| Delta variant stokes fear, it's the last day of the quarter, and difficult oil talks lie ahead. Risks The seemingly endless push and pull between reopening optimism and fear of new lockdowns dominates markets as virus variants spread. Travel stocks are under pressure again today, with a United Nations Conference on Trade and Development report suggesting the overall pandemic cost to the tourism sector could hit $4 trillion by the end of this year. While there was some good news on the vaccine front after Moderna Inc. said its shot produced protective antibodies against the delta strain, there are still problems with getting people to take vaccines in the developed world and problems getting supply in the developing world. Half wayOne of the major stories of the first half of the year is the rise and fall of cryptocurrencies. After hitting a record of almost $65,000 in mid-April, the original cryptocurrency has dropped more than 45% to $34,500 since. The volatility of the asset, in full display in this morning's 5% tumble, continues to be one of the main barriers to wider institutional adoption, according to Francesca Fornasari at Insight Investment. The China clampdown on digital assets also continues to weigh on sentiment as Bitcoin looking poised to end the first half of the year with only a small gain. The House Committee on Financial Services holds a hearing on crypto from 10:00 a.m. Eastern Time. Oil meeting While the first six months of the year may have been a wild ride for cryptocurrencies, it was a good one for crude which saw prices rise 50% for its best half since 2009. The market continues to be dominated by what OPEC and its allies will do next with policy makers weighing pressure to increase supply and the medium-term demand effects from the pandemic. The difficulty in coming to a decision can be seen in the delay of preliminary talks until tomorrow morning to allow more time for compromise ahead of the ministerial meeting, also Thursday. Markets slipThe last day of the quarter does not seem to be a popular one for adding risk, with most major equity gauges dropping into the red. Overnight the MSCI Asia Pacific Index slipped 0.1% while Japan's Topix index closed 0.3% lower. In Europe the Stoxx 600 Index was down 0.8% at 5:50 a.m. with every industry sector posting losses. S&P 500 futures were signaling a small drop at the open, the 10-year Treasury yield was at 1.460% and gold slipped. Coming up... A busy couple of days for the U.S. employment market kicks off at 8:15 a.m. with the latest ADP Employment report. U.S. pending home sales data for May is at 10:00 a.m. Latest crude oil inventories are at 10:30 a.m. USDA quarterly crop stocks data is at 12:00 p.m. Atlanta Fed President Raphael Bostic and Richmond Fed President Tom Barkin speak later. Constellation Brands Inc., General Mills Inc. and Bed Bath & Beyond Inc. are among the companies reporting. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningInflation carries with it a lot of emotional and political valence. So you'll see a lot of people pointing to high headline CPI as a critique of government policies since the pandemic hit.

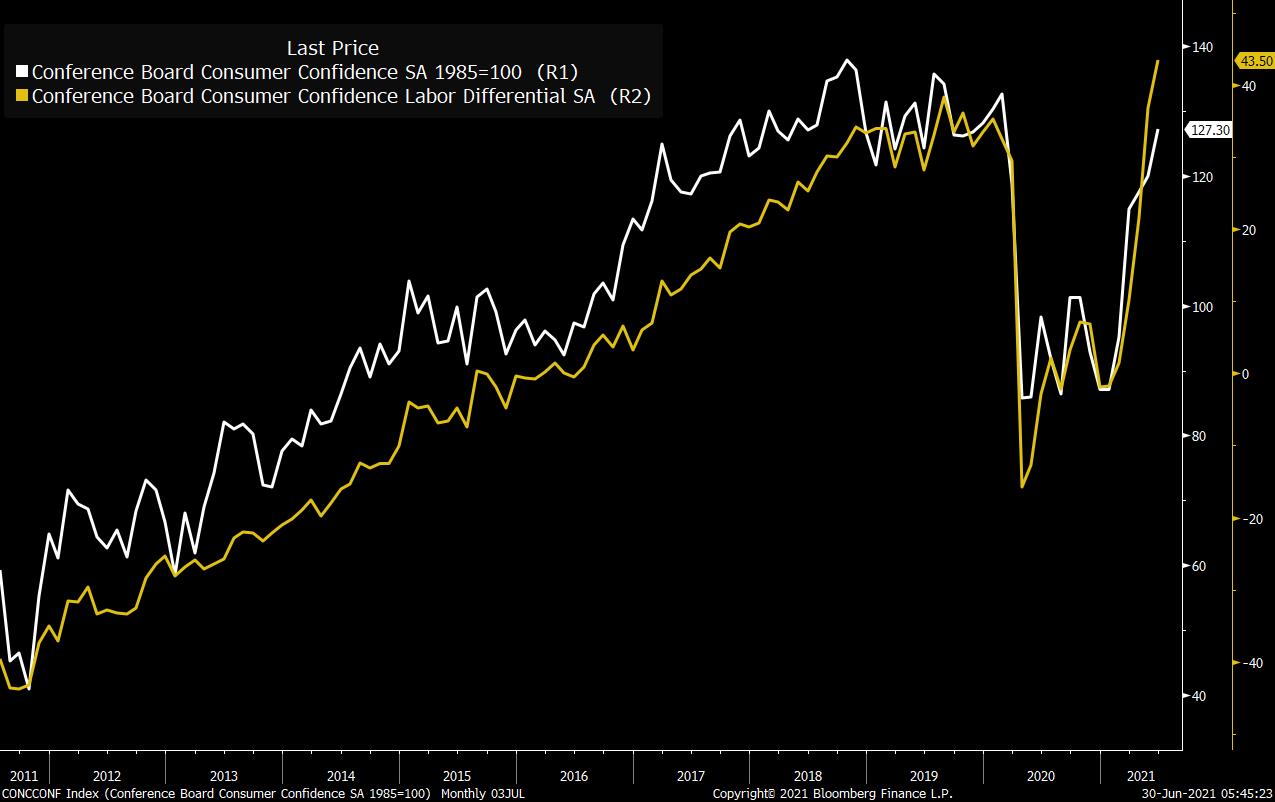

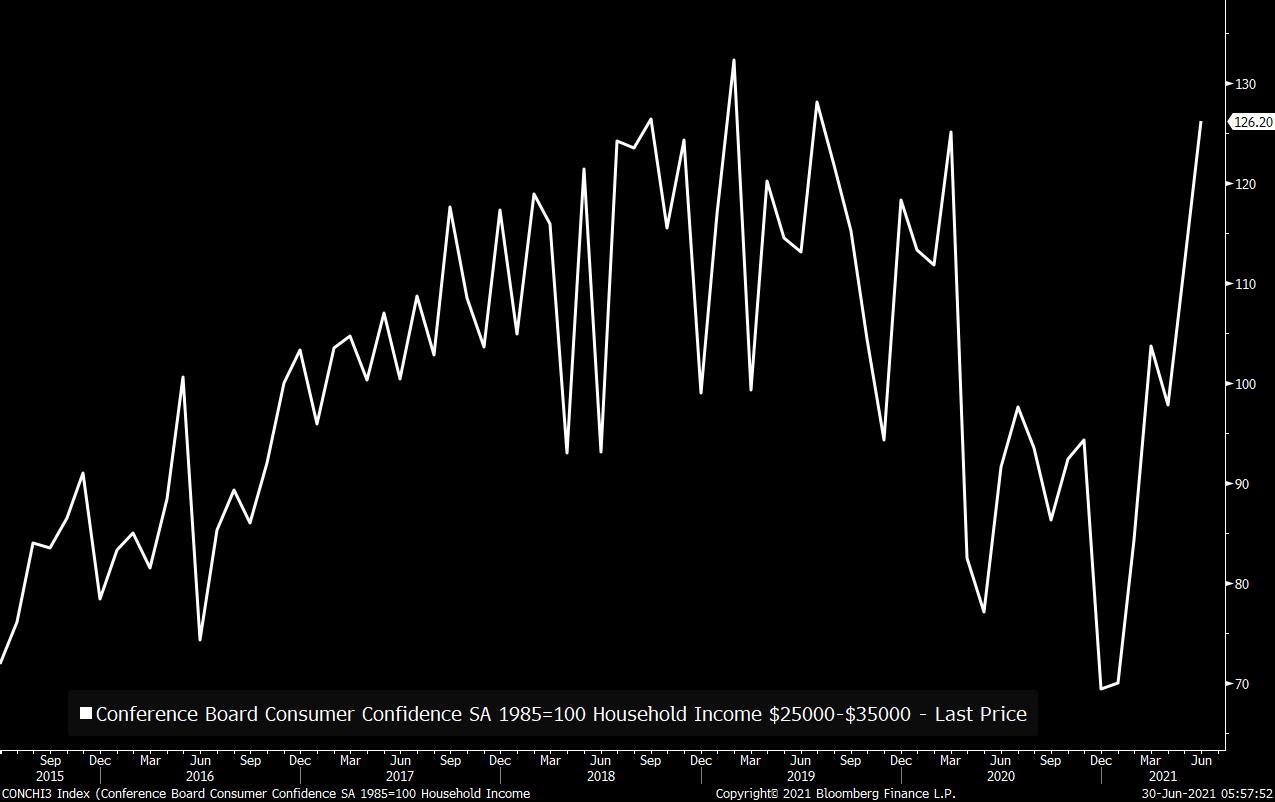

It's true that inflation measures are high by recent standards. And while there's good reason to think that much of this is transitory, that's not much solace to someone who has to, say, buy a car or a home right now. That being said, it doesn't make sense to judge an economy just by looking at the prices for things. And the best evidence are measures tracking how people say they feel about the economy right now, which are soaring. Yesterday we got the latest Conference Board Consumer Confidence numbers, and they're moving straight up and to the right. The headline confidence measure (white line) jumped to 127.30, the highest level since February 2020 and ahead of economist forecasts of around 120. A sub-index which measures consumer perceptions of the job market (yellow line) soared to its highest level since 2000.  So yes, prices are up, but so is employment. And so is the stock market, and a bunch of other stuff. And taken in total, the public's perception (not economists' perception) of the economy is that it's massively better than it was a year ago. What's more, this isn't just confined to the rich. You often hear people in the investor class concern-troll, citing stimulus measures and saying things like "the inflation mainly hurts the poor". This is rooted in some truth, as higher gasoline and food prices and other consumer goods costs will inevitably hit people who spend a greater share of their income harder. But by the same token, soaring job openings and higher service sector wages will also disproportionately benefit lower paid workers. And again, this isn't just conjecture. If you look at people whose household income is, for example, between $25,000-$35,000, their assessment of the economy is now at its highest level since 2019.  Again, we're not talking about some academic economists trying to make the case that on balance the inflation is worth it because there's more jobs. We're talking about surveys of people showing this solid rise. Obviously at any given moment, there are a range of forces and pressures affecting the broader macro landscape. Prices are one of them. However it's myopic to put such a focus on prices, when if you just go out and ask people how they feel right now, it's clear that things have improved dramatically. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment