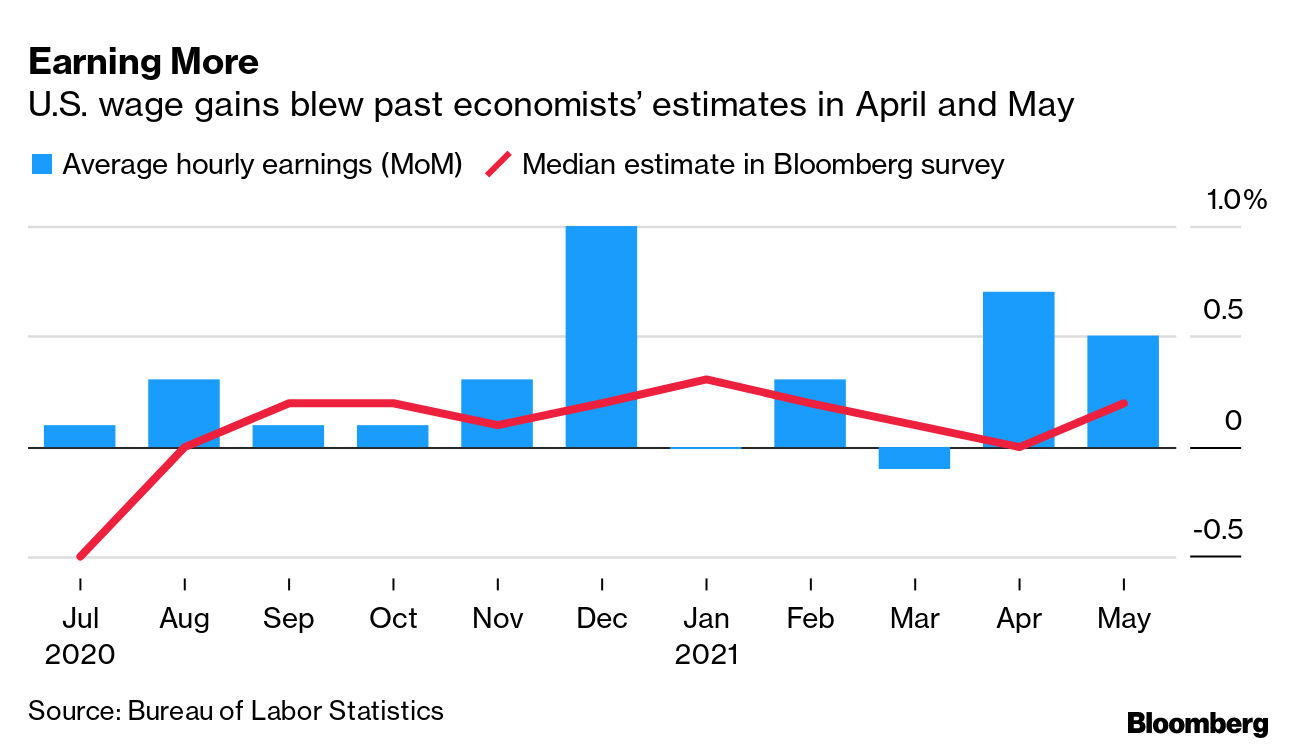

| Hello. Today we look at the inflation implications of rising wages in the U.S, what's happening at the factory gate in China and the economic challenges in Sudan and Israel. Payday U.S. wage gains were supposed to be weakening this spring, according to the experts and even White House economists. The thinking was that average pay rises would be depressed as hundreds of thousands of Americans went back to work in jobs in lower-wage sectors like restaurants and lodging. The May jobs report confirmed that that's not at all how it's panning out, as Olivia Rockeman and Reade Pickert explain. While politicians and economists debate the reasons, it's clear that labor shortages have forced many employers to boost pay or offer bonuses, which has led to unexpected increases in average hourly earnings.  Wage gains are a good thing for those that are getting them and for the broader economy if they are spent.

But permanent base-wage increases could also escalate pressure on consumer prices, which are already surging. A report Thursday is forecast to show consumer prices rose 0.4% in May from the month prior, building on a steady string of price increases. Among those hiking wages lately: "The fact that we're seeing companies commit to wage increases means that they believe that they need to raise long-term wages in order to attract talent," said Daniel Zhao, senior economist at Glassdoor Inc. "That signals that they perceive a longer-term challenge to attracting workers that couldn't be solved just by offering one-time bonuses." Much of this may cool as health concerns abate and jobless benefits run down in coming months. But the developments add to the case for the Federal Reserve to raise its level of vigilance. Former Fed Vice Chair Donald Kohn said Tuesday he'd like to see policy makers openly acknowledge the inflationary dangers they face and reflect that in their next set of quarterly economic forecasts next week. "The Fed needs to be more open and honest than I think it was in the last round of projections about what it is actually expecting to do," Kohn said. "That in itself will be a constructive step."

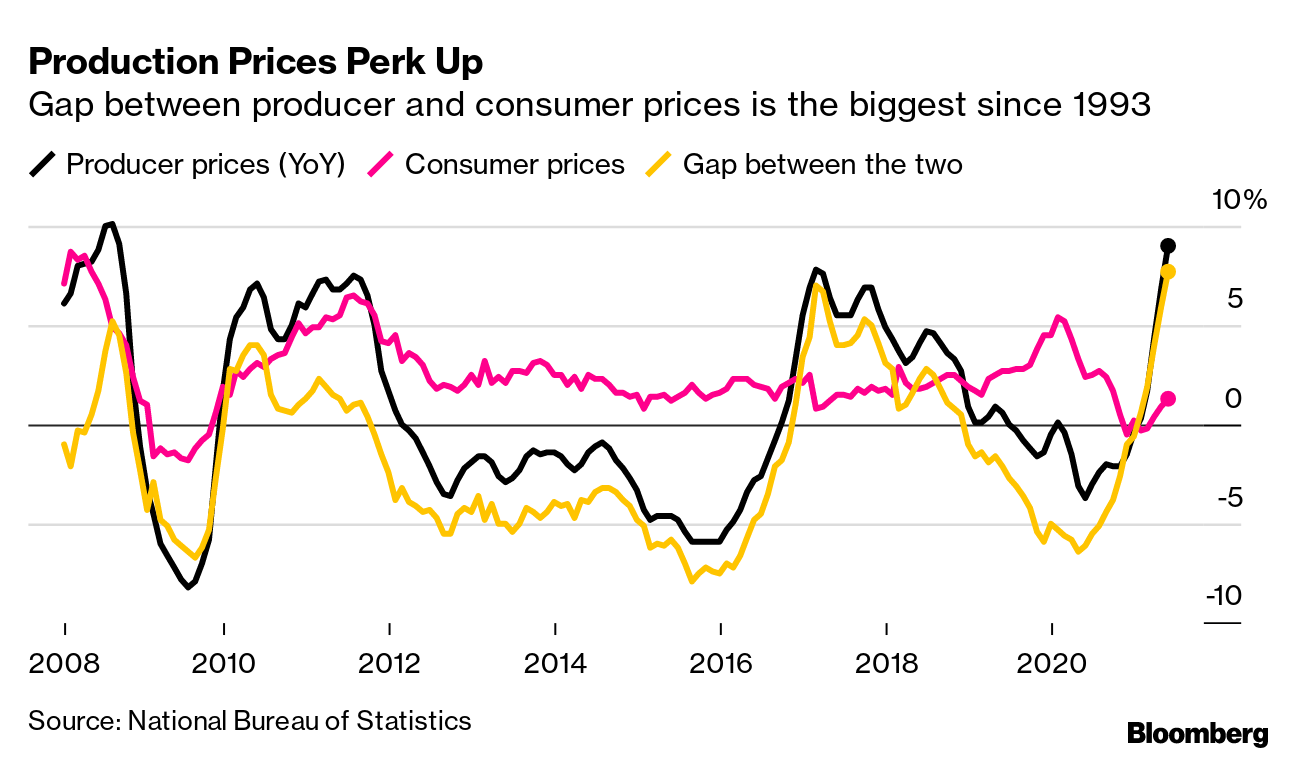

—Chris Anstey The Economic Scene Inflation pressures are bubbling up elsewhere. Surging costs of imported commodities drove China's factory-gate inflation to its highest level since 2008 in May. That's not feeding through to consumer prices at home as price-savvy online shoppers cap scope for price increases and sagging pork prices weigh on the broader index. And so far, China's factories have been acting as a shock absorber for those rising input prices, taking a blow to margins rather than passing them along to overseas buyers. Now, there's increasing anecdotes of companies increasing their export prices, especially as global demand perks up. That has more economists questioning if (or when) China will switch from being a brake on global price pressures to an accelerator. Today's Must Reads - Broad support. The Senate overwhelmingly passed an expansive bill to invest almost $250 billion in bolstering U.S. manufacturing and technology to meet the economic challenge from China. Meanwhile, President Joe Biden and European Union leaders are planning to commit to ending their outstanding tariff battles.

- U.K. objection. Chancellor Rishi Sunak is pressing for the City of London to be exempt from a plan by global leaders to make multinationals pay more tax to the countries they operate in.

- Not a Gulag. After Russian officials bemoaned the collapse of migrant labor in the coronavirus pandemic, the head of the country's prison service offered a solution: reviving the Soviet-era practice of putting convicts to work.

- Canada rates. Investors will be looking for fresh hints from the Bank of Canada today on its next move to reduce emergency levels of monetary stimulus.

- New fight. Gibril Ibrahim once led a rebel group fighting to overthrow Sudanese dictator Omar al-Bashir. Now the nation's finance chief, he's struggling to revive the shattered economy.

- New era. An end to two years of paralysis in Israeli economic policy making is in sight as lawmakers prepare to vote on a new coalition government that would eject Prime Minister Benjamin Netanyahu.

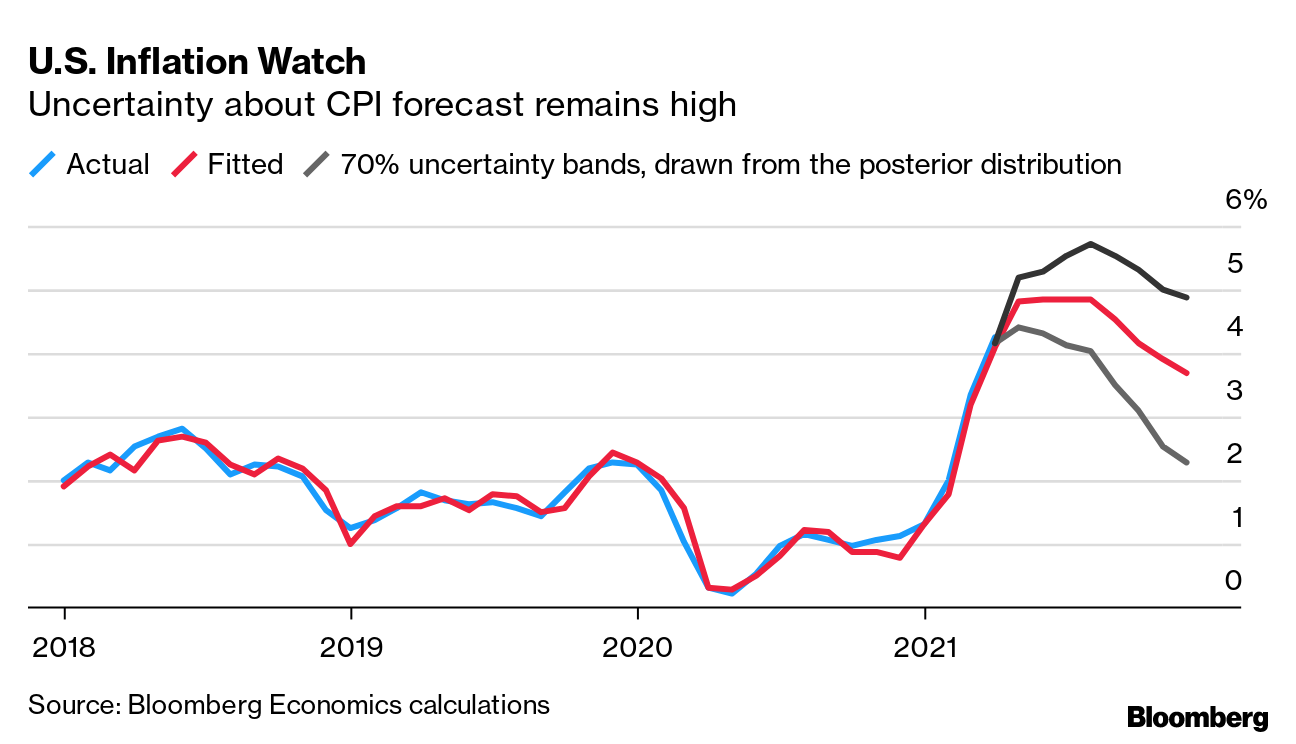

Need-to-Know Research Sticking with the inflation theme, Bloomberg Economics has dusted off an academic model from former Fed Chair Ben Bernanke and used it to forecast the outlook for U.S. inflation. The results suggest the consumer price gains will touch 4.8% year on year in May and hold there through August before easing back to 3.7% at year-end — supporting the "transitory" inflation view. Yet, as economists Bjorn van Roye and Tom Orlik note, uncertainty around the model's forecast is elevated. As the chart above shows, the 70% uncertainty band around the central forecast flags a distinct possibility: the CPI could peak above 5.5%, and still be close to 5% at year-end. That trajectory would shift the Fed's and the market's view. Read the full research on the Bloomberg Terminal On #EconTwitter Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment