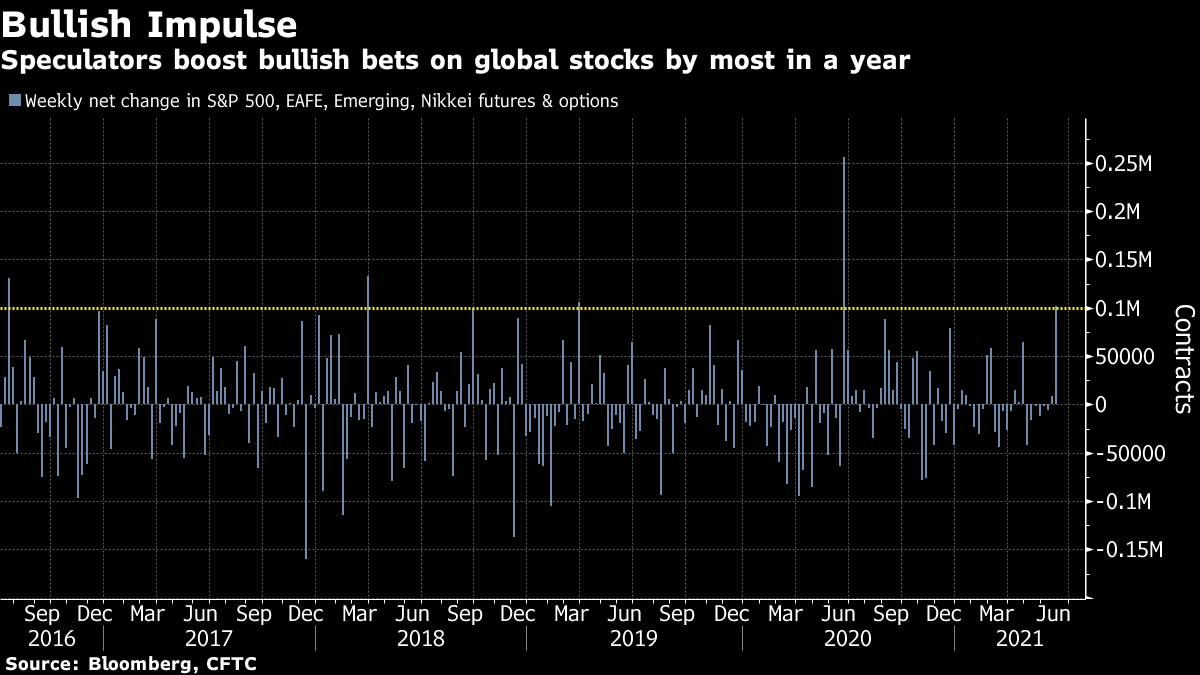

| Good morning. More Covid-19 restrictions are being re-imposed, the U.K. has a new health secretary and crypto exchange Binance Markets is restricted. Here's what's moving markets. Delta RestrictionsThe highly contagious Delta strain of Covid-19 is inducing renewed curbs in some countries, as it continues to loom large over the tourism season in Europe. Australia has placed millions of people under restrictions as the variant causes new cases, putting more pressure on the government to step up its lagging vaccination program. South Africa, meanwhile, has banned alcohol and closed schools to combat surging infections, while Malaysia has extended a national lockdown which had been due to end on Monday. This amid the question of whether Covid-19 will return when the weather turns colder in a few months. Hancock OutMatt Hancock quit as the U.K. health secretary after he was caught embracing a senior aide in his office, in breach of the social distancing guidelines he helped to create. Prime Minister Boris Johnson quickly named Sajid Javid, a former Chancellor of the Exchequer, as Hancock's successor and Javid said his top priority is ending the pandemic and getting the country back to normal. The scandal around Hancock, however, risks undermining Johnson's government's public health agenda and political ambitions at a key time, with Covid cases surging and a local election this week. Binance Markets BarredThe U.K. financial regulator barred cryptocurrency exchange Binance Markets — an affiliate of the global crypto exchange Binance — in a move that extends a regulatory crackdown on the crypto sector amid concerns about struggles by firms to meet anti-money laundering standards. The exchange has to remove all its advertising and make clear on its website and social media that it's no longer permitted to operate in the country. Digital assets are rising on Monday, however, and more support for the market is emerging among gold-obsessed Indian households and Mexican billionaires, even if strategists are flagging near-term risks for Bitcoin. Election DisappointmentFrench President Emmanuel Macron and far-right leader Marine le Pen both delivered a disappointing set of results from the latest round of regional elections in France. Nationwide, right-wing parties fared marginally better than their left counterparts. For Macron, the election was the first big test of his party outside of Paris and the results indicate he is yet to build a solid regional base. In Sweden, meanwhile, Prime Minister Stefan Lofven has until midnight on Monday to broker a new deal and stitch a new coalition together after he lost a confidence vote last week. Coming Up…European and U.S. stock futures are relatively steady following a similarly mundane day in Asian trading, with investors weighing up the pace of economic recovery against the threat of more potent Covid strains. Oil prices are also pretty flat, holding close to a two-year high ahead of an OPEC+ meeting due to start on Thursday. It's a quiet day for economic data and earnings in Europe, while in the U.S. meme-stock GameStop will start trading in the FTSE Russell 1000 index. Elsewhere, the Mobile World Congress starts in Barcelona and the Wimbledon tennis tournament gets underway. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe market may have become more data-dependent in the wake of the recent Federal Reserve meeting but global equity bulls aren't hanging around waiting for the numbers. An aggregate gauge of speculative futures and options positions in U.S., European, emerging-market and Japanese stock benchmarks jumped by the most in a year last week, according to the latest Commodity Futures Trading Commission figures. The weekly measure rose by more than 100,000 contracts for just the fifth time in five years and was dominated by bets on U.S. shares. The S&P 500 closed at an all-time high Friday after a bipartisan infrastructure deal added to optimism the economic recovery is taking hold. Investors who are waiting for the data will have some important releases to pore over this week. Trends in U.S. payrolls and global PMI indexes are likely to set the tone as the second half of the year begins.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment