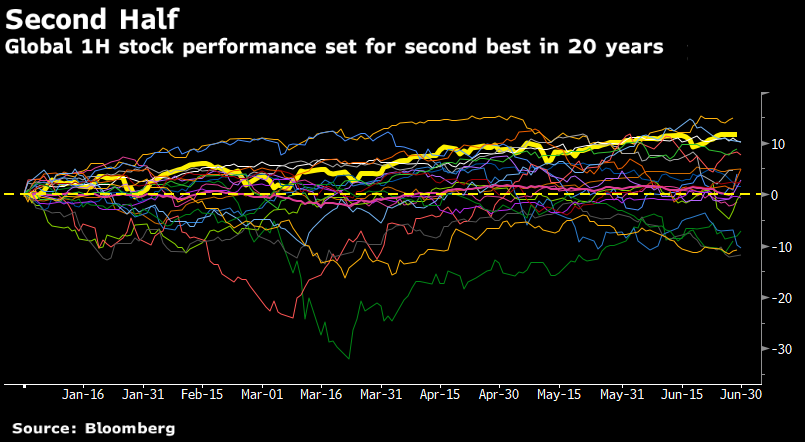

| Good morning. Delta fears are growing, central banks face challenges and the shape of the U.K. and Europe post-Brexit continues to form. Here's what's moving markets. Delta FearsConcern about the more contagious Delta coronavirus variant is growing and those fears helped fuel a rise in Moderna shares to a record high after the drugmaker said its vaccine produces protective antibodies against the strain. The medicine was approved for restricted emergency use in India, where little more than 4% of the population is so far fully vaccinated. The variant is rippling through emerging markets, with more curbs in Indonesia and warnings of a potentially "catastrophic" wave in Kenya. A widening gap in vaccination rates in the U.S. also shows the risks faces to certain regions. Policy ChallengesThe major challenge for central banks is going to be how to wean the global economy off the unprecedented support they have deployed to deal with the disruption Covid-19 has caused. U.S. and European confidence data is soaring, underlining the rebound the economy is experiencing, while China's central bank has also struck a more positive tone. Some more data points will arrive for policymakers to mull over on Wednesday, led by U.K. GDP and European inflation numbers. Brexit ShiftsParis is JPMorgan's new trading center in the European Union post-Brexit as the U.S. banking giant inaugurated a new headquarters in the French capital. It is a victory for France in the ongoing race with other European countries to lure business from London after the referendum to leave the EU. It comes as the U.K. government unveiled a system of overseeing subsidies to companies, promising "more agile" decisions. And the U.K. is expecting to reach a truce in the so-called "sausage wars'' with the EU over post-Brexit trading rules in Northern Ireland. OPEC+ DelayOPEC and its allies have delayed preliminary talks for a day to create more time to find a compromise on oil-output increases. It comes with crude oil prices on track for the best half of a year since 2009. Surging commodity prices are creating all sorts of headaches for policy makers, from rising inflation expectations that could move the hand of central bankers to a higher cost in shifting to more sustainable energy sources. This has initially led to a surge in profit for commodity trading houses but will end up hitting consumers down the road through higher prices. Coming Up…Asian stocks mostly rose following a record close in the U.S. on signs that vaccines can protect against the delta variant of the coronavirus. European and U.S. stock futures are steady. The earnings calendar is relatively thin but watch for the reaction to two long-running takeover sagas moving toward a conclusion. EssilorLuxottica, the eyewear giant, decided to go ahead with the acquisition of smaller peer GrandVision and the board of France's Suez has backed its takeover by rival Veolia. And the Organization for Economic Cooperation and Development meets in Paris to finalize plans to overhaul the global minimum corporate tax. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith just one more day of trading in the first half of 2021 to go, global stocks are on track for their second-best performance since 1998. If the MSCI AC World Index's gain of about 12% through June 29 holds, it would be beaten only by a 15% rise in 2019. The global stock benchmark closed at a record on June 28, and has risen almost 90% since its pandemic low in March 2020. As we begin the second half, investor focus will soon switch to the upcoming earnings season. The second quarter could well mark peak earnings growth so comments on the outlook will be key for stock performance as will the impact of rising costs on margins. Outside of that, the same themes that dominated the first half will monopolize the second, and whether we get an equally strong next six months will likely depend on the path of other asset classes most notably bonds.  Bloomberg Bloomberg Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment