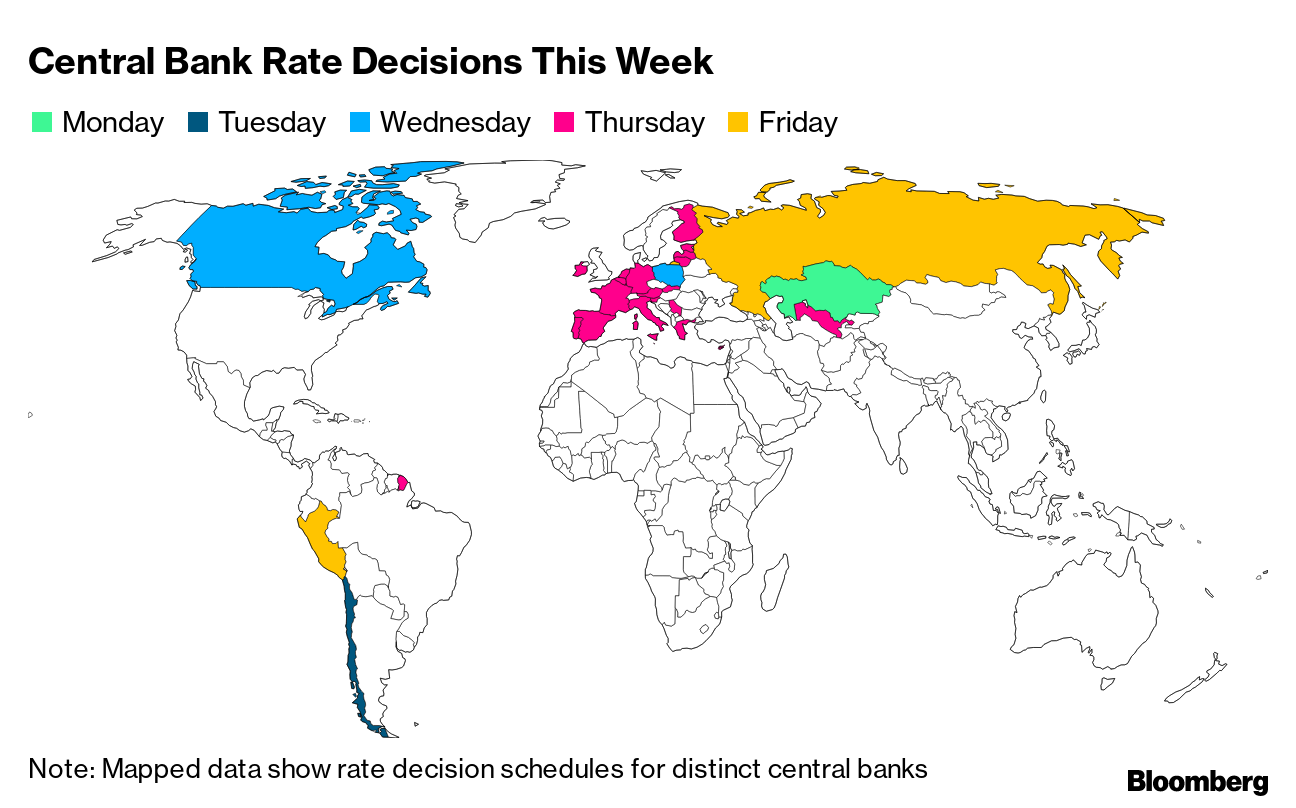

| Hello. Today we look at how China's consumers are lagging the recovery, the week ahead in global economics, and central banks' performance. Cautious ConsumersChina was first-in, first-out of the Covid-19 economic shock, making post-pandemic economic trends there worth watching for the world. That's why lingering caution among China's consumers serves as a warning for forecasters elsewhere who are currently making their predictions while their economies are roaring ahead in the upslope of their V-shaped recoveries. Enda Curran writes that economists have identified two reasons for the restraint: an unequal distribution of savings from the pandemic and lingering virus worries that's prompted more conservative habits and cut spending on services. Both trends aren't unique to the Asian giant.  For China's investment and production-heavy economy, the lagging consumer is putting the brakes on what's an otherwise robust recovery. Exports continue to power ahead, with data Monday showing exports continued to surge in May, fueled by strong global demand as more economies around the world opened up. But for economies without that export juggernaut to drive growth, recoveries will lag or even falter if consumers follow China's lead. — Malcolm Scott The Week Ahead European Central Bank officials will debate whether to prolong their elevated pace of emergency bond-buying on Thursday, a judgment that rests on how fragile they determine the economy's recovery to be.

Underpinning the ECB's decision on Thursday will be new economic forecasts, which are likely to emphasize the volatility of incoming data. Officials led by President Christine Lagarde foresaw the jump in inflation, and insist it will prove temporary as energy prices stabilize and the shortages that have hampered companies are overcome. Elsewhere, Canada's central bank is set to continue laying the groundwork for a tightening of monetary policy, while Russia may hike interest rates. In the U.S., eyes will be on the latest reading of the consumer price index on Thursday, given the intense debate around inflation. For a full rundown of the week ahead, click here. Today's Must Reads - Pressing on. Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plan even if it spurs inflation that persists into next year and higher interest rates.

- Tax deal. The G-7 secured a landmark deal that could help countries collect more taxes from big companies and enable governments to impose levies on U.S. tech giants such as Amazon and Facebook.

- Italian ambition. To address the disparities between regions, Italy's Prime Minister Mario Draghi has mapped out new high-speed rail lines to connect more than 11 million people.

- Student loans. More than 40 million holders of U.S. federal loans are due to start making monthly instalments again on Oct. 1, when the freeze imposed during the pandemic is due to run out.

- It's alive! An economist who wrote a book about the death of inflation a quarter of a century ago is seeing signs of its rebirth.

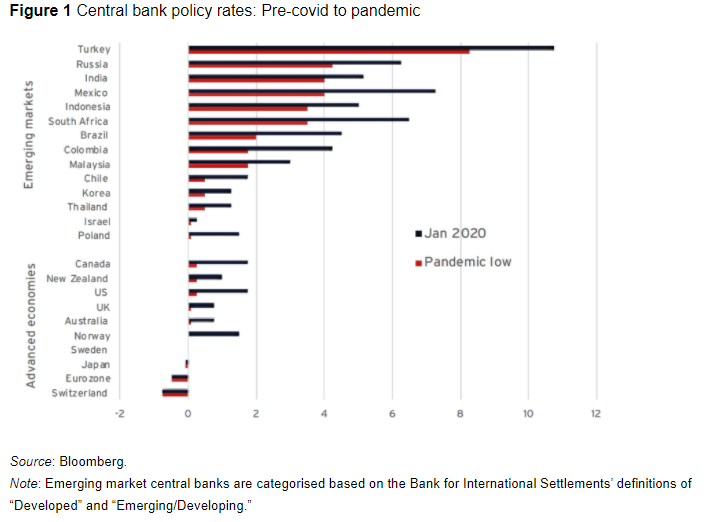

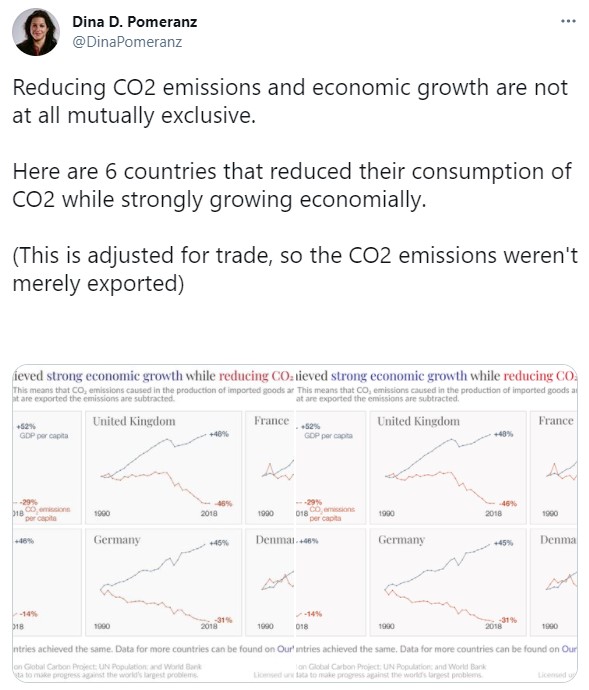

Need-to-Know Research A new book, published by the Centre for Economic Policy Research and written by former central bankers, takes a stab at assessing the performance of monetary policy makers in the Covid recession. Analyzing the work of 16 institutions, the authors found several common threads: the size, speed and breadth of the responses and the reliance on more broader tools such as asset purchases and supporting credit. They also said emerging markets behaved more like their counterparts in the advanced world. On #EconTwitterCombining climate concerns and economic growth.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment