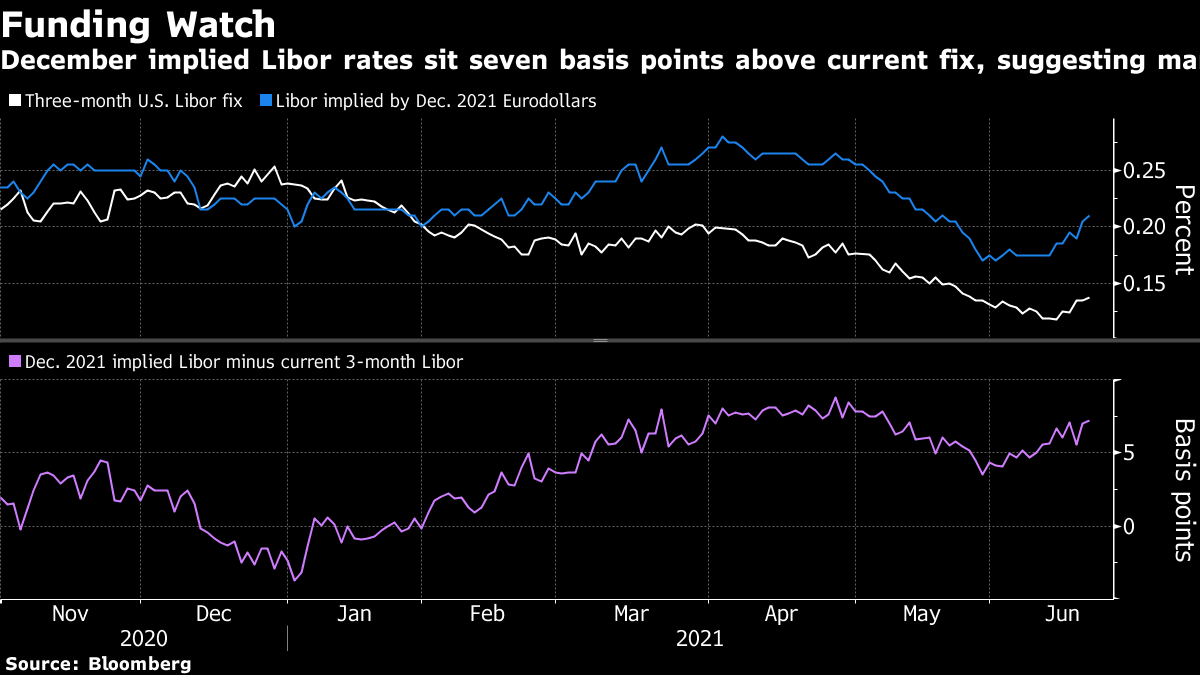

| The U.S. is poised to block some solar goods from China's Xinjiang region. Thai protestors plan a return to the streets. And antivirus software creator John McAfee is found dead in prison. Here's what you need to know to start your day. The U.S. is poised to bar some solar products made in China's Xinjiang region, a big step to counter alleged human rights abuses against China's ethnic Uyghur Muslim minority. Factories in Xinjiang produce roughly half the world's supply of polysilicon, a material critical for solar panels and semiconductors. China has denied the allegations, saying they're an attempt to undermine successful businesses. The move, which is expected to be announced Thursday, has implications for solar's supply chain and could force U.S. companies to find material elsewhere. It comes after both the Trump and Biden administrations accused China of "genocide" in a campaign to erase the culture of the predominantly Muslim Uyghurs. Asian stocks looked set to dip after U.S. shares moved in narrow ranges as traders digested commentary from Federal Reserve officials and the outlook for stimulus. Treasuries retreated. Equity futures fell in Japan and Australia and were little changed in Hong Kong. In the U.S., firms that benefit from economic reopening — such as retailers and financials — outperformed but overall the S&P 500 edged lower. A rally in Tesla Inc. helped the Nasdaq Composite eke out a record. Protesters in Thailand are set to return to the streets to demand the government's resignation as parliament discusses the amendment of the country's constitution and changes to its electoral system. At least five groups are planning to hold demonstrations across Bangkok on Thursday, calling for Prime Minister Prayuth Chan-Ocha to quit as well as commemorating the Siamese Revolution that marked the end of absolute monarchy in 1932. Protest leaders have said they plan to draw fresh support from citizens frustrated with the government's handling of Covid outbreaks and the nation's vaccine rollout. Japan surpassed 1 million doses of Covid-19 vaccines administered on a single day, meeting Prime Minister Yoshihide Suga's target as the inoculation drive accelerates ahead of the Tokyo Olympics and a general election. Meanwhile, about a million people in Sydney have been barred from leaving the city, as Australia races to control an outbreak of the delta variant. In the U.K., a drug used to treat parasite infections in humans and livestock will be investigated as a possible treatment for Covid-19, while U.S. public-health leaders have been seeking to reassure Americans that Covid-19 shots are safe after reports that a relatively small number of mostly young men had suffered a heart problem after receiving shots. John McAfee, the creator of the eponymous antivirus software, was found dead in prison outside Barcelona, according to the Associated Press. He was 75. In recent years, McAfee became a prominent booster of cryptocurrencies, ran unsuccessfully for U.S. president, had numerous run-ins with the law and traded in extreme conspiracy theories. McAfee was discovered dead in his cell hours after Spain's National Court approved his extradition to the U.S. over multiple tax fraud charges. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayHappy bank stress test day! On Thursday, the Federal Reserve will release its latest stress test results, which will help determine the amount of extra capital banks need to hold in 2022. The size of these capital buffers has an impact on banks' behavior in money markets and their risk appetite in general. They can also feed into banks' systemic risk scores, known as G-SIB, that also generate additional regulatory charges for the banks.  For instance, if today's stress test results were to come in lower than expected, banks might feel more comfortable sticking with higher balance sheets that they know will lead to bigger G-SIB scores and more capital requirements. G-SIB scores for banks like JPMorgan and Bank of America have already been trending higher in recent months as a flood of the Fed's emergency liquidity descended on their balance sheets. Simply put, the big have gotten even bigger during the pandemic. And the degree to which they're willing to continue getting bigger is worth watching now, given that the market is still awash in money and deposits but still racked by idiosyncratic funding concerns. Or as Zoltan Pozsar at Credit Suisse put it overnight: "If JPMorgan's SCB [stress capital buffer] drops a lot, year-end premia might shrink a lot from here." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment