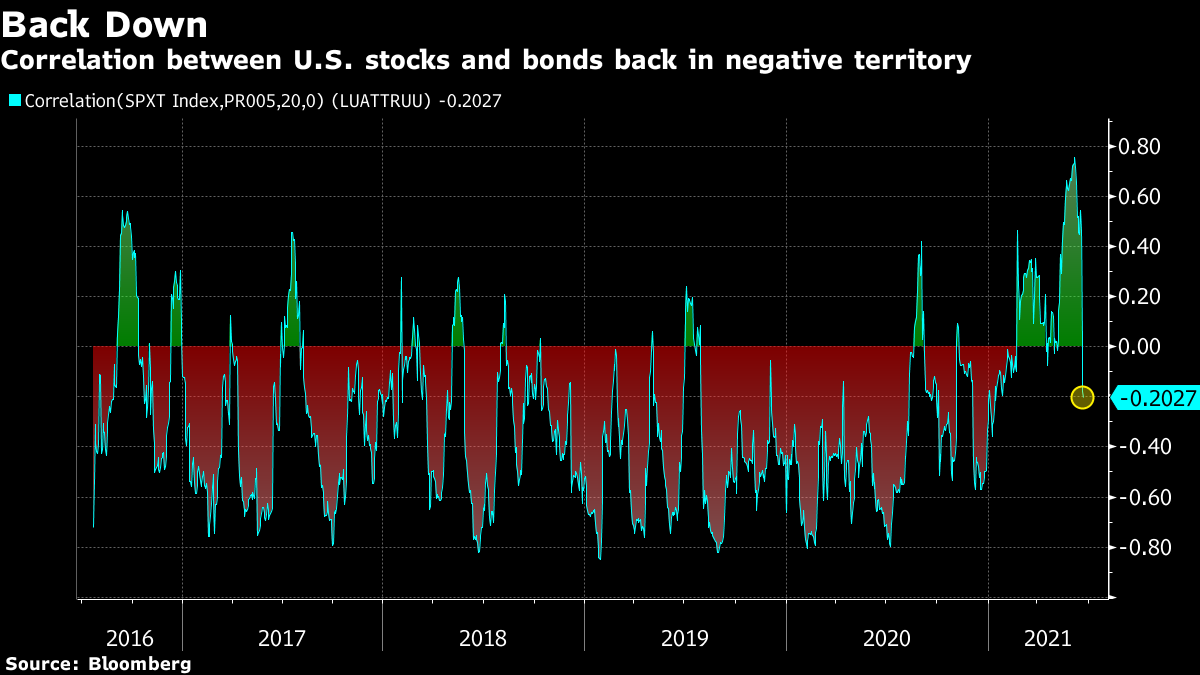

| Good morning. Signs of a truce in the sausage wars, dovish tones from the Fed and the chip shortage. Here's what's moving markets. Mix & MatchAngela Merkeljoined the ranks of people mixing vaccines, getting her second shot with Moderna's vaccine instead. Germany has allowed such mixing as experts believe it could offer broader protection, though conclusive studies haven't been completed. Elsewhere, the White House acknowledged that the U.S. will likely fall just short of President Joe Biden's goal of getting 70% of U.S. adults a first Covid-19 shot by the July 4 holiday. Sausage WarsBritish and European officials are increasingly optimistic they will avert a post-Brexit trade war, believing the two sides will strike a truce in the dispute over checks on goods moving into Northern Ireland. EU officials meet today to discuss the next steps after the U.K. asked for a longer grace period before a ban on certain meat products entering Northern Ireland from the rest of the U.K. In a standoff the British media has labeled ``sausage wars,'' Prime Minister Boris Johnson has threatened to suspend the new rules if the EU refuses to back down. Patient FedFederal Reserve Chair Jerome Powell said the price increases seen in the economy recently are bigger than expected but reiterated that they will likely wane. Stocks climbed after Powell's remarks and U.S. equity futures are trading positively on Wednesday. The yield on 10-year Treasuries declined and the dollar fell. Powell also said the Fed would be patient in waiting to lift borrowing costs. Chip-StarvedChip-starved industries from automakers to consumer electronics will need to wait a bit longer for components, as delays in filling orders continue to get worse. Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by seven days to 18 weeks in May from the previous month, an indication that chipmakers' struggles to keep up with demand are worsening, according to research by Susquehanna Financial Group. That's the longest gap since Susquehanna started tracking the data in 2017. Coming Up…European stocks are looking flat today after soothing comments from Fed officials calmed investor sentiment. There will be more chance to hear from the Fed today, with Governor Michelle Bowman speaking at a conference on economic resilience while the Atlanta and Boston presidents are also scheduled to speak. IHS Markit is among the firms reporting in a quiet earnings day, while GSK holds its investor day. The Czech Republic's central bank may follow Hungary's lead and deliver its first rate hike since before the pandemic. The new 50-pound bank note enters circulation in the U.K. today, featuring mathematician, code-breaker and computer scientist Alan Turing. And it's exactly one month before the delayed Olympic Games are set to begin in Tokyo. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe recent rally in Treasuries has helped bring their relationship with U.S. stocks back to more traditional ground. One-month correlations between the Bloomberg Barclays U.S. Treasury Index and the S&P 500 Total Return Index have fallen back below zero -- where they have spent much of the last five years -- after climbing into positive territory for a large part of 2021. Stocks and bonds moving in lockstep create headaches for fund managers who use fixed-income securities to diversify their portfolios and protect them against a selloff in equities. This year's positive correlations had generated a lot of anguished headlines about the death of bonds as a diversifier. However, assets don't have to move in different directions to help protect portfolios from the wildest swings. While a Bloomberg gauge of a 60/40 equity-bonds portfolio is up 7% so far this year, lagging the 13% rise in the S&P 500, its holders have had a much smoother ride. The balanced basket had a 60-day realized volatility of just over 7% versus about 12% for the all-equity approach.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment