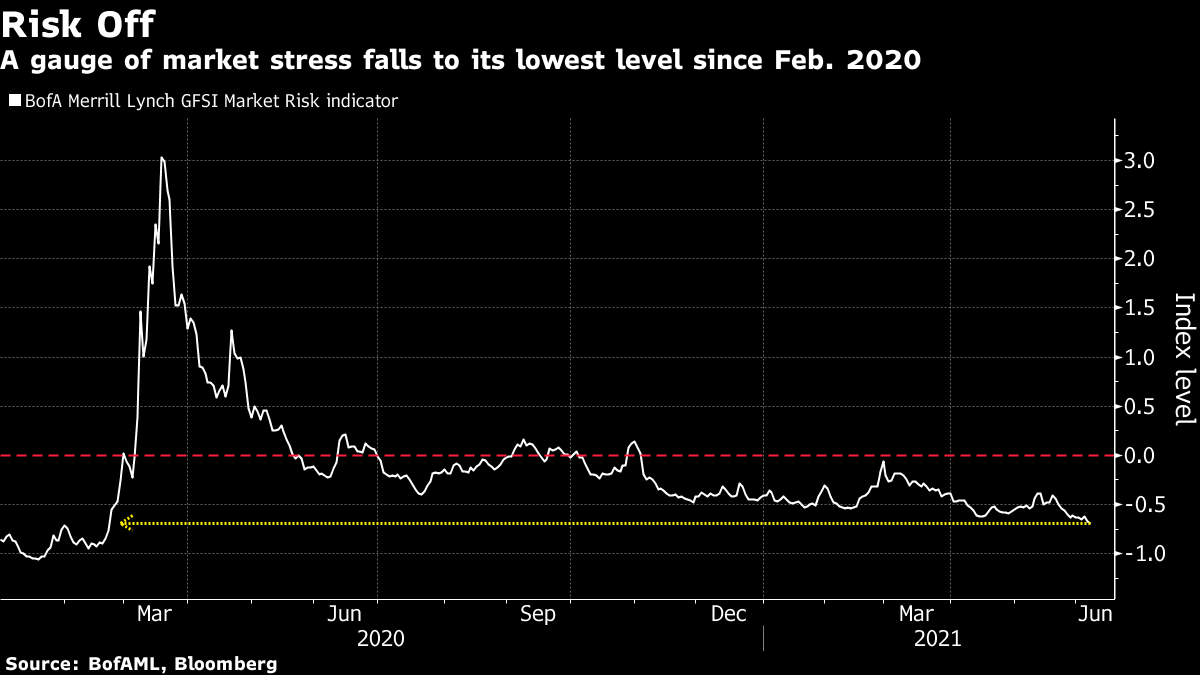

| Good morning. More talks over Northern Ireland, probing Covid-19's origins and easing travel warnings. Here's what's moving markets. Tough TalksU.K. and European Union officials are due to meet on Wednesday in an attempt to defuse the row over Northern Ireland which is threatening to spill over into the Group of Seven summit later in the week. The U.K.'s top Brexit adviser, David Frost, is to attend the G-7 summit, a sign that the country is preparing for tough talks on the sidelines of the event over the situation in Northern Ireland with both the EU and the U.S. It comes after the EU this week warned of "swift" and "firm" action should the U.K. again breach the terms of the Brexit agreement related to Northern Ireland. Origin InvestigationThe U.S. and the EU are to back a renewed push into investigating the origins of Covid-19. The pair are hoping to adopt the pledge at a summit later this month and the move follows a call for China, from the U.S. and several other countries, to be more transparent and allow greater access to assess the source. Separately, the EU and the U.S. are to commit to ending outstanding trade battles between the pair at a summit next week, including removing tariffs on steel and aluminum and ending the dispute over plane makers Airbus and Boeing. Easier TravelThe U.S. State Department has loosened its travel warnings for a series of countries around the world, including France and Germany, in a move that may ease airline restrictions for people wanting to travel overseas. U.S. health officials, meanwhile, are urging vaccinations amid warnings about the potentially more harmful Delta variant, which has become the dominant Covid-19 strain in the U.K. In the U.K. itself, the military has been sent in to virus hotspots to help the highly transmissible strain which is fueling a rise in cases ahead of a crunch decision on whether to keep to the current target for easing restrictions. Crypto PressureBitcoin continues to come under pressure this week, with strategists warning of more pain to come and suggesting $20,000 per token could come back into view. There are warnings of a technical breakdown, while others have cited the recent recovery of the ransom from the Colonial Pipeline hack as evidence that the cryptocurrency is not beyond government control. U.S. Internal Revenue Services Commissioner Charles Rettig called for more authority to police the crypto industry, another development likely to add to the regulatory overhang. Still, plenty of millionaires have been minted by Bitcoin's meteoric rise. Coming Up…European and U.S. stock futures are pointing to a pretty uneventful start to Wednesday, with Asian stocks stuck in a narrow range and U.S. stocks steady on Tuesday. Earnings from Spanish fast-fashion giant Inditex, owner of Zara, top the agenda and after U.S. markets close there will be earnings from one of the defining meme stocks, GameStop. Oil prices extended their advance from recent weeks with WTI topping $70 per barrel. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningMore evidence is emerging that traders across asset classes are gearing up for a slow summer. Despite fears over inflation, concern about risk-asset valuations and worries about central bankers pulling back their unprecedented stimulus, measures of anxiety across global markets continue to look relatively subdued. The Bank of America Merrill Lynch GFSI Market Risk indicator, a measure of future price swings implied by options trading on equities, interest rates, currencies and commodities, has fallen to the lowest since before the pandemic first started to roil markets. A negative reading indicates less stress than normal, while a positive figure signals the opposite. Market pricing suggests no policy move is expected at the Federal Reserve's June gathering (which means there would be a major spike in volatility if they do surprise in some way). So that leaves the options market betting on a summer lull until August, when the central bank holds its annual meeting in Jackson Hole -- a venue in the past for important policy signals.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment