| U.S. and China talk, all eyes on inflation and G-7 plans to end the pandemic. First callContact between the U.S. and China is slowly resuming, as commerce ministers from the two superpowers held their first call since President Joe Biden took office. The two nations agreed to strengthen trade and investment ties and exchanged views "frankly" during their conversation. Some aspects of U.S. policy toward Beijing are becoming clearer, with Biden amending a ban on U.S. investment in Chinese companies earlier this month — though the fate of last year's 'Phase One' trade deal remains uncertain. The global tax agreement hammered out by the G-7 last week could be another sticking point, with people familiar saying China will likely seek exemptions. CPI watch Key U.S. inflation data for May is due at 8:30 a.m. Eastern Time, with a faster-than-expected reading likely to bolster the case for the Federal Reserve to start discussions on withdrawing stimulus. Last month's report showed prices climbed in April by the most since 2009, in a sign that the economic recovery continues to gain traction. While the data dump could help stocks break out of their tight range, bond traders have actually been cutting back their exposure to Treasuries ahead of the figures. End itAs they gather for their summit in Cornwall, G-7 leaders are cobbling together a plan to end the Covid-19 pandemic by December 2022. The heads of the richest countries on Earth will pledge to deliver enough vaccines over the next year to help cover 80% of the world's adult population, according to a draft communique seen by Bloomberg News. The U.S. plans to buy 500 million doses of the Pfizer Inc. vaccine to help the effort. In another step toward normalcy, European Union officials approved vaccine passports to allow quarantine-free travel within the bloc. Sleepy marketsGlobal equities were steady as traders awaited clues on the outlook for monetary policy in the CPI data. Overnight the MSCI Asia Pacific Index rose 0.4%, while Japan's Topix Index closed little changed. In Europe, the Stoxx 600 Index was flat as of 5:52 a.m., with travel and leisure shares weighing on the gauge. S&P 500 futures were also broadly unchanged, the 10-year Treasury yield was 1.499% and gold slipped. Coming up...In addition to U.S. inflation figures, both initial weekly jobless claims and continuing claims are due at 8:30 a.m. The monthly budget statement for May arrives at 2 p.m. The European Central Bank publishes its latest policy decision at 7:45 a.m., with a press conference from President Christine Lagarde 45 minutes later. What we've been readingHere's what caught our eye over the weekend. - Crypto is a 'wild west', says Elizabeth Warren

- In the FOMO economy, everyone is making money but you

- JBS paid hackers $11 million after cyberattack

- Welcome to Florida's Trump coast

- What does El Salvador's Bitcoin bombshell mean?

- A Saudi princess in Iowa

- New images from NASA's Juno mission

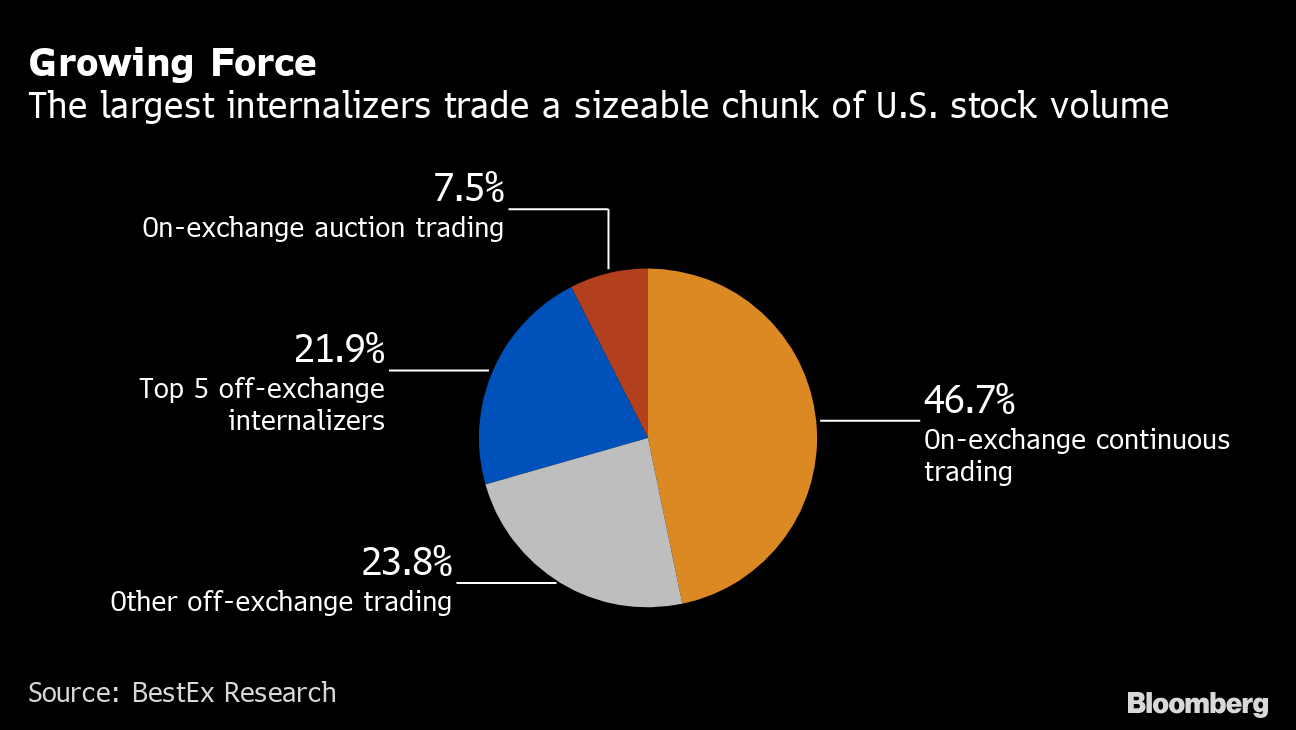

And finally, here's what Justina's interested in this morningThe wonkiest controversy ignited by the GameStop mania -- and my favorite -- is about market structure. In short: Is it unfair and detrimental to market functioning that a handful of wholesalers execute most retail trades? SEC Chairman Gary Gensler seems to think so, judging by his speech yesterday where he echoed many common critiques of the retail-execution status quo. If all this translates into regulatory changes, it'll be a game changer. Virtu Financial -- which handles the bulk of retail volume alongside Citadel Securities -- slid nearly 8% yesterday. Gensler's take is not entirely inevitable. The wholesalers like to stress they give retail investors billions of dollars worth of price improvement. I wrote yesterday about why this is overstated versus what those trades could have received in other venues -- and the SEC seems to agree. Better execution is not best execution, as Gensler said.  But at the same time, that doesn't disprove the price-improvement defense entirely, partly because you don't know there's a better alternative for the Robinhood crowd. The wholesalers have natural advantages like tick size and segmentation that help them give day traders good prices. So the bigger question is whether the market's overall functioning is damaged by this. Are the displayed quotes that make up the National Best Bid and Offer becoming less representative? Are institutions getting worse execution because they can't interact with a sizable chunk of flows? The logical answer would be yes and yes. A few brokers and algo shops have argued this is problematic for institutions, which, as they like to remind us, invest for the ordinary folks too. But it was never clear how big of an issue this is relative to a status quo that seems to be benefiting retail traders, especially when U.S. rules have always prioritized best execution for retail rather than worrying about market fragmentation. But now Gensler is saying the current market structure is not that great for markets or retail investors. It's a big shift. Follow Bloomberg's Justina Lee on Twitter at @justinaknope

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment