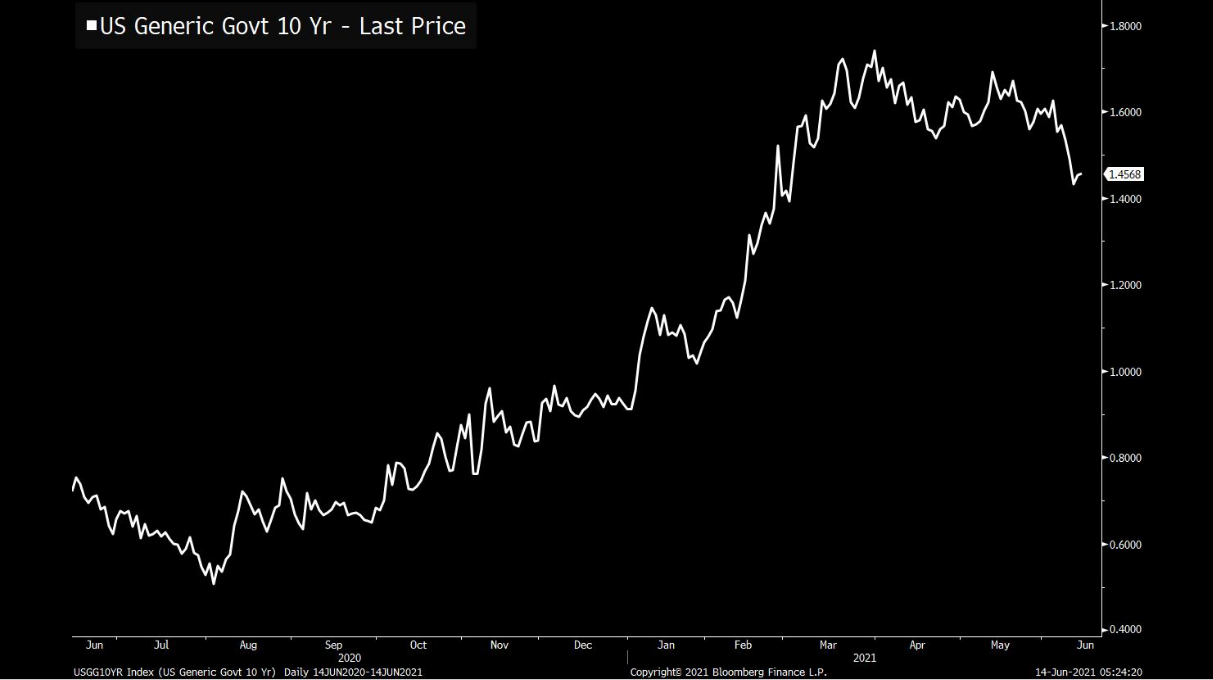

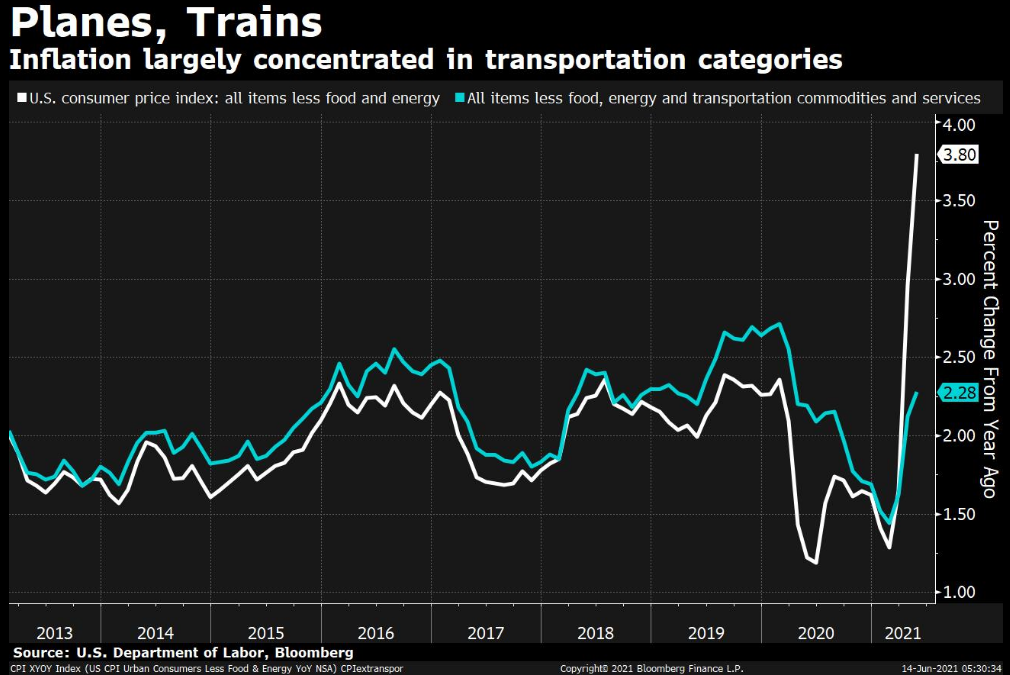

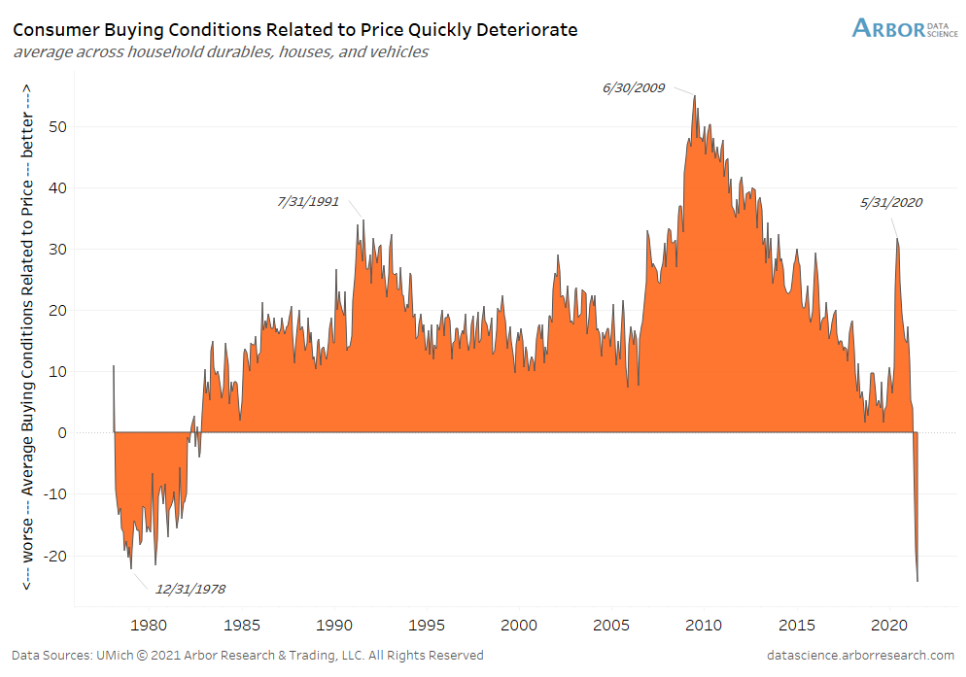

| Fed policy decision, G-7 tensions, and oil rises. Liftoff Federal Reserve officials are meeting tomorrow and Wednesday, with their latest monetary policy decision set to include updated forecasts. Economists expect the so-called dot plot to point to an interest-rate increase in 2023, while the bank is unlikely to signal a scaling back of bond purchases until later this year. The bond market remains very calm about Fed policy, with Chair Jerome Powell's messaging on inflation's transitory nature clearly being heeded. Across the Atlantic, there are signs of emerging tensions at the European Central Bank over the timing of the withdrawal of emergency support. G-7While the first meeting of the leaders of the Group of Seven nations in two years went off with little of the bluster of the Trump era, it was clear that differences remain on key issues. The communique at the end of the meeting promised more vaccine doses for poorer countries, took a swipe at China over human rights and asked Russia to do more about hackers. Arguments among European leaders about Brexit escalated at the summit. President Joe Biden is in Brussels this morning for a NATO meeting before heading for a face-to-face with Russian President Vladimir Putin on Wednesday in Geneva. Gaining Crude hit the highest level in 32 months, with a barrel of West Texas Intermediate for July delivery trading above $71.50 this morning. Oil has been surging as people in Europe and the U.S. get back on the road, and in the air. While talks with Iran continue, and seem to be making progress ahead of elections in that country this week, there is less fear that the return of its production will prove destabilizing for the market. Markets riseGlobal equities are pushing higher again this morning as the rally in sovereign debt loses steam. Overnight the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.3% higher. In Europe the Stoxx 600 Index had gained 0.3% by 5:55 a.m. Eastern Time with energy companies the biggest winners. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 1.465% and gold fell. Coming up... The U.S. economic data slate is fairly clean this morning, with Canadian April manufacturing sales at 8:30 a.m. the only North American data point of note. The NATO summit begins in Brussels, with Biden set to meet Turkish President Recep Tayyip Erdogan today. Plug Power Inc., one of the original meme stocks, reports earnings. What we've been readingHere's what caught our eye over the weekend. And finally, here's what Joe's interested in this morningGood morning and Happy FOMC week. This Wednesday we get the next FOMC decision, and so of course, one of the top things on everyone's mind is inflation. Actually there are two things on everyone's mind: inflation and the Treasury market. Despite the fact that by some measures, inflation is at its highest level in several years, the 10-year yield has been declining substantially. After a powerful move higher in March, the 10-year is now back to February levels.  As always it's helpful to ask the question: Why are we so obsessed with inflation? What are we really talking about here? Well in theory, it would be useful to know whether there's something going on in the economy that merits a policy response. Is the price of everything going up? Is something broken in the functioning of everyday economic life? Should the Fed try to raise interest rates to tap the brakes on investment and consumption? Should Congress dial back stimulus? So obviously to answer these questions you have to drill down further, to see what's driving the big upward move in CPI. This chart from my colleague Matt Boesler, looking at last week's CPI release gives a big clue. It shows core CPI (white line) vs. core CPI ex-transportation. You can see there's a huge difference. If you exclude transportation-related costs, inflation measures look a lot more normal.  Now of course transportation costs are real and hit people's pocketbooks. So the point isn't to deny the existence of rising prices. But we can go back to the questions above and ask whether this is something that broad macro policy measures can address. We know a lot about the mess in the car industry for example. We've been discussing all year the chip shortage, the interplay between the rental car market (which collapsed a year ago) and the used car market, and all of that. And it's hard to come up with a theory for how rate hikes or spending cuts or tax hikes is a productive way to deal with any of that. Furthermore, we already see signs that the normal functioning market is doing its thing when it comes to addressing inflation. As Jon Turek wrote in a note last week: "One of the interesting things we are seeing within the U.S. economy is that there is some level of self-correction within the reopening madness. Fixed income has taken note of it. The place this example has been most obvious is in housing." And it's not just housing. In a note out this morning from Ben Breitholtz at Arbor Research he notes there's been a big dropoff in perceived buying conditions for all kinds of durables, per the latest University of Michigan survey.  So although headline inflation is very high, there are basically two things to keep in mind: One is that price increases are still largely being driven by a handful of specific categories. And two, we already see evidence that the market "works" in these categories, with consumers balking at the price surge, which will likely have a mellowing effect. Not only is there no obvious reason to adjust macro policy in the face of this data, it's also hard to point to any existing policies as driving it. Did the enhanced Unemployment Insurance cause the chip shortage which has driven the used car shortage? Highly unlikely. Is the Fed's new "wait and see" approach on inflation to blame for transport-specific price gains? Again, probably not. Hence you can start to understand why the Fed and traders all seem to be looking through it for now.

Joe Weisenthal is an editor at Bloomberg

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

|

Post a Comment