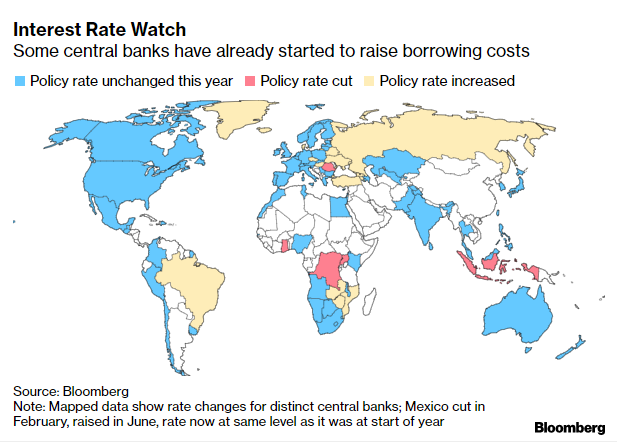

| Hello. Today we look at how central bank stimulus is peaking and diverging, the upcoming U.S. payrolls report and what a water crisis means for Brazil's economy. Peaking and DivergingThey spent 2020 uniting to fend off a historic recession, but central banks are slowly starting to take different paths in 2021. In the past two weeks alone, the Federal Reserve indicated it may tighten monetary policy sooner than it previously projected, authorities in Mexico, Hungary and the Czech Republic have raised interest rates and China has signaled it is turning its focus back to controlling debt. At the same time, the European Central Bank and Bank of Japan are showing no signs of pulling back stimulus. The result, as Enda Curran reports, is that peak central bank stimulus is behind us and investors will have to be attuned to more surprise hawkish turns and a divergence in international policy making.  Of course, policy makers are likely to act conservatively. JPMorgan Chase economists still see their average global interest rate at 1.28% at the end of the year versus 1.27% today. The big central banks will first shift by paring or ending their asset-purchase programs. How the transition plays out will nevertheless be a crucial test for the global recovery and markets. Move too fast and central banks risk shaking investors, hurting confidence, and stalling the rebound; go too slow and they could stoke inflation and worsen financial stability as house prices and other assets surge. Take the Fed, for example. Vishwanath Tirupattur, head of U.S.fixed income research at Morgan Stanley, warned clients in a Sunday note that it has opened up "legitimate concerns" in the minds of investors over the direction of monetary policy and how committed it is to its 10-month old strategy of letting the economy run hot. "Any real or perceived policy shift could heighten market uncertainties," wrote Tirupattur. "In this environment, the impact of incoming data on employment and inflation (both realized and expected) on markets would be magnified. Stronger economic data could intensify the hawkish tilt."

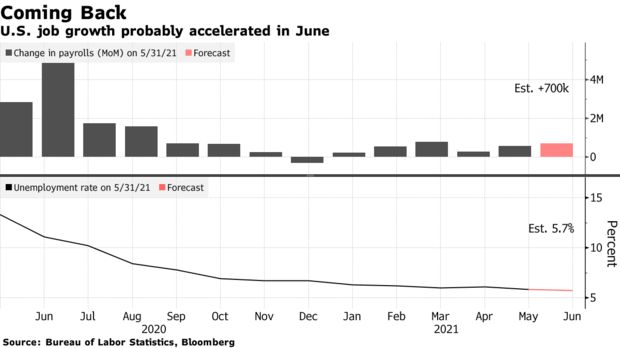

"So buckle up," he signed off. —Simon Kennedy Watch the future unfold on June 30. Register here for Bloomberg New Economy Catalyst, a global, 6-hour virtual event celebrating the innovators, scientists, policymakers and entrepreneurs accelerating solutions to today's biggest problems. We will explore what matters, what's next and the what-ifs of climate change, agriculture, biotech, digital money, e-commerce and space through the imaginations and stories of these ascendant leaders. Meet the 31 people charting the global course out of the pandemic and toward a brighter, more sustainable future. The Week AheadThe first Friday of a month means only one thing, the U.S. payrolls report. This one has investors and policy makers alike looking for meaningful improvement after two months of sub-par gains. Payrolls may have risen by 700,000 in June, according to the median estimate in a Bloomberg survey of economists. That would be the biggest increase since March, but remember predictions were wrong-footed in April and May.

As Katia Dmitrieva shows today, the labor market is entering one of its strangest summers ever.

Lingering concerns about Covid-19, highlighted by a worrying surge in the Delta variant, along with continuing childcare challenges have been a bar for some returning to work. For others, a temporarily strengthened unemployment-insurance safety net has reduced the need to immediately go back to employment, or given people the chance to be more discriminating before taking up a role. Meantime, disrupted immigration and international travel flows have curbed typical summer job patterns. Elsewhere, euro-area inflation is likely to come in around the ECB's target, China's official PMI will be closely watched to see how factories are handling the ongoing margin squeeze caused by surging input prices and Colombia and Sweden both set interest rates. For a full rundown of the week ahead, click here. Today's Must Reads - Christmas shopping roadblock | It could be a month before one of China's key export hubs is fully operational again, threatening to prolong 2021's supply-chain disruptions.

- IMF aid | The lender's board unanimously backed a proposal to create a record $650 billion of new reserves, a shift which would increase resources for countries struggling with the pandemic.

- Peru policy | Leftist presidential candidate Pedro Castillo said he is willing to reappoint the head of the country's central bank, in his most market-friendly move yet.

- Russian rates | The Bank of Russia is ready to consider a key interest rate increase of 25 basis points to 1 percentage point in July, Governor Elvira Nabiullina said in a Bloomberg TV interview. So far, Russia has stumbled in its bid to fight the global price surge with duties.

- Water inflation | Brazil's worst water crisis in nearly a century is fueling inflation that's reverberating through the economy. Elsewhere in Latin America, Goldman Sachs sees a 30% chance of a surprise rate hike in Colombia today.

- China stabilizes | The economy showed sighs of more balanced expansion, according to eight early indicators tracked by Bloomberg.

- Pandemic shock | Almost one in five young adults in the U.S. was neither working nor studying in the first quarter as Black and Hispanic youth remain idle at disproportionate rates.

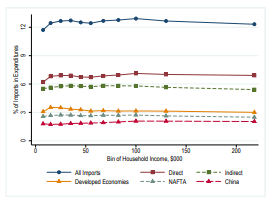

Need-to-Know Research Contrary to conventional wisdom, a decline in trade cost has little impact on inequality even though changes in commerce generate winners and losers at all income levels, via wage shifts, according to new research from

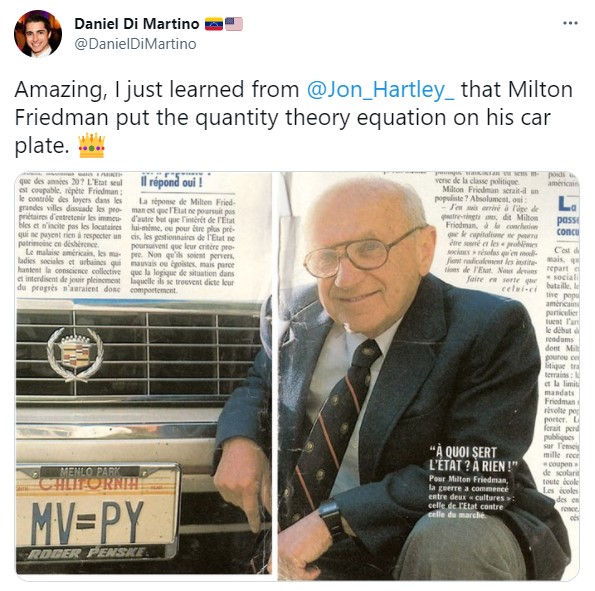

economists Kirill Borusyak and Xavier Jaravel. Their study of the U.S. suggested the purchasing-power gains from lower trade costs are distributed neutrally. Accounting for changes in wages too, they found substantial distributional effects, but not across, income and education groups. On #EconTwitterDriving home the quantity theory of money.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment