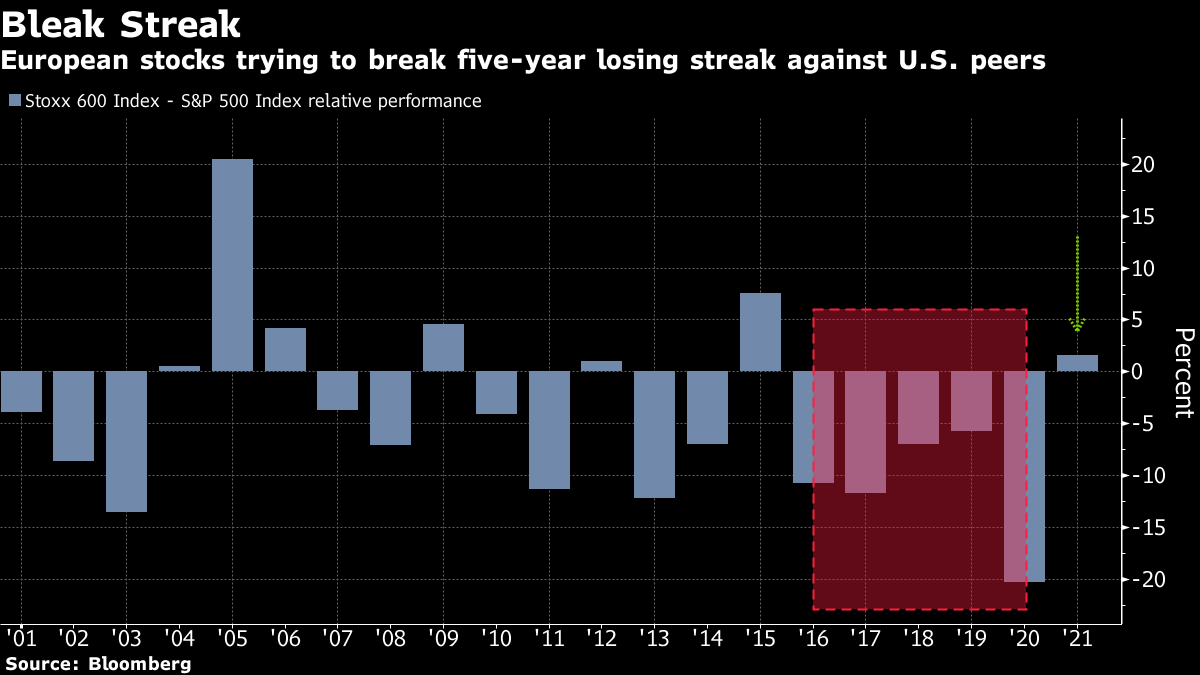

| Good morning. Trade tensions ease, U.K. delays lockdown easing, Erdogan's missile controversy and Dimon's warning. Here's what's moving markets. Trade TrucesIn a boost for transatlantic relations, the European Union and the U.S. are set to resolve a 17-year dispute over aircraft subsidies, according to the Financial Times, whose report cites diplomats and officials. The pact could potentially be announced this morning, the paper says. Bloomberg reported a potential end to the tariff spat last week. Elsewhere for trade, broad terms of a free-trade deal between the U.K. and Australia were finalized at a dinner between U.K. Prime Minister Boris Johnson and Australia's Scott Morrison last night, according to a person familiar with the negotiations. No DancingIn a move that surprised absolutely nobody, the U.K. postponed plans to remove all Covid-19 restrictions in England next week. The easing will be delayed to July 19 as a more infectious variant threatens to undermine the U.K.'s effort to vaccinate its way out of the pandemic. Johnson said he's "pretty confident" there won't be another postponement, but some members of his Conservative party hit out at the impact on the economy. There was a reprieve for weddings: the 30-person limit will be lifted to allow an unlimited number of guests, as long as there is no dancing. Meanwhile, full-capacity crowds are still expected for the final matches of the Wimbledon tennis club next month. Missile AngerTurkey President Recep Tayyip Erdogan sent the lira lower once again, this time by reiterating his nation's stance on a missile-defense system it bought from Russia. The purchase of the S-400 missiles had previously rattled North Atlantic Treaty Organization allies and resulted in American sanctions. Erdogan's update came right after he met with U.S. President Joe Biden in Brussels Monday. Following a recent winning run against the dollar, the Turkish currency is down almost 2% versus yesterday's high. More NormalThe party might soon be over for investment banks: JPMorgan Chase boss Jamie Dimon predicted a drop in quarterly trading revenue that was even bigger than Wall Street analysts had forecast, sending the U.S. firm's shares lower and weighing a little on European rivals like Deutsche Bank and Barclays on Monday afternoon. Pandemic-induced volatility has spurred a boom in fixed income and equities business, but things could soon be "more normal," Dimon said at a virtual conference held by rival Morgan Stanley. Coming Up…European stocks are set to follow other regions higher after U.S. equities closed at a record ahead of the Federal Reserve meeting this week. Today, U.S. producer prices and retail sales will be in focus. Biden continues his round of diplomacy with the EU-U.S. summit in Brussels, while Bank of England Governor Andrew Bailey speaks at TheCityUK annual conference. Equipment rental firm Ashtead updates, with shares having gained nearly 50% this year on infrastructure investment hopes. There will also be sales data from clothing firms Boohoo and H&M. Software giant Oracle reports in the U.S. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningA seventh consecutive all-time high for European stocks Monday will raise hopes they can finally put an end to a five-year losing streak against their U.S. counterparts. As we near the halfway stage for the year, the Stoxx 600 is ahead by a nose against the S&P 500 -- just over 1%. As my colleague Lu Wang pointed out, investors have been attracted to Europe's greater number of value and cyclical stocks and lower share of tech, which has been hurt by concerns over rising inflation. U.S. stocks are also facing possible corporate tax hikes and the specter of a less friendly Federal Reserve. Goldman Sachs upgraded their European equity targets this month, though cautioned that in some markets the rebound may be in the price. And obviously both the S&P 500 and Nasdaq 100 also posted fresh all-time highs Monday, so U.S. shares are still very much in the game. Halfway through the year, it's all to play for.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment