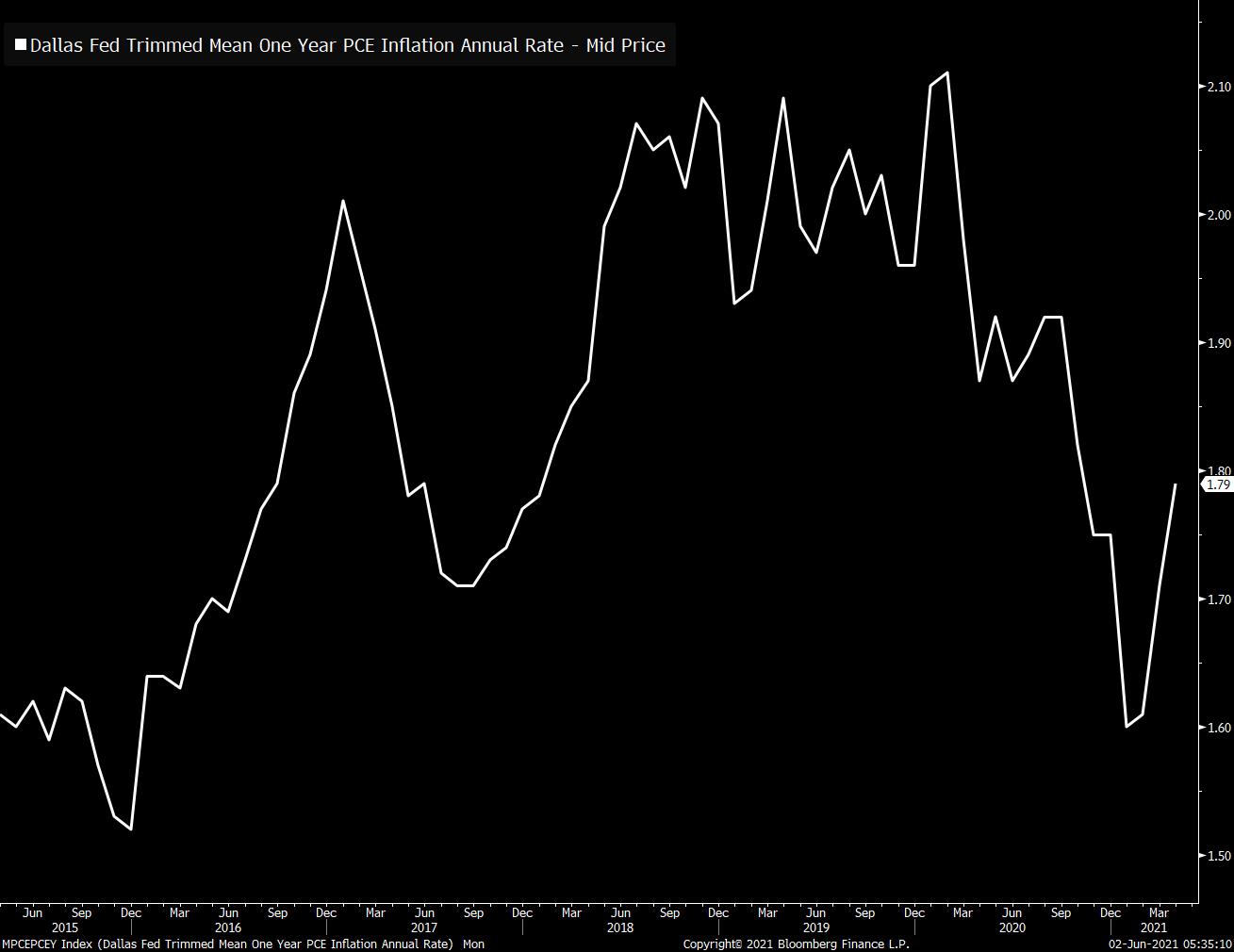

| Meat hack blamed on Russian group, oil rises again, and lira hits record low. Beef hack The world's largest meat producer said it will have the "vast majority" of its plants operational today after a cyberattack shut all of its U.S. operations. A notorious Russia-linked hacking group is behind the attack, according to four people familiar with the assault. The hack also meant none of the pricing data on which agricultural markets rely on was available. It comes only weeks after the Colonial Pipeline was shut down in a similar attack, showing hackers are increasingly focusing on the commodity industry. Crude rally OPEC and its allies provided an upbeat assessment of oil demand for the rest of the year as the group ratified a production increase for July. There was also a boost to crude bulls with news that any nuclear agreement which would allow Iranian barrels back onto the market may not now happen until August. A barrel of West Texas Intermediate for July delivery was holding above $68 this morning. TurkeyTurkey's President Recep Tayyip Erdogan called again for interest rates to be cut, saying that reducing the burden of interest costs on producers would lead to lower inflation in future. His monetary policy suggestion is at odds with conventional economic theories, and has helped push the lira to a new record low against the dollar this morning. Erdogan is facing falling domestic popularity as unemployment remains very high, a factor which may be playing into his call for central bank easing. Markets quietInvestor sentiment is finely balanced between lingering inflation angst and optimism about economies reopening. Overnight the MSCI Asia Pacific Index was broadly unchanged while Japan's Topix index closed 0.8% higher. In Europe the Stoxx 600 Index had gained 0.2% by 5:50 a.m. Eastern Time as data showed producer price inflation in the region at the highest since 2008. S&P 500 futures indicated little change at the open, the 10-year Treasury yield was at 1.606% and gold dipped below $1,900 an ounce. Coming up... The ECB is publishing a report on the international role of the euro at 7:00 a.m. U.S. May autosales data is out today. Chicago Fed President Charles Evans, Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan speak at a forum on racism and the economy. The Fed Beige Book is published at 2:00 p.m. Splunk Inc., Endeavor Group Holdings Inc. and NetApp Inc. are among the companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningHere are two things that relate to inflation that are on my mind. First up, check out lumber. We've talked all year about lumber, but it's looking more and more like we've passed the peak of the price surge. July lumber is now down six days in a row for its second substantial losing streak of the year. Back in mid-May, lumber trader Stinson Dean said the great short squeeze is over and at least on this chart it kind of looks like it.  Of course, a big contributor to this has got to be the slowing down of the homebuilding market, which is a result of tight supplies, tight labor and tight land, but again, that's how it's supposed to work. So at least here we're seeing some balancing out. The price of one commodity in and of itself doesn't tell you much about inflation, other than the fact that markets kind of work how you expect markets to work. More importantly, last week we got the latest PCE release, and it came in hotter than expected. However, if you look at the Dallas Fed Trimmed Mean PCE measure on a year-over-year basis, it looks quite mild and well below 2019 and early 2020 levels. (The measure attempts to lop off specific categories that are skewing the overall number.)  So there are signs that commodity price moves are abating, and also that the headline inflation numbers are still mostly skewed by a handful of categories relating to the reopening. The inflation pressures are real, but so far there are no big signs that there's been a change to the overall inflation dynamic, the likes of which would spook the Fed or necessarily the markets. Joe Weisenthal is an editor at Bloomberg

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment